2017 Remuneration Policy guidelines

In the light of the new challenges and the new ownership structure, the 2017 Remuneration Policy Guidelines include the development of the existing variable remuneration systems in order to strengthen the connection between the actions of management and the value created for shareholders.

Specifically, there are plans for the introduction of a new share-based Long-Term Incentive Plan (ILT) for the CEO and a limited number of Executives (a maximum of 20), who hold the positions which have a greater impact on the creation of wealth or of strategic importance for the purpose of achieving Snam’s multi-year targets. The plan, subject to approval at the Shareholders’ Meeting3, involves the granting of the Company’s ordinary shares if performance targets measured over a period of three years are reached. The maximum number of annual shares to service the plan is 3,500,000. This new share plan replaces the previous medium-/long-term variable remuneration tools for beneficiaries (IMD and IMLT) and guarantees a direct connection with stock performance.

The 2017 Remuneration Policy guidelines were defined in line with the aims and general principles stated and were evaluated, by the Remuneration Committee, to be consistent with the applicable market benchmarks.

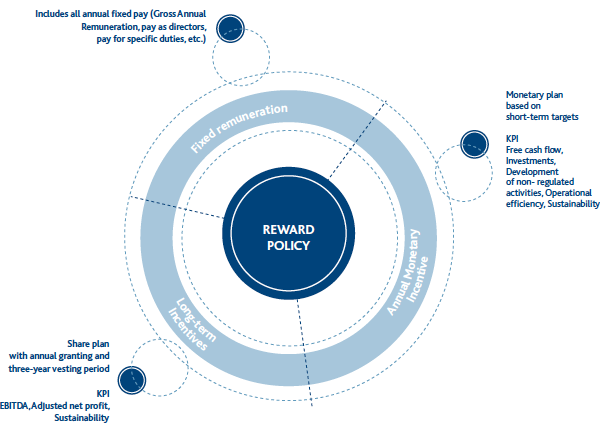

The remuneration instruments are summarised and explained in the following diagram:

FIGURE 2 – REWARD POLICY

3 The plan will be submitted for the approval of the Shareholders’ Meeting called for 11 April 2017. The conditions of the Plan are described in detail in the information document available to the public of the Company’s website, implementing the existing legislation (Article 114-bis of Legislative Decree 58/1998 and the Consob implementing regulation).