Chief Executive Officer

Fixed remuneration

The Remuneration Committee, having analysed the remuneration position of the CEO, at the meeting of 26 May 2016, through specific benchmarks with peer companies comparable with Snam in terms of size and complexity4, reported to the Board of Directors on 31 May 2016 that the position was below the market median values, both with regard to the fixed remuneration component and to total remuneration.

The fixed pay for the CEO was therefore defined at € 970,000, taking into consideration: the pay established by the Shareholders’ Meeting for Directors; the pay approved by the Board with regard to the powers delegated, equal to € 150,000; the annual gross pay for the position of General Director, equal to € 750,000.

In the capacity of a Snam senior manager, the CEO receives the compensation due for travel expenses, domestically and abroad, in line with the provisions of the national collective agreement and supplementary company agreements.

Short-term variable incentives

The annual variable component (Annual Monetary Incentive Plan - IMA) is calculated with reference to a target incentive level (performance = 100) and a maximum level (performance = 130) respectively equal to 50% and 65% of the fixed remuneration, in connection with the results achieved by Snam in the previous year compared with the targets defined. A threshold level is set (performance = 85) below which the short-term incentive is not delivered.

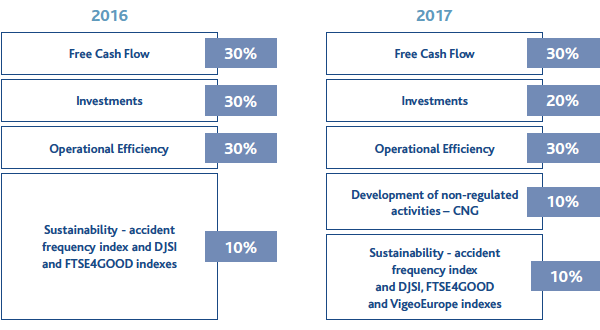

The 2017 targets approved by the Board of Directors on 2 February 2017 were focused on the economic, financial and operating performance of the Company, on investments, on the development of non-regulated activities and on sustainability issues.

FIGURE 3 - Annual Monetary Incentive Targets - 2016 compared with 2017

The Free Cash Flow is the (monetary) flow of cash produced by operational management and non-operational management. The objective of investments breaks down into two items: spending on investments, to achieve in relation to the budget (weighting of 15%) and the percentage of milestones reached for the main investment projects (weighting of 5%). The operational efficiency objective is measured through the decrease in fixed costs that can be controlled in relation to the budget. The objective relating to the development of non-regulated activities - CNG is measured in terms of milestones to be reached during the course of the year. Lastly, sustainability breaks down into two objectives: the accident frequency index for employees and contractors, measured in terms of the number of accidents that are recorded for every million hours worked during the year; the confirmation of the inclusion and improvement of Snam’s position in relation to the Dow Jones Sustainability Index, FTSE4GOOD and VigeoEurope sustainability indexes.

Long-term variable incentives

The 2017-2019 Long-Term Incentive Plan (ILT), for managerial positions with a greater impact on company results, involves the annual granting of free shares up to a maximum value of 210% of fixed remuneration after three years (vesting period) to an extent connected with the results achieved in relation to the following parameters: EBITDA (60%), Adjusted Net Profit (30%), Sustainability (10%). Performance in terms of EBITDA and Adjusted net profit is calculated with reference to budget figures, while the sustainability objective is measured based on annually defined targets. At the end of the vesting period there are plans for an additional number of shares to be granted, defined as dividend equivalent, calculated as the value of the dividends not received in relation to the actual number of vested shares. The plan also includes a two-year lock-up period on 20% of the shares.

Severance pay

For the CEO, who is also a Snam Executive, in addition to the termination of employment indemnity established in the national collective agreements, conditions are being defined for severance pay agreements, also taking market practices into consideration.

The effects of any termination of the CEO’s employment on the rights assigned under the scope of existing long-term incentive plans are described in the allocation regulations.

Benefits

In line with the provisions of national agreements and supplementary company agreements for Snam senior management, the CEO comes under the supplementary pension (FOPDIRE)5, the supplementary healthcare benefits scheme (FISDE)6 and life and disability insurance cover, as well as a company car for personal and business use.

4 Panels used for remuneration benchmarks are described in figure 4

5 Defined-contribution and individual capitalisation negotiated pension plan, www.fopdire.it.

6 Fund that refunds healthcare expenses to senior managers in office or retired, and their families, www.fisde-eni.it.

There is also other health insurance (Generali/Previgen), to supplement the FISDE.