Sustainable finance as a tool for change

The change needed to limit global warming and, more generally, to guarantee sustainable development, entails the careful definition of projects, ideas and goals, not always easy to achieve and which have time constraints, but more especially economic ones. The UNCTAD (United Nations Conference on Trade and Development) estimated that achieving the SDGs (Sustainable Development Goals), the cornerstone objectives of the European Union in terms of sustainable development, would be possible through global investments in the period 2015-2030 of between USD 5 and 7 thousand billion. In the energy field alone, to achieve its objectives in terms of energy efficiency and investment in renewable resources, the European Union would need a sum equal to €180 billion per year, which would rise to €270 billion if the targets relating to transport, water and the waste sector are also taken into account. It is obvious how these figures could only be achieved through collaboration between private and public entities, creating synergies between sustainability and the financial sector and investments.

Climate change is perceived by investors as a systemic risk for the global economy which could threaten the capacity of the financial system to achieve results in the long-term.

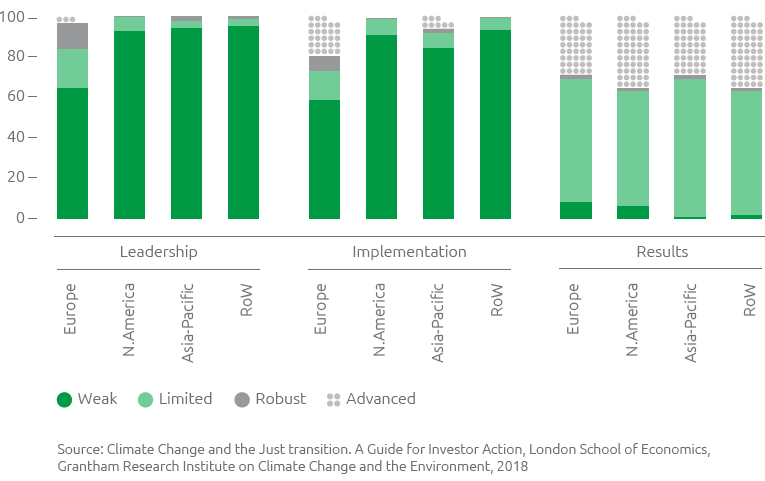

According to the London School of Economics guidance “Climate Change and the Just transition. A Guide for Investor Action”, the way in which society manages the transition towards a more resilient and low carbon emission economy will have important impacts on their licence to operate; the management of the social dimension will become increasing more important and material in achieving value targets. By incorporating a social dimension in their evaluations, investors manage to interpret the transition in relation to the prospect of traditional investments better. The successful outcome of this transition depends on an economy which functions well and which produces a social impact with the contribution of investors as well. The UNPRI (United Nations Principles for Responsible Investments) actually states that “a sustainable and economically efficient global financial system is necessary for the creation of value in the long-term”.

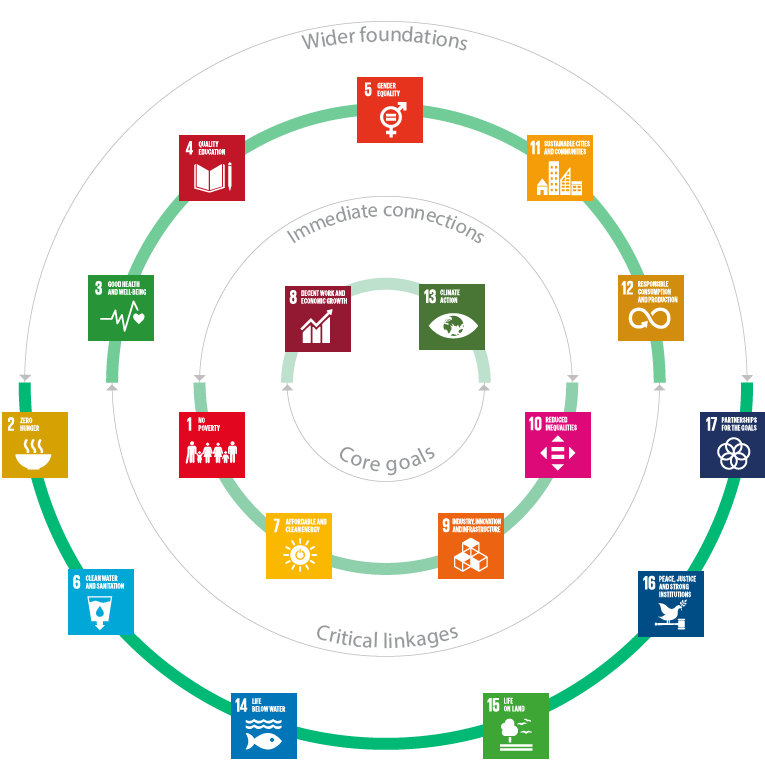

The just transition and the Sustainable Development Goals

Source: Adapted from Robins N, Brunsting V and Wood D (2018) ‘Climate change and the just transition: guide for investor action.’ London: Grantham Research Institute on Climate Change and the Environment, London School of Economics and Political Science. Available at: http://www.lse.ac.uk/GranthamInstitute/publication/climate-change-and-the-just-transition-a-guide-for-investor-action/

There are several instruments like the SDGs which support investments in the transition towards a more resilient and low carbon emission economy.

Also according to the guide issued by the London Stock Exchange “Revealing the full picture”, the 17 SDGs provide an internationally recognised framework for drafting and prioritising the initiatives and investments in corporate business plans. The SDGs are consistent with the majority of the ESG reporting frameworks and measure progress in relation to the sustainable development global goals making sustainable investments comparable on a global scale.

Sustainable finance (or green finance) attempts to respond to these expectations, proposing a new way of financing, where the objective is to create value in the long-term, directing capital towards types of activity which can generate economic returns and benefits for society and the environment. As defined by the European Commission, sustainable finance is based on two fundamental principles: the first is aimed at improving the contribution of finance to sustainable growth and the mitigation of climate change; the second strives to strengthen financial stability incorporating environmental, social and governance considerations (ESG) in investment decisions.

Taking the European situation into consideration, in March 2018 the High-Level Expert Group on Sustainable Finance (HLEG), a group of experts set up in December 2016 by the European Commission with the task of drawing up guidelines for the development of sustainable finance in Europe, published an Action Plan on sustainable finance.

The document identifies ten actions aimed at directing capital flows towards sustainable investments, promoting the transparency of economic-financial activities and the better management of financial risks coming from climate change, the consumption of resources, environmental damage and social inequality.

In addition to this, EUROSIF (the European Forum for Sustainable and Responsible Investment) defined the different strategies of socially responsible investment, like choosing to invest in companies which demonstrate a better performance in ESG terms or the desire to invest in specific sectors (thematic investing) such as health and renewable energy, excluding those deemed unethical or not very ethical, such as the tobacco or arms industries. The EUROSIF report on responsible investment notes growing European interest in these new types of investing strategies, stressing how in the period 2015-2017 growth in responsible investment stood at 25%. In Italy also, there has been greater interest in sustainable investment with thematic investing between 2015 and 2017 rising from €2 to €53 billion, while as far as investments in companies performing well in ESG terms, the number increased from €4 to €58 billion .2

The support of banks and the bond market is important to ensure that companies can have access to sustainable finance instruments. Banks can act as consultants for companies and institutions that intend to issue sustainable bonds and can provide loans at preferential rates upon to certain ESG criteria. Insurance firms can also play a key role in supporting businesses in the management of non-financial risk by applying variable rates in relation to their ESG performance.

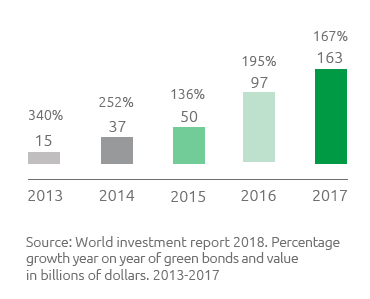

The most widely available sustainable finance instruments on the market are green bonds and social bonds, bonds issued to fund environmental and social projects, respectively. The availability of these new types of bonds has grown rapidly in recent years. In spite of green bonds only representing 0.2% of the entire bond market, their value and number increased exponentially, reaching around USD 163 billion in 2017. Another widely available financial instrument is represented by sustainable loans, loans aimed at promoting environmental sustainability within companies, at the same time guaranteeing an economic advantage.

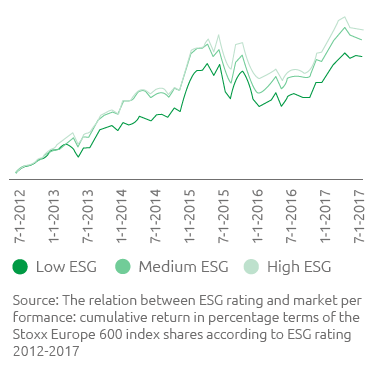

Equity securities more "sustainable" have increased by

15%

compared with other securities, in the period 2012-2017

The study “Relation between ESG rating and market performance”, promoted by the Milan Polytechnic University, highlights how securities of companies with a high ESG performance have a better return than those with a lower performance. Equity securities deemed more “sustainable” have increased in the period 2012-2017, by 86% compared with 70.9% for securities defined as “less sustainable”.

Evidently institutional investors and the financial sector have been demonstrating ever increasing interest in the sustainable performance of companies. In years to come businesses which do not manage environmental, social and governance aspects correctly could be partly excluded from investor’s portfolio choices. As a result, developing structures and strategies capable of recognising, quantifying and managing these types of risks will be necessary for safeguarding the interests of companies in the financial market and beyond.

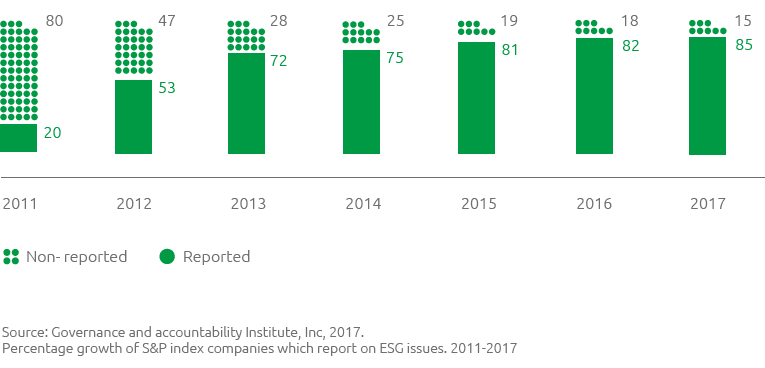

Alongside the correct management of these aspects there must be effective disclosure: the reporting of information relating to sustainability is strategic in the dialogue with investors and financial institutions. A 2017 study of the Governance and Accountability Institute into Standard & Poor 500 companies showed that accounting on ESG aspects increased considerably over the last 6 years, going from 20% to 85%.

Growth of ESG Reporting by S&P 500 Companies (%)

In this regard, the Financial Stability Board set up the Task Force on Climate Related Financial Disclosure (TCFD) in 2015 to develop the guidelines for clear and comparable reporting of corporate information in relation to financial risks and opportunities related to climate change. The final recommendations, published in 2017, were designed to include the risk of climate change in business decisions and to facilitate the allocation of capital to smooth the transition to a low carbon emission economy.

In 2018, the World Economic Forum (WEF), included a principle relating to reporting and disclosure among the 8 principles for climate governance. This principle refers to the responsibility of the Board to ensure that the strategic information and material risks and opportunities related to climate change are disclosed transparently and consistently to all company stakeholders in particular towards investors and, where required, to the regulatory authorities as well.

Disclosure by companies can therefore help investors understand better how to invest responsibly and “strategically”. The fundamental element in this understanding is a correct evaluation of any exposure of portfolio assets to environmental and social risks. Vigeo Eiris, a European social and environmental ratings agency, developed a database of 365 companies throughout the world which generate over 20% of profits from activities associated with fossil fuels, classifying them on the basis of their ESG criteria, to support investors in their portfolio decisions. The results show how European countries have demonstrated that they perform better from an ESG perspective.