Implementation of the Third Energy Package adjustment project

The Gazzetta Ufficiale of 28 June 2011 published Legislative Decree no. 93 of 1 June 2011, which enacts EU Directives 2009/72/EC and 2009/73/EC (the Third Energy Package) concerning common rules for the internal market in electricity and natural gas. The Decree sets Snam an obligation to conform, by 3 March 2012, to the ITO (Independent Transmission Operator) model, which provides for the operational and decision-making separation of the transporter from the vertically integrated business (i.e. Eni) marketing the gas.

On 5 December 2011, the Shareholders’ Meeting, in implementing the Community guidelines adopted by the Decree, authorised, pursuant to Article 12.2 of the Articles of Association of Snam Rete Gas S.p.A., the transfer of the “Transportation, dispatch, remote control and metering of natural gas” business unit to Snam Trasporto S.p.A., a wholly-owned subsidiary which acts as operator of the transportation system continuously from 1 January 20125.

The same Shareholders’ Meeting also approved, with effect from 1 January 2012, the amendment to the Articles of Association concerning the change in company name from “Snam Rete Gas S.p.A.” to “Snam S.p.A.”, corresponding to the abbreviated version of the previous name. This decision is due to the expediency of giving “Snam Trasporto S.p.A.” the name “Snam Rete Gas S.p.A.”, taking into account the reputation of the brand, both in the specific business sector and in the market in general, as the leading national gas transportation operator.

The enactment of the Third Energy Package also gave rise to:

- the termination of the services agreements with Eni or with its subsidiaries;

- the acquisition of the Eni subsidiary Adfin, dedicated to the accounting and administration of Snam and its subsidiaries (1 November 2011);

- the acquisition of the Eni subsidiary, dedicated to the ICT services of Snam and its subsidiaries (1 November 2011);

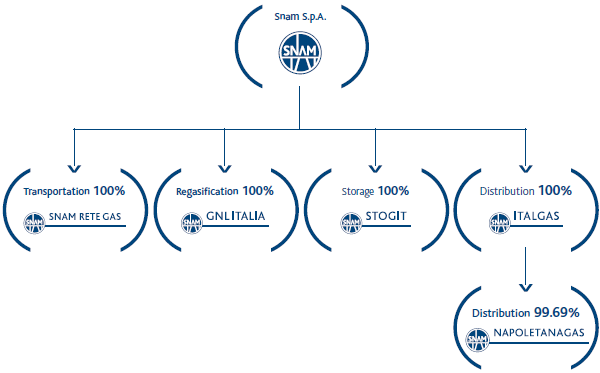

The Electricity and Gas Authority is assessing the conformity of the model adopted by Snam, pursuant to the legal proThrough the effect of the above operations, the scope of consolidation and the new logos of the company and the group as at 1 January 2012 are as follows:

SCOPE OF CONSOLIDATION AS AT 1 JANUARY 2012:

Liberalisation Decree

Decree Law no. 1 of 20 January 2012 was published in the Gazzetta Ufficiale of 24 January 2012 authorising “Urgent arrangements for competition, development of infrastructures and competitiveness”. Specifically, Article 15 “Arrangements on the subject of ownership unbundling” established that the Prime-Ministerial Decree pursuant to Article 1, paragraph 905 of Law no. 296 of 27 December 2006 relating to the implementation of ownership unbundling between Eni and Snam, will be issued within six months of the above-mentioned Decree Law coming into force.

Decree-Law no. 138 of 13 August 2011 - Additional urgent measures for financial stability and development

Net profit for 2011 was strongly penalised by the fiscal measures introduced by Decree Law no. 138 of 13 August 2011, converted into Law no. 148 of 14 September 2011. Specifically, Article 7 of this Decree amended Decree Law no. 112 of 25 June 2008 (converted into Law no. 133 of 6 August 2008) establishing an additional corporate income tax (Robin Hood Tax) for companies operating in the fields of hydrocarbons exploration and development, oil refining, production and sale of petrol, oil, diesel, lubricants, liquefied natural gas and natural gas, and the production or sale of electricity, making provision, from the current financial year, for:

- extending the scope of the Decree to include companies operating in the fields of transmission, dispatch and distribution of electricity and transportation and distribution of natural gas;

- for financial years 2011, 2012 and 2013, the increase in the rate of additional tax from 6.5% to 10.5%;

- changes to the ceiling above which the additional tax applies, identified, with reference to the previous financial year, as revenue of €10 million and taxable income of €1 million, to replace the previous threshold of €25 million.

As a result of the measures in question, Snam companies operating in the natural gas transportation and distribution segment are subject to the additional corporate income tax (IRES) at a rate of 10.5% for financial years 2011, 2012 and 2013 and 6.5% from 2014.

5 For more details on operation please see the section “Other information” of the Notes to the individual financial statements of Snam Rete Gas S.p.A.