Chief Executive Officer

Fixed remuneration

The Chief Executive Officer receives the fixed annual compensation established for directors by the Shareholders’ Meeting plus the fixed compensation decided by the Board in relation to the delegated responsibilities assigned, considering the average levels of remuneration observed in the market among major European and Italian listed companies for positions with a comparable level of responsibility and complexity.

At its meeting on 23 February 2016, after analysing the remuneration of the Chief Executive Officer using specific benchmarks with a peer group of companies comparable to Snam in terms of size and complexity, the Remuneration Committee indicated to the Board of Directors on 16 March 2016, that the remuneration was not appropriate since it was substantially lower than the median market level.

In his capacity as an executive of Snam, the Chief Executive Officer receives indemnities for work-related travel, both in Italy and abroad, in line with the provisions of the CCNL [National Collective Labour Agreement] and supplementary company agreements.

Short-term variable incentives

The annual variable component (Annual Monetary Incentive Plan – IMA) is determined with reference to a target incentive level (performance = 100) and a maximum incentive level (performance = 130) of 50% and 65% respectively of total fixed remuneration, linked to the results achieved by Snam in the previous year with respect to the defined objectives. A threshold level (performance = 85) has been set, below which no short-term incentive is paid.

The 2016 targets approved by the Board of Directors on 24 February 2016 focus on the Company’s economic, financial and operating performance, on investments and on issues of sustainability.

| Download XLS (23 kB) |

2015 |

|

2016 |

||

|

|

|

|

|

Free Cash Flow |

30% |

|

Free Cash Flow |

30% |

|

|

|

|

|

Investments |

30% |

|

Investments |

30% |

|

|

|

|

|

Operational efficiency |

30% |

|

Operational efficiency |

30% |

|

|

|

|

|

Employee and contractor accident frequency index |

10% |

|

Sustainability - accident frequency index and improvement of the DJSI and FTSE4GOOD indexes |

10% |

|

|

|

|

|

Free Cash Flow represents the (monetary) cash flow produced by operating and non-operating activities. The investment target is composed of two items: spending on investments at the budgeted level (20% weighting), and completion of milestones for key investment projects (10% weighting). The operational efficiency target is measured through a decrease in controllable fixed costs as compared to the budget. Lastly is the sustainability issue that consists of two targets starting from this year: the employee and contractor accident frequency index, a sustainability indicator measured in terms of the number of accidents occurring per million hours worked during the year; the confirmation of including and improving the score in absolute terms of the sustainability indexes Dow Jones Sustainability Index and FTSE4GOOD.

Long-term variable incentives

The variable long-term component is characterised by deferral of the incentive with a view to ensuring sustainability in the creation of value for shareholders in the medium-to-long term. The variable long-term component is divided into two distinct plans:

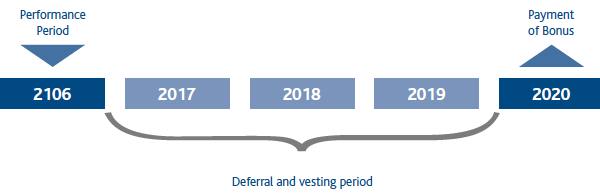

- The 2016 Deferred Monetary Incentive Plan (IMD), linked to the Company’s performance as measured in terms of EBITDA7, a parameter widely used in large industrial companies as a summary indicator of the results achieved and consistent with the strategy of growing/strengthening Snam’s current positioning in its areas of business. The basic incentive to be awarded is determined, in relation to the results achieved by the Company in the year preceding the award, for a target value and a maximum value of 35% and 45.5% respectively of the fixed remuneration8.

The incentive to be paid at the end of the reference three-year period (vesting period) is determined in relation to the results achieved in each of the three years subsequent to that of the award, as a percentage of between 0 and 170% of the awarded amount9.

The 2015 EBITDA results for the 2016 award and the 2016 EBITDA targets were approved by the Board of Directors’ meetings on 24 February 2016 and 16 March 2016, and on the recommendation of the Remuneration Committee, in line with the Strategic Plan.

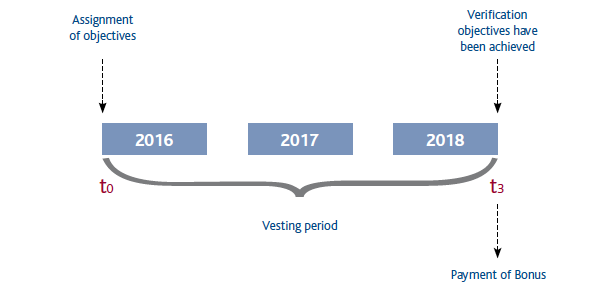

- The 2015-2017 Long-Term Monetary Incentive Plan (IMLT) provided for managers that have a greater impact on the corporate results provides for the annual award of an amount equal to 50% of fixed remuneration, and the payment of the incentive after three years (vesting period) as a percentage ranging from 0 to 130% based on the weighted change in adjusted net profit (60%) and total shareholder return (40%).

Performance in terms of adjusted net profit is calculated in relation to budget amounts10, and in terms of total shareholder return, on the basis of Snam’s position in the panel comprising a peer group made up of the following leading listed European companies in the utilities sector: Enagas, National Grid, Red Electrica, Severn Trent, Terna and United Utilities11.

Indemnities for termination of office or employment

For the Chief Executive Officer in office, in line with practices in reference markets, an indemnity is provided for the termination of his post as director and his executive position.

If the term of office is not renewed when it expires, or if it is terminated in advance, two years of fixed annual compensation are payable upon termination of employment plus the average of the Annual Monetary Incentive paid over the last three years, subject to the application of the provisions of the national contract for executives of companies that produce goods and services.

The indemnity is not payable if the employment relationship is terminated for just cause or due to dismissal with notice on subjective grounds involving the notion of justifiability as defined by the collective agreement or in the event of a resignation.

The impact of the possible termination of the CEO’s employment contract on the benefits allocated under existing long-term incentive plans is described in the relevant allocation rules.

Non-compete agreements

Non-compete agreements are entered into to protect the Company’s interests. Based on standards used by companies with an equivalent standing, and pursuant to the provisions of Article 2125 of the Italian Civil Code, if the CEO in office undertakes not to carry out any type of activity competing with the business performed by Snam for a period of a year after the termination of employment in all countries of the European Union and in Switzerland, Russia or Norway, he will be paid one year’s compensation consisting only of total fixed compensation. For the Company’s protection, penalties are provided for cases of infringement, without prejudice to the right to claim further damages.

Benefits

In compliance with the provisions of national bargaining and supplementary agreements for Snam’s executives, the CEO will be registered in the supplementary pension fund (FOPDIRE)12, and the supplementary healthcare fund (FISDE)13, and will be provided with life and disability insurance cover, as well as a car for both business and private use.

7 Earnings before interest, tax, depreciation and amortisation.

8 The target corresponds to a result achieved between the budgeted amount and budget +5%, and the maximum corresponds to a result achieved that is greater than the budget +5%.

9 The percentage is determined from the average of the results achieved in three successive years from the year of the award, measured on a linear scale and with a result of: 170% if the result achieved is equal to or greater than the budget +5%; 130% if it is equal to the budget; 70% if it is equal to the budget -5%; and 0% if it is less than the budget -5%.

10 If adjusted net profit is less than the budget, the score is zero; for results between the budget and the budget +5%, the score is determined on a linear scale from 100-130; and for results over the budget +5%, the score remains at 130.

11 Performance is measured on a linear scale from 70-130, and after removing the lowest value recorded among the seven companies on the panel (if this is Snam, the performance score is 0), the highest TSR is 130, the average TSR is 100, and the lowest TSR of the six remaining companies is 70.

12 A contractual pension fund with defined contributions and individual capitalisation, www.fopdire.it.

13 A fund that provides for the reimbursement of medical expenses to in-service or retired executives and their families, www.fisde-eni.it.