Compliance with the Code of Conduct

In line with the values enshrined in the Code of Ethics, integrity and transparency are the principles that Snam pursues in formulating an administration and control structure that is suited to its size, complexity and operating structure, in adopting an effective internal control system, and in communicating with shareholders and other stakeholders, particularly by reviewing and updating the information available on its website.

Snam has complied with the Code of Conduct since its listing on the stock exchange in 2001. Through the decision of its Board of Directors on 19 December 2011, Snam implemented the recommendations regarding the remuneration of directors as provided by the Code of Conduct, pursuant to its last amendment in the new version published in December 2011. On 23 April 2012, the Board of Directors acknowledged the essential compliance of Snam’s organisational and regulatory structure with the Code of Conduct and made the required adjustments to the governance system in order to ensure timely implementation.

In particular, the Board:

- updated the powers assigned to the Board of Directors in order to implement the new provisions of the Code regarding: (i) internal control and risk management; (ii) remuneration policies; and (iii) shareholders’ guidelines on the professional profiles of the directors being appointed. Furthermore, detailed amendments were made in order to officially adapt the text of said powers within the Code;

- modified the Appointments Committee regulation in order to further coordinate the functions of the duties required by the Code;

- renamed the Internal Control Committee as the Control And Risk Committee and redefined its tasks, roles and responsibilities, in particular regarding coordination with other players in the internal control and risk management system;

- identified the Chief Executive Officer as the officer in charge of the internal control and risk management system;

- established the dependence of the Internal Auditor from the Board of Directors which, in compliance with the Code and the rules of the Company, hereby approves their appointment, dismissal and remuneration. The Internal Auditor will report to the director in charge of the internal control and risk management system and, in compliance with the Code, shall no longer be the head of internal control.

The Code of Conduct is available to the public on the website of Borsa Italiana S.p.A. (www.borsaitaliana.it).

The corporate governance system is aimed at creating value for shareholders in the medium to long term, out of an awareness of the social relevance of the activities in which the Company is engaged, in particular environmental protection, personal health and safety, worker protection and equal opportunity, cooperation with the local and national communities where the Company operates and, in general, the interests of all stakeholders.

Corporate governance structure

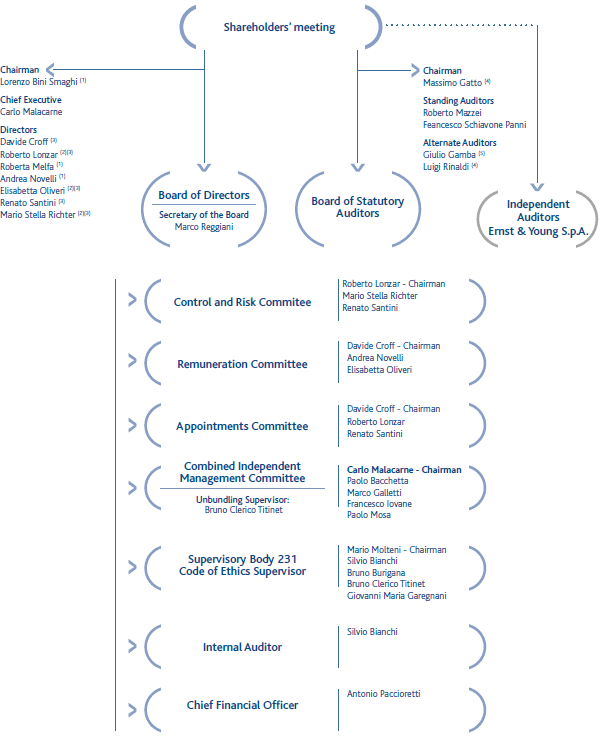

The corporate governance structure of Snam follows the traditional model, which – notwithstanding the tasks to be carried out by the Shareholders’ Meeting50 – assigns corporate management to the Board of Directors, supervisory functions to the Board of Statutory Auditors and auditing to the Independent Auditors appointed by the Shareholders’ Meeting. The chosen model therefore establishes a clear distinction between the functions of the Chairman and those of the Chief Executive Officer; pursuant to Article 19 of the Bylaws, both retain representative powers for the Company.

Please find below a graphic summary of the governance structure of the Company:

SUMMARY CHART

(1) Directors coopted to replace: Salvatore Sardo, Alessandro Bernini and Massimo Mantovani

(2) Directors appointed from the minority shareholders list

(3) Independent directors

(4) Statutory auditors appointed from the minority shareholders list

(5) He resigned from office from 21 January 2013

Bylaws

The Bylaws define the Company’s governance model and the main rules for the operation of corporate bodies.

The Shareholders’ Meeting of 26 April 2012 amended Articles 13 and 20 of the Bylaws to adopt the balancing principle between the types of composition of corporate bodies, as ratified by Article 147-ter, paragraph 1- ter and Article 148, paragraph 1- bis of the TUF. These provisions shall be applied when the corporate bodies are next renewed (Shareholders’ Meeting for approval of the financial statements for the year ended 31 December 2012, to be held on 25 and 26 March 2013).

Furthermore, the Extraordinary Shareholder’s Meeting of 30 July 2012 amended Article 5.1 of the Bylaws, eliminating the indication of the par value of the ordinary shares comprising the share capital and cancelling 189,549,700 treasury shares without par value, without affecting the amount of the share capital. In its meeting of 12 February 2013, the Board of Directors resolved to propose certain amendments to the Bylaws at the next Extraordinary Shareholders’ Meeting of 25, 26 and 27 March 2013. In particular, in addition to certain purely formal interventions, the most significant amendment proposals are listed below.

- Article 9 of the Bylaws. The clause provided for in the second section can be eliminated. In fact, this clause contains the contents of Article 126- bis of the TUF (“Additions to the agenda”), as provided by Article 3 of Legislative Decree 27 of 27 January 2010 (“Shareholders’ Rights”). Subsequently, Article 3 of Legislative Decree 91 of 18 June 2012 (the corrective decree of “Shareholders’ Rights”) amended and supplemented Article 126- bis by renaming it (“Integration of the Shareholders’ Meeting agenda and presentation of new proposals for resolution”). Article 126- bis of the TUF does not require that this right be reported in the Bylaws and elimination would make it possible to avoid, as has occurred with legislation amendments, a statutory clause which does not confirm with the law in force pro tempore. The conditions for exercising this right would, in any case, be reported in the Convocation notices for the Shareholders’ Meetings.

- Article 1, paragraph 2 of Legislative Decree 91 of 18 June 2012 has amended the first paragraph of Article 2369 of the Italian Civil Code to provide that convocation on its own shall be the default method for organising the shareholders’ meetings of companies that operate in the risk capital market, except by statutory derogation. The decision to opt for a single convocation can also be justified by the simplification requirements. Article 12 of the Bylaws is also currently aligned with the single convocation provision.

- Articles 13, 16 and 20 of the Bylaws. Directors, statutory auditors, general managers and the Chief Financial Officer should not also hold an office in the administrative or control body or managerial duties of eni S.p.A. and its subsidiaries, or maintain any relation, directly or indirectly, of a professional or equity nature with these companies (Article 2, paragraph 2, letter c) of the Prime Ministerial Decree of 25 May 2012).

Board of Directors

Pursuant to Article 13 of the Bylaws, the Board of Directors has a variable number of members ranging from five to nine, elected by list vote. Only those shareholders51 who, severally or jointly, represent at least 1% of the share capital shall have the right to submit lists (percentage set by Consob). In their meeting of 27 April 2010, the shareholders decided that there would be nine directors, and appointed the Board of Directors52 and the Chairman for three years, until the date of the Shareholders’ Meeting called to approve the financial statements for financial year 2012 (to be held on 25 and 26 March 2013).

The Board of Directors is appointed by the Shareholders’ Meeting, in compliance with the applicable laws regarding a balance between genders and based on the lists presented by the shareholders in which the candidates are listed by progressive number, and in a number no greater than the members of the body to be elected.

The Board of Directors is the central body in the Snam corporate governance system and is vested with the broadest powers of ordinary and extraordinary administration of the Company, and, in particular, is authorised to carry out any acts it considers expedient to the implementation and achievement of the corporate object, except for any acts which fall by law or by the bylaws to the Shareholders’ Meeting.

Following the sale of the controlling interest in Snam by eni S.p.A. to CDP Reti S.r.l. as provided by the Prime Ministerial Decree of 25 May 2012, concluded on 15 October 2012, the three members of the Snam Board of Directors who are directors of eni S.p.A. (Salvatore Sardo, Alessandro Bernini and Massimo Mantovani) resigned from their Board offices of Chairman and Director and Directors, respectively, with effect from 15 October 2012, and were replaced. The current Directors are: Lorenzo Bini Smaghi, Carlo Malacarne, Davide Croff, Roberto Lonzar, Roberta Melfa, Andrea Novelli, Elisabetta Oliveri, Renato Santini and Mario Stella Richter. The Board of Directors appointed Lorenzo Bini Smaghi as its Chairman.

- Directors Carlo Malacarne, Davide Croff and Renato Santini were candidates in the list presented by the shareholder eni S.p.A., which also included the Directors who resigned, Salvatore Sardo, Alessandro Bernini and Massimo Mantovani;

- Directors Lorenzo Bini Smaghi, Roberta Melfa and Andrea Novelli were co-opted by the Board of Directors to replace the eni directors who resigned;

- Directors Roberto Lonzar, Elisabetta Oliveri and Mario Stella Richter were candidates on the list submitted jointly by certain minority shareholders;

- Directors Davide Croff, Roberto Lonzar, Elisabetta Oliveri, Renato Santini and Mario Stella Richter were specifically indicated in the list since they meet the independence requirements set forth in the Bylaws.

On 15 October 2012, the Board of Directors appointed Lorenzo Bini Smaghi as Chairman (to replace Salvatore Sardo who resigned from his office as Chairman and Director concurrently) and also assigned the following duties, powers and authorisations to him. In addition to that assigned to him by law and by the Bylaws, the Chairman shall have the following powers:

- he is the Company’s legal representative;

- he deals with institutional bodies and international authorities on issues of strategic relevance, together with the CEO;

- he calls and presides over board meetings and sets their agendas, together with the CEO. He guides, oversees and coordinates board activities, ensuring proper function and adequate disclosure by directors; he verifies the implementation of board decisions;

- in consultation with the Control and Risk Committee, he assesses and shares the CEO’s proposals with the Board regarding the appointment, dismissal and remuneration of the Internal Auditor;

- he assesses and shares the CEO’s proposals to the Board regarding the appointment of general managers, the Chief Financial Officer and members of the supervisory body, pursuant to Legislative Decree 231 of 8 June 2001.

On 30 April 2010, the Board of Directors appointed Carlo Malacarne as CEO, conferring to him all functions and powers not reserved for the Board or the Chairman by law, the Bylaws or Board resolution.

Pursuant to Article 19 of the Bylaws, the Chairman and the Chief Executive Office represent the Company.

During the same meeting, Marco Reggiani, the Company’s Director of Corporate, Legal and Compliance Affairs, was confirmed as the Secretary of the Board of Directors, and on that same date the Board introduced a set of rules to regulate his work in this capacity.

The Board shall periodically evaluate the independence and integrity of the Directors, as well as the lack of grounds for ineligibility or incompatibility.

Pursuant to the terms of the Company Bylaws which are more favourable than those provided for by law if there are no more than seven directors on the Board at least one must satisfy the independence criteria established for auditors of listed companies; however, with more than seven directors on the board, at least three must satisfy the independence criteria. The composition of the Board of Directors must comply with the applicable laws on balance between the genders.

If one of the directors does not fulfil or no longer fulfils the established independence or integrity requirements imposed by law, or if there are grounds for ineligibility or incompatibility, the Board will dismiss the director and arrange for him or her to be replaced, or will ask that the grounds of incompatibility be removed within an established period of time, otherwise he or she must forfeit the post.

Directors’ independence and integrity as well as the inexistence of grounds for ineligibility and incompatibility is assessed following their appointment and at least once a year by the Board of Directors, based on information provided by the director or made available to the Company by other means. In its meeting of 12 February 2013, the Board of Directors noted that no grounds for director incompatibility or ineligibility existed and that the directors met the integrity requirements for supervisory bodies established by Ministry of Justice Decree 162 of 30 March 2000.

In the same meeting of 12 February 2013, the Board of Directors noted that the non-executive directors Davide Croff, Roberto Lonzar, Renato Santini, Elisabetta Oliveri and Mario Stella Richter met the independence requirements imposed by current legislation and the Code of Conduct. The Board of Statutory Auditors also verified that the criteria and the assessment procedures adopted by the Board of Directors were correctly applied.

In accordance with the provisions of the Code of Conduct, on 12 February 2013 the Board of Directors evaluated the size, composition and workings of the Board and its committees, using for this purpose the services of Egon Zehnder International, an outside specialist.

In the light of the results of Egon Zehnder International’s evaluation of the Board of Directors and its committees, the Board expressed a very positive opinion on the size, composition and workings of the Board and its committees. Furthermore, given the outcome of the assessment, the Board of Directors expressed the following view on the professionals that the Board requires, which was also set forth in the Report of the Board of Directors to the Ordinary Shareholders’ Meeting of 25 and 26 March 2013 regarding the appointment of Directors: “the skills that the majority of Directors consider useful for strengthening the new Board are:

- strategic and market orientation

- knowledge of the Energy business

- international dimension

Otherwise, we consider that the mix of current skills is generally appropriate for the future requirements of Snam”.

The independent directors met in 2012, in line with the Code of Conduct, to approve the report and discuss the issues of major importance. In particular, at that time the Chief Executive Officer indicated the need for (i) Snam to set into motion on the market the refinancing for the repayment of the existing debt to eni in view of the latter’s exit from Snam and its subsidiaries; and (ii) setting up a Snam finance function, separate from that of eni. The statutory auditors of Snam were invited to that meeting.

Board of Statutory Auditors

In compliance with the provisions of the law and the Bylaws, Snam’s Board of Statutory Auditors is composed of three statutory auditors and two alternate auditors, who are appointed by the Shareholders’ Meeting for three-year terms and may be re-elected at the end of their term in office. Like the Board of Directors and in line with applicable provisions, the Bylaws provide for the auditors to be appointed by list vote, except when they are replaced during their term in office.

The Board of Statutory Auditors is appointed by the Shareholders’ Meeting, in compliance with the applicable laws regarding balance between genders and based on the lists presented by the shareholders in which the candidates are listed by progressive number, and in a number not to exceed the members of the body to be elected.

The Shareholders’ Meeting of 27 April 2010 appointed the following auditors53 for a period of three years or until the date of the Shareholders’ Meeting called to approve the 2012 financial statements: Massimo Gatto (Chairman), Roberto Mazzei and Francesco Schiavone Panni (statutory auditors), and Giulio Gamba and Luigi Rinaldi (alternate auditors). Roberto Mazzei, Francesco Schiavone Panni and Giulio Gamba were elected from the list presented by eni S.p.A. Massimo Gatto and Luigi Rinaldi were elected from the list presented by a number of minority shareholders.

Alternate auditor Giulio Gamba resigned from office on 21 January 2013.

Statutory auditors are chosen from among those who meet the professionalism and integrity requirements indicated in Ministry of Justice Decree 162 of 30 March 2000. For the purposes of this Decree, the Company’s business areas are commercial law, business administration and corporate finance. Likewise, the sector pertaining to its business is the engineering and geological sector.

The Board of Statutory Auditors, based on its own statements, has verified that all members of the Board satisfy the independence requirements provided by law, as well as those for directors contained in Article 3 of the Code of Conduct.

Independent auditors

As required by law, the Company’s financial statements are audited by Independent Auditors included in the relevant register and appointed by the Shareholder’s Meeting based on a proposal issued by the Board of Statutory Auditors.

On the same date, the Shareholders’ Meeting appointed Reconta Ernst & Young S.p.A to audit the Company for the 2010-2018 period.

Remuneration

At its meeting of 27 February 2013, the Board of Directors approved the Remuneration Report required by Article 123- ter of the TUF, which will be submitted to the Shareholders’ Meeting. The Report contains, inter alia, the Remuneration Policy for the Chairman, CEO and other managers with strategic responsibilities. The Remuneration Report prepared in accordance with Article 123- ter of the TUF can be found in the Governance section of the Company’s website.

Committees instituted by the Board of Directors

For more efficient performance in its duties, in accordance with the Code of Conduct, the Board of Directors has established three committees: the Remuneration Committee, the Appointments Committee and the Control and Risk Committee. The composition, duties and operations of the Committees are governed by the Board and set forth in specific regulations (which are available in the Governance section of the Company’s website), in compliance with the criteria established in the Code.

Furthermore, pursuant to Article 16 of the Bylaws, the Combined Independent Management Committee has been created.

1) The Remuneration Committee consists of three non-executive directors, two of whom are independent, including the Chairman Davide Croff. The other members are: Andrea Novelli and Elisabetta Oliveri. The Committee has the following responsibilities in terms of making proposals and providing advice to the Board on directors’ remuneration:

- to submit the Remuneration Report for the approval of the Board of Directors, with particular regard to the Remuneration Policy for directors and managers with strategic responsibilities, so that it may be presented to the Shareholders’ Meeting called to approve the financial statements within the time limits set by law;

- to periodically evaluate the suitability, compliance and sound application of the policy adopted, expressing proposals to the Board in this regard;

- to make proposals relating to the remuneration of the Chairman and the Chief Executive Officer, concerning the various forms of compensation and remuneration;

- to make proposals on the remuneration of the members of the Directors’ Committees established by the Board;

- to make proposals, having considered the recommendations of the CEO, regarding the general criteria for the remuneration of managers with strategic responsibilities, annual and long-term incentive plans including those based on equity; to define performance objectives and record the results of performance plans in order to determine the variable remuneration of directors with specific responsibilities and the implementation of incentive plans;

- to monitor the implementation of the decisions taken by the Board;

- to report to the Board on its activities every six months.

The Committee also expresses any opinions requested of it pursuant to the procedures in regard to transactions with related parties according to the terms and conditions set forth in the procedure.

In accordance with the decision of the Board of Directors, each year the Remuneration Committee reviews the remuneration structure for the Internal Auditor, checking that it meets the general criteria approved by the Board for all managers and informing the Chairman of the Control and Risk Committee of its findings so that they, in turn, may report on the matter to the Board.

2) The Appointments Committee is composed exclusively of non-executive and independent Directors: Davide Croff, Roberto Lonzar and Renato Santini. Davide Croff chairs the Committee. On 23 April 2012, the Board of Directors approved the new regulation. The Appointments Committee makes proposals and provides advice to the Board of Directors.

The Committee has the following functions:

to propose the candidates for the office of director to the Board, in the event that during the year one or more directors leaves the board (Article 2386, paragraph 1, of the Italian Civil Code), ensuring adherence to the provisions regarding the minimum number of independent directors and the percentages reserved for the under-represented gender;

- to submit to the Board of Directors, upon proposal of the CEO, the candidates for the replacement of the corporate bodies of direct subsidiaries. The Committee’s proposal is binding;

- to develop and propose: a) annual self-assessment procedures for the Board of Directors and its committees; b) directives on the limits and rules against the accumulation of positions by the directors of Snam and its subsidiaries; and c) criteria for assessing the professional and independence requirements that apply to directors of Snam and its subsidiaries, and their competitive activities;

- to report to the Board on its activities every six months.

3) The Control and Risk Committee is composed of three non-executive independent directors (Roberto Lonzar – Chairman, Renato Santini and Mario Stella Richter), and, as defined in the Code of Conduct for listed companies, its role is to propose and advise the Board in order to support, with the appropriate research, the assessments and decisions of the Board regarding the internal control and risk management system, in addition to the approvals of the periodic financial statements.

In particular, the Committee has the following functions:

a) to evaluate, together with the Chief Financial Officer and upon hearing the opinion of the Independent Auditors and Board of Statutory Auditors, the proper use of accounting standards and their consistency for purposes of preparing the consolidated financial statements;

b) to express opinions on specific aspects involving the identification of the main risks to the Company;

c) to perform additional duties assigned to it by the Board of Directors, in particular expressing an opinion on the rules governing the transparency and substantial and procedural correctness of transactions with related parties and those in which a director or statutory auditor has an interest, either on his own behalf or on behalf of a third party;

d) to examine the periodic assessment reports of the internal control and risk management system and the reports of particular significance prepared by the Internal Auditor;

e) to monitor the autonomy, adequacy, efficiency and effectiveness of the Internal Audit department;

f) to potentially request the Internal Auditor to carry out checks on specific areas of operation, while concurrently informing the Chairman of the Board of Statutory Auditors;

g) to report to the Board, at least every six months, upon approval of the annual and half-yearly financial statements, on the activity carried out and the adequacy of the internal control and risk management system;

h) to express an opinion on the proposals made by the Chief Executive Officer, in agreement with the Chairman, to the Board of Directors (i) regarding the appointment, dismissal and remuneration of the Internal Auditor, in line with the Company’s remuneration policies, and (ii) which aim to ensure that this individual has the appropriate skills and resources with which to carry out his/her duties.

Furthermore, the Committee informs the Board of Directors in regard to its opinion on:

1. the definition of the guidelines for the internal control and risk management system, so that the main risks affecting the Company and its subsidiaries are correctly identified and adequately measured, managed and monitored, and to determine the degree of compatibility of such risks through management that is in line with the strategic objectives that have been set;

2. periodic assessment, at least annually, of the adequacy of the internal control and risk management system with regard to the characteristics of the Company and the risk profile assumed, as well as its efficacy;

3. periodic, but at least annual, approval of the work plan prepared by the Internal Auditor;

4. the description in the Report on corporate governance and the ownership structure of the main characteristics of the internal control and risk management system as well as the assessment of the system’s adequacy;

5. the assessment of the results provided by the Independent Auditors in the recommendation letter following the legal audit.

4) Resolution ARG/com 57/2010 of the Electricity and Gas Authority, amending Resolution 11/07 on the functional unbundling of regulated activities in the natural gas sector, established that, pursuant to and in accordance with Article 9 of the aforementioned Resolution 11/2007 (the “Consolidated Unbundling Act”), the activities of natural gas storage, regasification, transportation, dispatching, distribution and metering may be managed jointly, and are not subject to functional unbundling obligations.

Through the decision of 27 July 2010, the Board of Directors established the Combined Independent Management Committee (“the Management Committee”) pursuant to Article 9 of the Consolidated Unbundling Act. The Management Committee oversees the joint management of natural gas transportation and dispatching, distribution, storage and regasification activities, and is composed of persons who, pro tempore, fill the following positions:

- CEO of Snam;

- CEO of GNL Italia;

- CEO of Italgas;

- CEO of Snam Rete Gas;

- CEO of Stogit.

The Board has conferred all powers on the Committee to perform its functions. The Combined Independent Management Committee has adopted its own operating regulations.

The Chief Executive Officer of Snam chairs the Management Committee and represents the organisational structure within the Management Committee responsible for expressing opinions binding on the Board of Directors in compliance with and for the purposes cited in Article 11.5, letter c) of the Consolidated Unbundling Act, for all decisions taken by the said body affecting the business’ managerial and organisational aspects; on any decisions that could have a direct or indirect effect on the independence of the transportation system; and to approve the development plan cited in paragraph 11.1, letter b), point i) of the Consolidated Unbundling Act.

The Management Committee appointed the Supervisor, in the person of the Snam Head of Compliance and Assurance, responsible for the proper management of commercially sensitive information in the context of the business activities.

Legislative Decree 93 of 1 June 2011 and Prime Ministerial Decree of 25 May 2012: from functional unbundling to ownership unbundling

Legislative Decree 93 of 1 June 2011 on the “Implementation of Directives 2009/72/EC, 2009/73/EC and 2008/92/EC concerning common rules for the internal market in electricity and natural gas and a Community procedure to improve the transparency of gas and electricity prices charged to industrial end users, repealing Directives 2003/54/EC and 2003/55/EC” (the “Decree”) saw the transposition by Italian legislation of Directive 2009/73/EC, which introduced new provisions on the unbundling of natural gas transportation system operators from the other activities in the gas supply chain.

The Decree provides that the major transportation company shall comply with the rules governing an “Independent Transmission Operator” (ITO, hereinafter the “Operator”).

According to the rules governing the ITO model, in order to demonstrate the unbundling of the Operator from the vertically integrated company, the Operator’s compliance with the requirements of the Decree must be certified by the Electricity and Gas Authority. Having obtained this certification, the Operator is approved and appointed by the Ministry of Economic Development as the “Operator of the Transportation System”. The appointment is notified to the European Commission and published in the Official Journal of the European Union.

Furthermore, the Decree: (i) confirmed the system of commercial and functional unbundling of distribution activities, as already provided by Directive 2003/55/EC; (ii) enforced the commercial unbundling of the transportation network from the ownership structure for storage activities, in the cases where the transportation network had adopted the ISO model (designed for minor transportation companies); and (iii) confirmed, with regard to regasification of liquefied natural gas (LNG), the principle of unbundling the accounts of LNG regasification activities from the other activities in the gas supply chain and identified the duties of the operator of the LNG gas system.

In order to comply with the Decree, the Snam Board of Directors decided that the most efficient way to proceed was to transfer the transportation, dispatching, remote control and metering business unit to its wholly owned subsidiary Snam Rete Gas, on behalf of which certification as an Independent Transmission Operator was then requested.

As a result of the ensuing corporate reorganisation, an organisational structure was created which, in order to reinforce the rules of functional unbundling from the vertically integrated company (eni), is made up of four operating companies that are direct subsidiaries of Snam (GNL Italia, Italgas, Snam Rete Gas and Stogit, alongside the indirect subsidiary Napoletanagas, the “Subsidiaries”), which are focused on the management and development of their respective businesses, plus a corporate company (Snam), which is responsible for:

a) strategic planning, management, coordination and control of the subsidiaries;

b) providing business support services to the subsidiaries (including by taking over the services previously provided by eni and its subsidiaries) in accordance with the rules of the Decree, in order to retain the levels of operating efficiency obtained following the acquisitions of Italgas and Stogit in 2009.

In accordance with the provisions of the Decree, Snam Rete Gas has been given a system of governance, responsibilities and organisational structures that are in line with the Decree’s specific requirements, including in terms of personnel and asset ownership.

On 8 June 2012, the Electricity and Gas Authority published its preliminary decision regarding the certification of Snam Rete Gas as an Independent Transmission Operator, pursuant to Article 9, paragraph 8 of the Directive and Article 10, paragraph 1, letter a) of the Decree (Resolution 191/2012/E/gas), which was followed with a request for an opinion from the European Commission on 1 August 2012. On 4 October 2012, the Electricity and Gas Authority concluded the procedure for the certification of Snam Rete Gas as an Independent Transmission Operator, through the issuing of Resolution 403/2012/R/gas (“Resolution 403/12”). While the certification process for Snam Rete Gas as an Independent Transmission Operator was being finalised, Law 27 of 24 March 2012 was passed, which converted into law Decree-Law 1 of 24 January 2012 (“Law 27/12”), Article 15 of which makes it mandatory to ensure the ownership unbundling of the regulated services of natural gas transportation, storage, regasification and distribution from the other activities of the relative competitive activities by 24 September 2013.

To this end, Prime Ministerial Decree of 25 May 2012 established the “criteria, conditions and procedures which Snam S.p.A. complies with in order to adopt the ownership unbundling model for the domestic gas transportation network and to ensure the full impartiality of Snam S.p.A. towards vertically integrated companies that produce and supply natural gas and electricity”.

The provisions of the Prime Ministerial Decree of 25 May 2012 create an ownership unbundling regime (hereinafter, “OU”) in Italy which is decidedly more incisive than the one provided by the “Third Energy Package”. Indeed, in addition to not imposing an OU obligation for natural gas transportation, European law provides for: (i) the possibility of adopting an OU regime only in relation to natural gas transportation, while it provides only for ownership and functional unbundling for distribution, functional unbundling for storage and merely the administrative and accounting unbundling for regasification; and (ii) the presence, if an OU regime is in operation, of a “minority” interest in the share capital by the vertically integrated company and strong restrictions regarding its voting rights (Article 9 of Directive 2009/73/EC).

Conversely, in Italy an OU regime which encompasses all regulated activities of natural gas transportation, distribution, storage and regasification has been opted for, and furthermore the vertically integrated company (eni) is required to transfer the entire equity interest it holds in the share capital of Snam.

The Prime Ministerial Decree provides that within the shortest time possible allowed by market conditions but no later than 25 September 2013, eni will reduce its equity interest in order to transfer control to Snam and subsequently transfer its remaining equity interest in the share capital of Snam. In particular, the Prime Ministerial Decree of 25 May 2012 provides that eni:

- within the shortest time possible allowed by market conditions, will transfer to CDP, potentially in several tranches, a share that overall will be no less than 25.1% of Snam’s share capital through direct negotiations;

- following the transfer of at least 25.1% of Snam’s share capital to CDP, it shall transfer the remaining share it holds in Snam’s share capital using transparent sales procedures that do not discriminate between retail and institutional investors.

The Prime Ministerial Decree provides that as a result of purchasing at least 25.1% of the share capital of Snam, CDP will ensure the independence and full impartiality between eni and Snam. To this end, Article 2 of the Prime Ministerial Decree of 25 May 2012 provides that:

- even in the event that Snam is included in the separate operation of CDP, all decisions regarding the management of Snam’s equity investments shall be adopted by the Board of Directors of CDP, as if the equity investment were included in ordinary operations, therefore excluding the planning powers of the Ministry of Economy and Finance and ensuring that members of the CDP Board of Directors for administration of separate operation cannot influence these decisions;

- CDP’s equity investment in eni shall not change;

- the members of the corporate and managerial bodies of eni and its subsidiaries shall not be members of the corporate bodies of CDP or Snam and their subsidiaries nor will they hold managerial positions therein or any relation, whether direct or indirect, of a professional or equity nature with these companies or vice versa.

In regard to the latter, Snam and its subsidiaries have carried out the necessary verifications proving that the aforementioned incompatibility does not apply to the Directors and managers of Snam and its subsidiaries. With regard to statutory auditors, in the event that such incompatibility is found, the measures which aim to resolve situations of incompatibility have been taken and the Boards of Statutory Auditors of the Snam Group have been composed so that they conform to the aforementioned regulation.

The Prime Ministerial Decree also provides that, starting from the first date between 25 September 2013 and the date on which eni lost control over Snam, eni’s voting rights (or those of other gas and/or electricity producers or suppliers or the companies controlling them or which are controlled by or associated to them) in the Snam Shareholders’ Meeting shall be limited to the provisions of Article 19 of the Decree.

Pursuant to the provisions of the Prime Ministerial Decree and upon occurrence of the conditions precedent indicated in the relative acquisition contract (including the granting of authorisation by the Competition Authority), eni completed the transfer to CDP Reti S.r.l. (a company that is wholly owned by CDP) of 30% minus one share of the voting capital of Snam.

As a result of eni’s loss of control over Snam, the application for the re-certification of Snam Rete Gas as the transmission system operator under the ownership unbundling regime was submitted on 14 December 2012.

After the completion of the ownership unbundling, the conditions linked to the legal regime for the transmission operator were fulfilled, and therefore on 19 December 2012 the Shareholders’ Meeting of Snam Rete Gas adapted its Bylaws (effective from 1 January 2013).

The internal control and risk management system

Snam has adopted an internal control and risk management system conforming to the prescriptions of the Code of Conduct for Listed Companies and in line with the current best practices. The purpose of the internal control and risk management system is to contribute to operating a company that pursues the corporate objectives defined by the Board of Directors, focusing on making informed decisions; this ensures the protection of corporate assets, the efficiency and effectiveness of corporate processes, the reliability of financial reporting, and compliance with the laws and regulations as well as the Bylaws and internal procedures.

With the assistance of the Control and Risk Committee, the responsibility of the internal control and risk management system requires that the Board of Directors directs and assesses the adequacy of the system and identifies within it one or more directors in charge of establishing and maintaining an efficient internal control and risk management system.

Pursuant to the above, the Board of Directors of Snam has identified the Company’s Chief Executive Officer, the director who establishes and maintains an effective internal control and risk management system, to carry out the activities required by the Code of Conduct.

Applying the control system is the primary responsibility of the functional management insofar as control activities are an integral part of management procedures. Management must therefore foster an environment which encourages controls and in particular must manage “line controls”, consisting of all the control activities that individual operating units or companies perform over their own procedures.

The Internal Audit department carries out an independent role and in particular is in charge of ensuring that the internal control and risk management system is functioning and adequate.

In compliance with the recommendations of the Code of Conduct, upon the proposal of the director in charge of the internal control and risk management system with the agreement of the Chairman and subject to the favourable opinion of the Control and Risk Committee acknowledged by the Board of Statutory Auditors, the Board of Directors (i) appoints and revokes the Internal Auditor; (ii) ensures that they fulfil the requirements for carrying out their responsibilities; and (iii) defines the remuneration in line with corporate policies. The internal audit activities are carried out based on the guidelines approved by the Board of Directors, while ensuring that the necessary conditions regarding independence, objectivity, skills and professional diligence are upheld.

The Internal Auditor reports to the Chief Executive Officer, who is in charge of the internal control and risk management system, and to the Board of Directors through the Control and Risk Committee and the Board of Statutory Auditors.

The Bylaws also provide for the Board of Directors to appoint the Chief Financial Officer, on the proposal of the Chief Executive Officer, by agreement with the Chairman and based on a favourable opinion from the Board of Statutory Auditors.

In compliance with the professionalism requirements established by the Bylaws, upon the proposal of the Chief Executive Officer, by agreement with the Chairman and subject to the favourable opinion of the Board of Statutory Auditors, on 29 October 2007 the Board of Directors appointed Dr Antonio Paccioretti, the Planning, Administration, Finance and Control Manager of Snam, as Chief Financial Officer. The Board of Directors also verified the adequacy of the powers and resources at the disposal of the CFO to perform the duties assigned, as well as the observance of existing administrative and accounting procedures.

The internal control and risk management system is subject over time to verification and updating, in order to continually ensure its suitability to protect the main risk areas of the Company’s activities, with respect to the characteristics of its operating sectors and its organisational configuration, and in keeping with any new legislative or regulatory developments.

Within this framework and in order to implement the provisions of the Code of Conduct, Snam has begun work aimed at establishing the Enterprise Risk Management System with rules, procedures and organisational structures for the identification, measurement, management and monitoring of the main risks that could influence the achievement of the strategic objectives, with appropriate reference to the existing reference models and best practices. In 2013, the Board of Directors will formalise the guidelines for the internal control and risk management system so as to determine the level of risks with respect to management of the Company according to the identified strategic objectives.

Principal characteristics of the risk management and internal control system in the financial reporting process

The internal control system on financial reporting aims to provide reasonable certainty of the reliability54 of said financial reporting and of the capability of the financial statement preparation process to produce financial information in keeping with generally accepted accounting principles.

Snam has adopted a body of rules that define the standards, methods, roles and responsibilities for designing, implementing and maintaining the system of internal controls over time on the financial reporting of Snam and its subsidiaries, and on the evaluation of its efficacy.

The set of procedures for the financial reporting control system was defined in accordance with the provisions of Article 154- bis of the TUF and takes into account the prescriptions of the U.S. Sarbanes-Oxley Act of 2002 (SOA), which apply to the former ultimate parent eni S.p.A. in its capacity as an issuer listed on the New York Stock Exchange (NYSE) and which had repercussions for Snam as a significant subsidiary.

With the transfer to Cassa Depositi e Prestiti of a portion of eni’s equity investment in Snam on 15 October 2012, Snam exited eni’s scope of consolidation and is therefore no longer subject to the requirements requested by the SOA. Snam continues to be required to abide by the obligations set forth in Italian law for listed companies, pursuant to the aforementioned Article 154- bis of the TUF.

The internal control model for financial reporting adopted by Snam is based on the COSO Report (“Internal Control – Integrated Framework” published by the Committee of Sponsoring Organisations of the Treadway Commission).

In addition to Snam, the control model is applied to its subsidiaries pursuant to international accounting standards and based on their relevance in the preparation of financial information. Snam subsidiaries adopt the control model defined as a reference to design and institute their own control system and tailor it to their size and the complexity of the activities they undertake.

The design, institution and maintenance of the control system are ensured by risk assessment, identification and evaluation of controls, and reporting.

Controls are subject to evaluation in order to verify the quality of their design over time and their operational effectiveness; to this end, line monitoring has been entrusted to the management responsible for significant processes/activities, and independent monitoring has been entrusted to the internal audit department.

The results of the monitoring activities form the subject of periodic reporting on the status of the control system, which involves all levels of Snam’s organisational structure and its significant subsidiaries, from business operation heads and department heads to administrative directors and Chief Executive Officers.

Evaluations of all the controls implemented within Snam and its subsidiaries are brought to the attention of the Chief Financial Officer, who, on the basis of this information, prepares a half-yearly report on the adequacy and effective application of the control system, which is shared with the Chief Executive Officer and copied to the Board of Directors, after notice is given to the Control and Risk Committee and the Board of Statutory Auditors.

Code of Ethics

On 26 October 2012, the Board of Directors updated the Code of Ethics, which incorporates the most modern guidelines on business ethics and sustainability in a manner that is fully consistent with the objective of including all of the values that the Company recognises, accepts and shares, as well as the responsibilities that it assumes inside and outside the Company.

The Snam Code of Ethics includes a special Addendum which considers the specifics of the activities engaged in by Snam and its subsidiaries, which are subject to regulation by the Electricity and Gas Authority. Special emphasis is given to relationships with the Electricity and Gas Authority and to unbundling regulations.

The functions of the Supervisor of the Code of Ethics were assigned to the Supervisory Body, to which the following may be submitted:

- requests for clarification or interpretation of the principles and contents of the Code;

- suggestions relating to the application of the Code;

- reports of violations of the Code that have been determined directly or indirectly.

Snam employees, without distinction or exception, have the duty to comply and ensure compliance with these principles within the scope of their functions and responsibilities. Under no circumstances can any conduct contrary to these principles be justified by the belief that one is acting in the Company’s interests.

Model 231

Legislative Decree 231 of 8 June 2001 introduced rules of corporate administrative liability, on the basis of which companies may be held liable and consequently punished for offences committed or attempted in the interest or advantage of the Company by persons vested with representation, administration or management functions at the entity or at one of its organisational units enjoying financial and functional independence, as well as by persons engaging in management and control of the entity, de facto or otherwise (i.e., top management) or by persons subject to management or oversight by one of the abovementioned parties (i.e., individuals managed by another person). The Company is not liable if, before an offence is committed, it has adopted and effectively implemented organisational, management and control models suitable for preventing such offences and if it has instituted a Body charged with overseeing the functioning and observance of the models.

In this regard, Snam and its subsidiaries have implemented the legal provisions by adopting its own organisation, management and control model commensurate with its particular nature, and by appointing for each of them a Supervisory Body responsible for monitoring the implementation and effective application of the Model.

In February 2012, following the restructuring of the Snam Group after endorsement of the provisions of Legislative Decree 93/2011 and the introduction of environmental crimes into the text of Legislative Decree 231/2011, a new text was approved for Model 231. Subsequently, following the conclusion of eni’s transfer to Cassa Depositi e Prestiti S.p.A. of 30% minus one share of Snam’s voting capital and eni S.p.A.’s consequent loss of control over Snam, as part of a more complex redefinition of the Company’s information flows, Snam’s Board of Directors made changes to Model 231.

A multi-functional team was established within the Company named “Team 231”, aimed at identifying and developing the activities required for the update of Model 231 for the Company and its subsidiaries, through the implementation of new laws introduced into the field and the application of Legislative Decree 231 of 8 June 2001.

The composition and functions of Team 231 have recently been modified in order to include the activities required for identifying and organising the update of Model 231 by Snam and subsidiaries, following the approval of Law 190 of 6 November 2012 “Anti-corruption Law – Provisions for the prevention and repression of corruption and illegality in administration”.

The Supervisory Body of Snam consists of the Head of HR, Organisation and Security, the Internal Auditor, the Head of Compliance and Assurance and two external members, one of whom acts as Chairman.

Anti-corruption Management System Guidelines

With its resolution of 9 February 2011, the Snam Board of Directors authorised the Chief Executive Officer to adopt and update the MSG regarding compliance with reference, inter alia, to issues connected to the fight against corruption.

The Anti-corruption MSG adopted by Snam on 13 July 2012 cancel and replace eni Circular 377 of 12 November 2009 named “Anti-corruption guidelines”, adopted by the Board of Directors of Snam on 10 February 2010, in line with the Snam Code of Ethics, which prohibits corruption without any exceptions, including between private parties.

In addition to avoiding significant penalties, the purpose of the policy is to protect and promote Snam’s reputation by introducing a specific system of rules designed to ensure that the Company complies with the best international standards in the fight against corruption.

The adoption and implementation of the Anti-corruption MSG is mandatory for Snam and its subsidiaries, which have implemented it through a Board of Directors resolution.

The “Anti-Corruption” regulatory and procedural system was reviewed as part of the update of Model 231, in relation also to the provisions of Law 190/12 (anti-corruption law) and the UK Bribery Act (in relation to Snam’s investments abroad, and Great Britain in particular).

Antitrust Code of Conduct

On 3 August 2012, Snam adopted the “Antitrust Code of Conduct” (hereinafter the “Antitrust Code”) Management System Guidelines, which all employees of Snam and its subsidiaries must comply with to ensure that Snam and its subsidiaries comply with the principles set forth on antitrust regulations.

Snam subsidiaries implemented the Antitrust Code into their own system of regulations.

The antitrust code is one of the initiatives of the Snam Group which aim to promote the development of a corporate culture that protects competition and sets up systems and procedures that reduce antitrust violations to a minimum level, as part of the broader compliance initiatives (Model 231, fight against corruption, corporate ethics, etc.).

In particular, given that the main risks that a company can experience as a result of violations of the antitrust laws include (i) pecuniary administrative sanctions; (ii) liability for compensation payable for damages caused to third parties due to antitrust violations; (iii) damage to a company’s image; and (iv) a potentially negative impact on the prices of the securities traded on regulated markets, an antitrust compliance programme was created following analysis of the best international practices in terms of antitrust issues which is developed through:

(i) adoption of the Antitrust Code which provides, in a simple yet exhaustive form, the detailed guidelines and code of conduct to follow in relation to antitrust issues, with particular reference to the sectors of activity that are applicable to the Snam Group;

(ii) specific communications and training initiatives for all employees which aim to ensure awareness, effectiveness and correct implementation of the Code;

(iii) the establishment within Snam’s Legal and Corporate Affairs and Compliance Division of an Antitrust Unit which will support and assist in the application of the Code;

(iv) a monitoring programme to verify the effectiveness of the rules contained in the Code and the opportunity to make amendments and updates to it in order to ensure the more effective implementation of its rules, in light also of the changing regulations and business.

The Antitrust Code of Conduct is applicable to Snam and its subsidiaries and is particularly directed to all: (i) members of the corporate bodies, (ii) managers, (iii) employees and associates who represent the Company – together the “Snam Persons”.

Procedure to be followed for the interests of directors and statutory auditors with related parties

Through Resolution 17221 of 12 March 2010, amended by Resolution 17389 of 23 June 2010, Consob approved the regulations on related-party transactions carried out, directly or through subsidiaries, by listed companies and by public share issuers with persons with potential conflicts of interest, such as major or controlling shareholders, directors, statutory auditors and other executives, and their close family members.

The reform of company law (Article 2391- bis of the Italian Civil Code) gave Consob, in its role as the supervisory and regulatory body for the financial markets, the task of establishing general regulatory principles in order to “ensure the transparency and substantial and procedural correctness of transactions with related parties”.

The measure aims to provide better protection to minority shareholders and other stakeholders by combating any abuses which might arise from related-party transactions with a potential conflict of interest. These include, by way of example, mergers, acquisitions, disposals and reserved capital increases.

In short, the regulation provides for:

a) the reinforcement of the role of the independent directors in all phases of the decision-making process on transactions with related parties;

b) a system of transparency.

On 30 November 2010, the Board of Directors approved the procedure on “Transactions in which directors and statutory auditors have an interest, and transactions with related parties”. The procedure applies from 1 January 2011 and is adopted pursuant to Article 2391- bis of the Italian Civil Code and Consob Regulation 17221 of 12 March 2010, “Regulation on transactions with related parties”, as amended.

In its meeting of 13 February 2012, the Board of Directors made its first annual check on the effectiveness of the procedure, as required in said procedure and ahead of the three-year deadline set by Consob. The Board approved a number of amendments to take account of specific operating requirements that emerged during the first year of its application, as well as the modified organisational structure of Snam and its subsidiaries.

The procedure has been provisionally and unanimously approved by Snam’s Control and Risk Committee which, pursuant to Borsa Italiana’s Code of Conduct and the aforesaid Regulation, is composed entirely of independent directors.

Treatment of Company information

In compliance with the legislative provisions on Market Abuse, the Board of Directors has adopted the “Procedure for communication to the market of privileged information and documents concerning Snam and the financial instruments issued by it”, the “Procedure concerning the identification of relevant persons and the communication of transactions carried out by them, including via nominees, in relation to shares issued by Snam or other financial instruments connected with such shares” (“Internal Dealing Procedure”) and the procedure “Keeping and updating of the register of persons who have access to privileged information within Snam”55. In its meeting of 26 October 2012, the Board of Directors of Snam approved the updating of two of the three procedures (market disclosure and internal dealing). In particular, the amendments mainly consisted of: (i) amendment to the texts of all procedures referring to eni S.p.A. and (ii) certain updates which became necessary following amendments to regulations.

Shareholders’ rights

Shareholders’ Meetings are privileged corporate meetings between the Company’s management and its shareholders.

In order to involve shareholders in company life, Snam has taken various measures designed to ease the participation of shareholders in making decisions reserved to the Shareholders’ Meeting, making it easier for them to exercise their rights. Specifically, during 2010 Snam amended its Bylaws in light of the transposition in Italy through Legislative Decree 27 of 27 January 2010 of Directive 2007/36/EC on the exercise of certain rights of shareholders in listed companies (the “Shareholders’ Rights Directive”).

By taking measures which the legislation leaves up to companies’, Snam aimed to provide its shareholders with additional tools to encourage them to take part in shareholders’ meetings and exercise their voting rights (for example, the appointment of the listed company’s proxy holder).

The Board of Directors has resolved to propose to the Extraordinary Shareholders’ Meeting of 25, 26 and 27 March 2013 the amendment of the Bylaws in order for there to be a single convocation as a default for the organisation of shareholders’ meetings of companies that use risk capital markets, unless there is a specific derogation in the articles (as provided by Article 1, paragraph 2 of Legislative Decree 91 of 18 June 2012, the corrective decree named “Shareholders’ Rights”).

In 2010 the website was enhanced and now features the “Shareholders’ Guide”56, including an interactive version, which aims to provide a summary of useful information which will give all shareholders a more active experience in their Snam investment.

50 For further information on the role of the Shareholders’ Meeting and the participation of shareholders, please refer to the Governance section of the Snam website and the document “Report on corporate governance and ownership structure 2012”.

51 Each shareholder may present or be involved in the presentation of only one list, and may vote for one list only.

52 For further information on the personal and professional characteristics of the directors elected, please refer to the Governance section of the Snam website.

53 For further information on the personal and professional characteristics of the statutory auditors elected, please refer to the Governance section of the Snam S.p.A website.

54 Reliability (of the information): information characterised by accuracy and compliance with generally accepted accounting principles which meets the legal and regulatory requirements applied.

55 The above-mentioned procedures are published in the Governance section of the Company’s website, http://www.snam.it.

56 The Shareholders’ Guide is published in the Investor Relations section of the Company’s website at: http://www.snam.it.