Snam’s Remuneration Committee

Composition, appointments and tasks

The Remuneration Committee, first established by the Board of Directors in 2002, consists of, in line with the most recent recommendations of the Code of Corporate Governance, three non-executive directors, the majority of whom are independent, with the Chairman selected from among the independent directors. At least one member of the Committee has adequate knowledge and experience in financial matters or remuneration policies, as assessed by the Board at the time of appointment. The Board of Directors carried out such an assessment on 23 April 2013. Since 23 April 2013, the Remuneration Committee has consisted of the following directors: Elisabetta Oliveri (non-executive, independent director), serving as Chairman, Andrea Novelli (non-executive director) and Pia Saraceno (non-executive, independent director). Snam’s Director of Human Resources and Security serves as the Secretary of the Committee. The composition, tasks and operating methods of the Committee are governed by specific rules6, approved by the Board of Directors and most recently updated on 30 October 2014. The Committee has the following consulting and advisory functions with regard to the Board of Directors:

- it submits for the approval of the Board of Directors the Remuneration Report and, in particular, the Policy for the Remuneration of Directors and Managers with Strategic Responsibilities to be presented to the Shareholders’ Meeting called to approve the financial statements within the time frame established by law;

- it assesses the vote on the Remuneration Report taken by the Shareholders’ Meeting in the previous financial year and expresses an opinion to the Board of Directors;

- it periodically evaluates the adequacy, overall consistency and practical application of the Policy adopted, by formulating proposals on this subject to the Board;

- it makes proposals concerning the remuneration of the Chairman and the CEO in terms of the various forms of compensation and pay arrangements;

- it makes proposals relative to remuneration of the members of the Committees of directors established by the Board;

- it examines information reported by the Chief Executive Officer and proposes:

- general criteria for the remuneration of managers with strategic responsibilities;

- general guidelines for the remuneration of other executives of Snam and its Subsidiaries;

- annual and long-term incentive plans, including share-based plans;

- it proposes the definition of performance targets, the final calculations of company results and the definition of claw-back clauses connected with the implementation of incentive plans and the determination of variable remuneration for executive directors;

- it proposes, with respect to executive directors, the determination of: i) indemnities to be paid in the event of the termination of employment; and ii) non-compete agreements;

- it monitors the application of decisions adopted by the Board;

- it reports to the Board on the activities it carries out at least every six months, and within the deadline for approving the financial statements and the half-year report, at the Board meeting indicated by the Chairman of the Board.

In performing these functions, the Committee gives any opinions that may be required by the current company procedure on related-party transactions, within the time frame set out by that procedure.

Resolutions passed by the Board of Directors in 2014 concerning remuneration were among the cases excluded, pursuant to paragraph 10, sub-paragraph 6) of the Related Party Procedure, bearing in mind that, as also specified in Article 13 of the “Regulation Containing Provisions Concerning Related-Party Transactions” (adopted by Consob in Resolution No. 17221 of 12 March 2010 and later amended by Resolution No. 17389 of 23 June 2010): (i) the Company has adopted a remuneration policy; (ii) the Remuneration Committee was involved in determining the remuneration policy; (iii) the remuneration policy was submitted to the Shareholders’ Meeting for its advisory vote; (iv) in all cases, the remuneration proposed was checked for consistency with this policy.

In accordance with the decisions made by the Board of Directors, the Remuneration Committee annually reviews the remuneration structure for the Internal Audit Manager, while ensuring its compliance with the general criteria approved by the Board for all executives and informing the Chairman of the Control and Risk Committee thereof, according to the opinion which it is required to give to the Board.

In 2014, an in-depth analysis of the remuneration structure for the Internal Audit Manager was performed, including in relation to market practices. Based on these findings, and by agreement with the Control and Risk Committee, the Committee proposed the introduction of new provisions calling for: the configuration of an MBO (Management By Objectives) grid, solely with measurable functional objectives and excluding economic and financial objectives; the determination of the annual monetary incentive relying entirely on the results shown on that grid; the assignment of minimum, target or maximum performance levels and the assessment of results achieved, carried out by the Control and Risk Committee; and the standardisation of other forms of deferred monetary and long-term monetary incentives for all managers.

For the proper execution of its analysis and reporting functions, the Remuneration Committee makes use of the relevant departments of the Company and, through these structures, makes use of the assistance of external consultants who are not in a position that could compromise their independence of judgement.

In 2014 the Chairman of the Board of Statutory Auditors (or another permanent member designated by the latter) regularly attended the Committee’s meetings.

Activity cycle for the Remuneration Committee

The activities of the Committee are carried out through implementation of an annual schedule which provides for the following stages:

- verification of the adequacy, overall consistency and practical application of the Policy adopted - in the previous year, in relation to the results achieved and the salary benchmarks provided by highly specialised consultants;

- definition of remuneration policy proposals and proposals relating to performance objectives connected to short- and long-term incentive plans;

- proposals for the implementation of existing short- and long-term variable incentive plans, after checking the results achieved against the performance objectives set out in those plans;

- preparation of the Remuneration Report to be submitted each year, following approval by the Board of Directors, to the Shareholders’ Meeting.

Activities carried out and scheduled

In 2014, the Remuneration Committee met a total of six times. The attendance of its members was 100%. In the first part of the year, the Committee’s actions were focused on: preparing guidelines for the Remuneration Policy and the 2014 Remuneration Report, final calculation of the 2013 corporate results, and defining the 2014 performance objectives for the purposes of the monetary incentive plans. In the second half of the year, the following were analysed: the results of the Shareholders’ Meeting vote on the 2014 Remuneration Report with a thorough review of measures to be brought to the attention of shareholders and proxy advisors; performance indicators applicable for variable incentive plans; the Committee’s regulations in view of amendments to the Code of Corporate Governance; the remuneration structure for the Internal Audit Manager; and methodologies used by consulting companies to establish the remuneration benchmarks used during the assessment of remuneration policies.

MAIN ISSUES DEALT WITH IN 2014 |

|||

|

February |

1. |

Evaluation of 2013 Remuneration Policy |

|

|

(7 February) |

2. |

Evaluation of the remuneration of the Internal Audit Manager |

|

|

|

3. |

2014 Remuneration Policy guidelines |

|

|

|

4. |

2014 Remuneration Report (first draft) |

|

|

|

5. |

Determination of corporate objectives for 2014 |

|

|

|

6. |

Half-year report to the Board of Directors |

|

|

February |

1. |

Finalisation of corporate objectives for 2013 |

|

|

(25 February) |

2. |

Annual Monetary Incentive proposal for the CEO |

|

|

|

3. |

2014 Remuneration Report |

|

|

March |

1. |

Corporate objectives for 2014 |

|

|

|

2. |

2014 Remuneration Report |

|

|

July |

1. |

Analysis of results of Shareholders’ Meeting vote on: 2014 Remuneration Report |

|

|

|

2. |

Finalisation of adjusted net profit for 2013 |

|

|

|

3. |

Deferred Monetary Incentive Plan |

|

|

|

|

a. |

Regulations |

|

|

|

b. |

Proposed 2014 award for the CEO |

|

|

4. |

Internal Audit remuneration |

|

|

|

5. |

Half-year report to the Board of Directors |

|

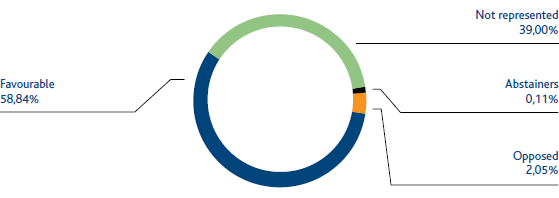

SHAREHOLDERS’ MEETING VOTING RESULTS ON REMUNERATION REPORT

(TOTAL SHARE CAPITAL)

SHAREHOLDERS’ MEETING VOTING RESULTS ON REMUNERATION REPORT

(VOTING CAPITAL)

|

October |

1. |

2014 Long-Term Monetary Incentive Plan |

|

|

|

|

a. |

Regulations |

|

|

|

b. |

Proposed 2014 award for the CEO and critical managers |

|

|

2. |

Remuneration Committee rules |

|

|

|

3. |

Corporate performance indicators to be used for the managerial incentive systems |

|

|

|

4. |

Internal Audit remuneration |

|

|

December |

1. |

Corporate performance indicators to be used for the managerial incentive systems |

|

|

|

2. |

Meeting with providers on the methodology used for remuneration. |

|

REMUNERATION COMMITTEE'S ACTIVITIES BROKEN DOWN BY ISSUE

The Committee has scheduled five meetings in 2015. As at the date of approval of this Report, the first three meetings have already been held, and were dedicated to the periodic assessment of the remuneration policies implemented in 2014, for the purposes of defining policy proposals for 2015, as well as the analysis of this Report for subsequent approval by the Board of Directors.

The Committee reports on the procedures used to carry out its functions to the Shareholders’ Meetings called to approve the financial statements, through the Chairman of the Committee, as provided for in its rules, while adhering to the guidelines set out in the Code of Corporate Governance and with a view to establishing a suitable channel for dialogue with shareholders and investors.

Information on the remuneration of directors and managers is further ensured by the updating of pages specifically dedicated to these matters in the “Governance” section of the Company’s website.

6 The rules governing the Remuneration Committee are available in the “Governance” section of the Company’s website.