Growing with the network

The gas value chain

With its business operations, Snam is positioned in the middle of the gas value chain, between production and supply and selling to end users and consumers. In this position, Snam pursues its own economic sustainability through a value-creation model based on three key tools: investments, operational and financial efficiency and return for shareholders.

This model is closely correlated to the fundamental objectives of EU energy policy that represent the value that should be created for stakeholders in the gas system: security of supply, competition, sustainability and integration of the internal market.

Since the 1960s, Western Europe has capitalised on the growing supply of natural gas from deposits outside of the continent, building a dense network of gas pipelines that currently extends over more than 190,000 km in total, with other gas pipelines close to completion or planned. The interconnected European system, which is constantly expanding, stretches from the North Sea and the Baltic to the Mediterranean, and from the Atlantic to Eastern Europe and Siberia, giving access to reserves from a range of extraction areas, diversifying transportation pathways and enabling quantitative international trade.

In this context, and taking into account the negative trend in national gas demand, broadening and modernising the network is a vital factor in Snam’s business development and is also a strategic opportunity for Italy as a whole.

It is only by investing in infrastructure, as well as developing reverse-flow technology and international partnership agreements, that Italy will play a decisive role in creating an interconnected, flexible European network, boosting cross-border trade and giving all consumers true freedom to choose their providers, with more competitive prices and higher service quality.

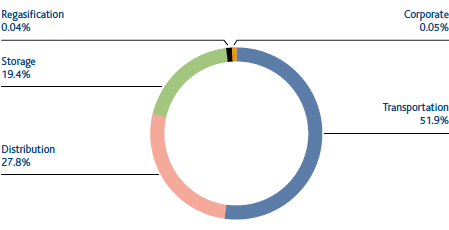

Snam supported the development strategy in 2013, making €1.29 billion in technical investments, in line with the amount spent in the previous year. The biggest proportion of this investment was in the transportation and distribution network. (See the Annual Report for further details on investments.)

TECHNICAL INVESTMENTS BY ACTIVITY

European expansion

After the acquisition of Interconnector with Fluxys, which led to Snam’s acquisition of TIGF, completed in July 2013 by Snam (45%) alongside Singapore sovereign wealth fund GIC (35%) and EDF (20%), represents another stage in the construction of the European gas market in which Snam aims to play an active role and in which it intends to add value to its industrial capacities in the integrated management of gas infrastructure.

TIGF is the second-largest operator on the French gas network, managing 5,000 km of gas pipelines (13% of total French transportation capacity) and two major storage sites, which together amount to 22% of transalpine storage capacity. The TIGF operation represents a sound foundation for a future link between Spain and central Europe. Snam invested approximately 600 million this significant transaction.