Abstract

| Download XLS (30 kB) |

|

Component |

Purposes and characteristics |

Criteria and conditions for implementation |

Amounts |

||||

|

|||||||

|

Fixed remuneration |

Adequately compensates the skills, professionalism and contribution required for the position held with the aim of providing motivation including for the purposes of retention |

Fixed remuneration is determined based on the position and responsibilities assigned with respect to levels used for equivalent positions in the market, and with possible annual adjustments established for merit (continuation of individual performance) or for promotions or increased responsibilities. |

Chairman: € 400,000 (including fixed annual compensation for directors set by the Shareholders’ Meeting). |

||||

|

Short-term variable incentives (IMA - Annual Monetary Incentive) |

Paid annually in cash, this is a useful tool to motivate and guide management activities over the short term in keeping with corporate goals established by the Board of Directors. The amount of the short-term annual incentive is based on the position held and the company and individual performance achieved. |

Corporate/CEO grid objectives: |

Incentives paid according to results achieved in the prior year and assessed against a performance scale of 70-130 points with a minimum threshold for incentives equal to overall performance of 85 points. |

||||

|

Long-term variable incentives (IMD - Deferred Monetary Incentive) |

Reserved for executives who have achieved the individual objectives set in the previous year, and who are a part of the Leadership Development Program. These incentives provide support for management activities over the medium and long term in keeping with the strategic plan’s objectives, and they also promote retention. |

Plan with annual assignment and three-year vesting period |

CEO: 45.5% of GAC for target performance; 77.4% of GAC for max performance. |

||||

|

Long-term variable incentives (IMLT - Long-Term Monetary Incentive) |

Reserved for those holding positions with the most direct responsibility for the company’s results; they ensure the best alignment between the interests of shareholders and management’s conduct. |

Plan with annual assignment and three-year vesting period. |

CEO: 50% of GAC for target performance; 65% of GAC for max performance. |

||||

|

Benefits |

These are an integral part of the remuneration package, and are focused primarily on welfare and pension components. |

Continually determined using the policy implemented in recent years and in accordance with the national contract and supplementary company agreements for executives |

These are assigned to all executive staff: |

||||

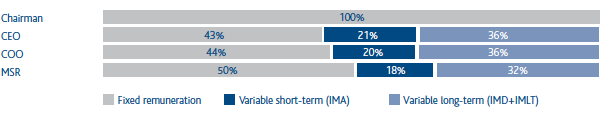

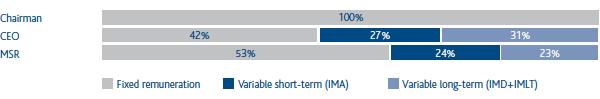

Pay mix

The guidelines of the 2016 Remuneration Policy call for a pay mix consistent with the management position held. In the case of the CEO, there is greater emphasis on the variable component than for the rest of the management structure, and it prevails over the fixed component even if results are equal to the target.

Target Pay Mix

Pay Mix used in 2015

Shareholders’ meeting vote on Section I of the 2015 Remuneration Report

As provided for by the legislation in force, Snam’s Shareholders’ Meeting again voted in an advisory capacity on the first section of the Remuneration Report in 2015. The percentage of votes in favour was 97.08% of the meeting participants. Compared with previous years, there was an increase in participation for the third year in a row. The presence of institutional investors rose from 31% in 2014 to 31.96%.

Total votes

in favour

Votes in favour - minority interests

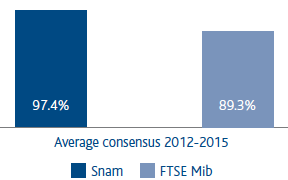

During the first four years of implementing "say on pay" in Italy, Snam achieved favourable votes, and in any event, over 96% of votes cast. The average consensus achieved by Snam over the four-year reference period was 97.4%. It is the highest approval level of the entire panel considered (FTSE MIB companies with capitalisation higher than 3 billion euro; total minority interests at the shareholders’ meeting greater than 15%).

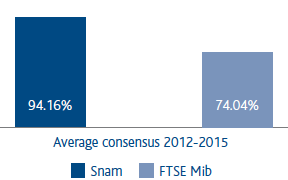

Even the average of the favourable votes cast by the minority interests (94.15%) confirms the high approval rating achieved (source: Georgeson).