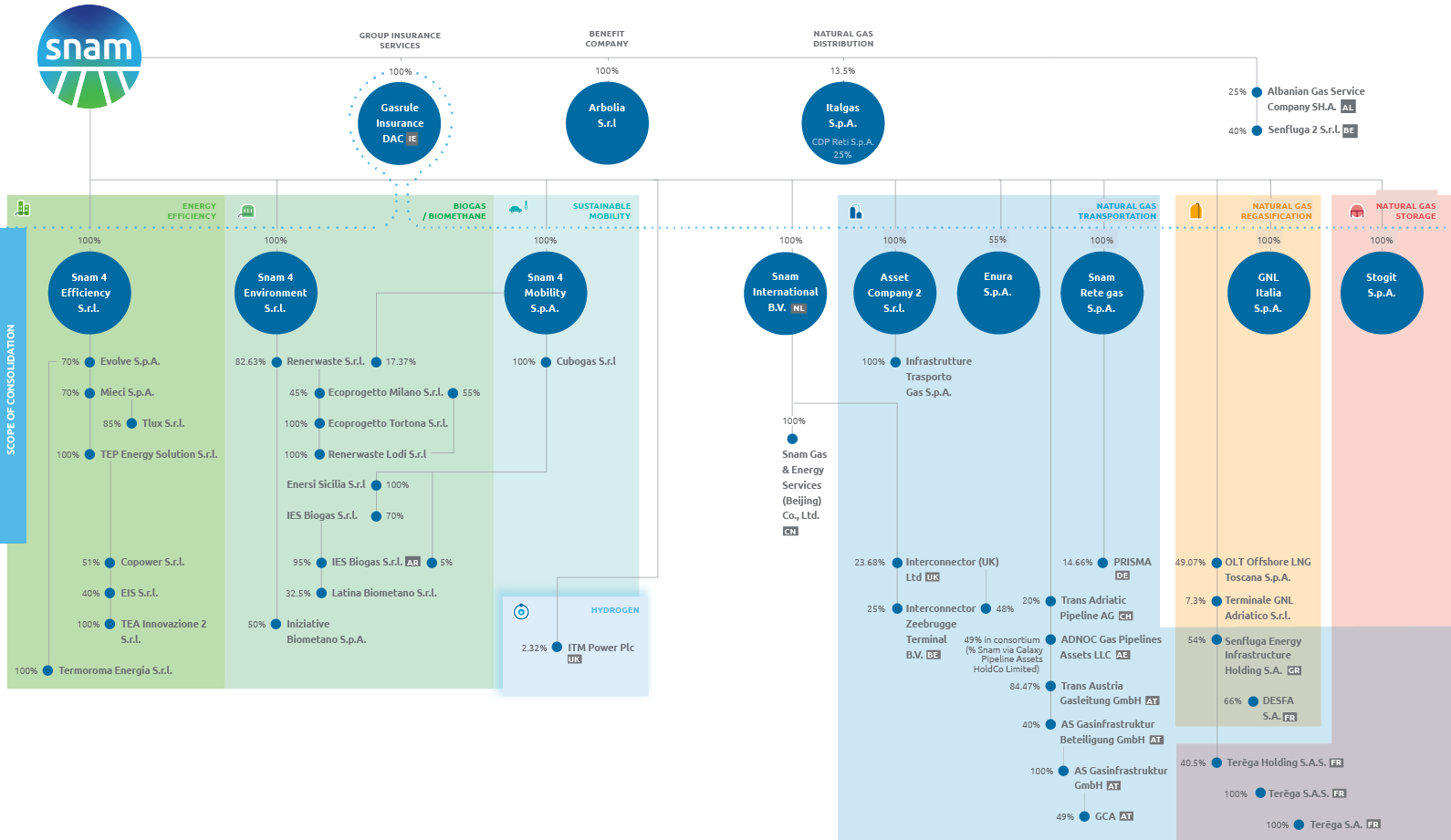

The changes in the Snam Group’s scope of consolidation as of 31 December 2020, with respect to that as of 31 December 2019, involve the acquisition on 5 October 2020, through the subsidiary Snam 4 Efficiency, of 70% of two companies working in the energy efficiency sector in Italy, Mieci S.p.A. and Evolve S.p.A.

The main equity investment transactions during 2020*, which had no impacts on the Group’s scope of consolidation, involved:

- the sale, on 13 January 2020, of a 6% equity investment in the associate company Senfluga, after which Snam’s stake in the company amounts 54%. This sale resulted from agreements signed by Senfluga shareholders to sell a total stake equal to 10%, in amounts proportional to the stakes held by each shareholder;

- the completion on 26 February 2020 of the acquisition of a 49.07% stake in OLT (Offshore LNG Toscana), based on which Snam obtained joint control over the regasification terminal with First State Investments International Ltd;

- the increase in the equity investment held in Tep Energy Solution S.r.l. (TEP) from 82% to 100% of share capital, through the exercising of a call option relative to the stakes held by minority interests (equal to 18%)**, carried out on 6 March 2020;

- the acquisition on 15 July, in a consortium with five international funds, of 49% of ADNOC Gas Pipeline LLC, a company which holds 20 year management rights for 38 gas pipelines in the United Arab Emirates;

- the acquisition on 30 September 2020, through the subsidiary Snam 4 Environment, of a 50% stake in the share capital of Femogas S.p.A., with joint control held with Iniziative Biometano S.p.A., a company which manages biogas and biomethane systems which use agricultural biomass obtained in Italy;

- entry into the share capital of ITM Power PLC in November 2020, one of the largest global producers of electrolyzers, gaining a stake of 2.318%.

* Additionally, on 18 November, the entry of Snam as a significant minority shareholder of Industrie De Nora was announced. The transaction was finalised on 8 January 2021.

** The controlling equity investment in TEP (82%), acquired in May 2018, on the basis of the contractual terms with the exercise of the put and call cross options on the interests of third-party (equal to 18%) is regulated as if Snam had acquired 100% control of TEP, without therefore detecting the interests of third parties shareholders.