Internal control and risk management system

| Download XLS (22 kB) |

|

Independent |

Executive/non-executive |

Elisabetta Oliveri (Chairwoman) |

✓ |

Non-executive |

Sabrina Bruno |

✓ |

Non-executive |

Lucia Morselli |

✓ |

Non-executive |

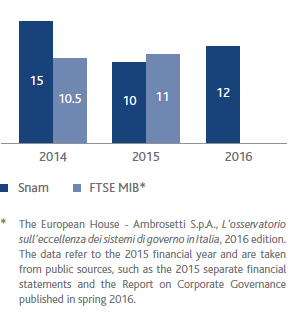

Number of meetings of Control, Risk and Related-party Transactions Committee

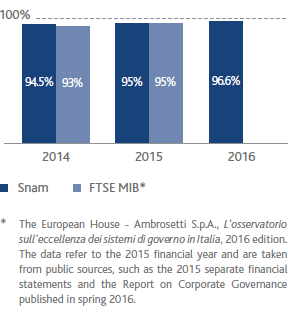

Rate of attendance of Control, Risk and Related-party Transactions Committee

| Download XLS (23 kB) |

Statutory Auditors |

Post |

Ind.** |

M/m* |

Other positions |

||||

|

||||||||

Leo Amato |

Chairman |

✓ |

M |

44 |

||||

Massimo Gatto |

Standing |

✓ |

m |

4 |

||||

Maria Luisa Mosconi |

Standing |

✓ |

M |

10 |

||||

Maria Gimigliano |

Alternate |

✓ |

M |

N/A |

||||

Sonia Ferrero |

Alternate |

✓ |

m |

N/A |

||||

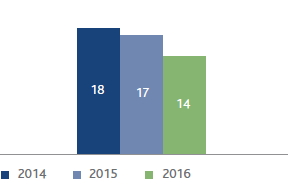

Number of meetings of the Board of Statutory Auditors

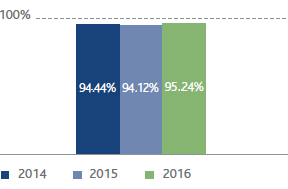

Rate of attendance of the Board of Statutory Auditors

| Download XLS (22 kB) |

|

Yes/No |

Presence of Risk Management function |

Yes |

Existence of Risk Management plan |

Yes |

If yes, has the plan been discussed with the Committee? |

Yes |

Presence of succession plans (in relation to Management) |

Yes |

Preparation of specific Compliance programmes (Antitrust, Anti-corruption, Whistleblowing, etc.) |

Yes |

Main risks |

Frequency |

Impact |

Mitigation measures |

Regulatory change (regulatory, legal and non-compliance context) |

|

Monitoring and discussion with the main institutions responsible. Regular review of the operational model in terms of health, safety and the environment. Update of 231 Model and the Code of Ethics. Analysis of adaptation to the latest version (July 2015) of the Code of Corporate Governance of Borsa Italiana and to corporate governance best practice. Anti-corruption monitoring. Monitoring of updates to corporate policies |

|

Operating risk (damage, breakdown, etc.) |

|

Ongoing checks and monitoring and communication initiatives aimed at providing information about the presence of infrastructure and the measures to be avoided/put into practice by third parties so as not to damage it |

|

Rating risk (downgrading) |

|

Ongoing monitoring of ratings indicators and activation of new lines if necessary |

|

|

|

|

|

|

|

|

|