Other information

Treasury shares

In compliance with the provisions of Article 2428 of the Italian Civil Code, the treasury shares held by the Company as at 31 December 2018 are analysed in the table below:

| Download XLS (18 kB) |

Period |

Number of shares |

Average cost (€) |

Total cost (€ millions) |

Share capital (%) |

||||

|

||||||||

Purchases |

|

|

|

|

||||

Year 2005 |

800,000 |

4.399 |

3 |

0.04 |

||||

Year 2006 |

121,731,297 |

3.738 |

455 |

6.22 |

||||

Year 2007 |

73,006,653 |

4.607 |

336 |

3.73 |

||||

Year 2016 |

28,777,930 |

3.583 |

103 |

0.82 |

||||

Year 2017 |

56,010,436 |

3.748 |

210 |

1.60 |

||||

Year 2018 |

113,881,762 |

3.743 |

426 |

3.28 |

||||

|

394,208,078 |

3.889 |

1,533 |

|

||||

Less treasury shares allocated/sold/cancelled: |

|

|

|

|

||||

- granted under the 2005 stock grant plans |

(39,100) |

|

|

|

||||

- sold under the 2005 stock option plans |

(69,000) |

|

|

|

||||

- sold under the 2006 stock option plans |

(1,872,050) |

|

|

|

||||

- sold under the 2007 stock option plans |

(1,366,850) |

|

|

|

||||

- sold under the 2008 stock option plans |

(1,514,000) |

|

|

|

||||

- cancelled in 2012 following resolution by the Extraordinary Shareholders’ Meeting of Snam S.p.A. |

(189,549,700) |

|

|

|

||||

- cancelled in 2018 following resolution by the Extraordinary Shareholders’ Meeting of Snam S.p.A. |

(31,599,715) |

|

|

|

||||

Treasury shares as at 31 december 2018 |

168,197,663 |

|

|

|

||||

In 2018, a total of 113,881,762 Snam shares were purchased, equal to 3.28% of the share capital, for a cost of 426 million euro (56,010,436 shares, equal to 1.60% of the share capital, for a cost of 210 million euro in 2017). Purchases were made of 36,606,724 shares as part of the share buyback programme resolved by Snam’s Shareholders’ Meeting held on 11 April 2017 and of 77,275,038 shares as part of the new approved share buyback programme, after revocation for the part not yet executed of the previous programme, by the Snam Shareholders’ Meeting of 24 April 201843.

The same Shareholders' Meeting held on 24 April 2018 in an extraordinary session, also approved the cancellation of 31,599,715 treasury shares in the portfolio, with no nominal value, without reducing the share capital.

As at 31 December 2018, Snam held 168,197,663 treasury shares, equal to 4.85% of the share capital (85,915,616 as at 31 December 2017, equal to 2.45% of its share capital), with a book value of about 625 million euro (318 million euro as at 31 December 2017) recorded on shareholders’ equity. The market value of the treasury shares as at 31 December 2018 was around 642 million euro44.

The share capital as at 31 December 2018 consisted of 3,469,038,579 shares with no nominal value, with a total value of 2,736 million euro.

In addition, it is confirmed that the subsidiaries of Snam S.p.A. do not hold, and have not been authorised by their Shareholders’ Meetings to acquire, shares in Snam S.p.A.

Incentive plans for executives with Snam shares

2017-2019 long-term stock incentive plan

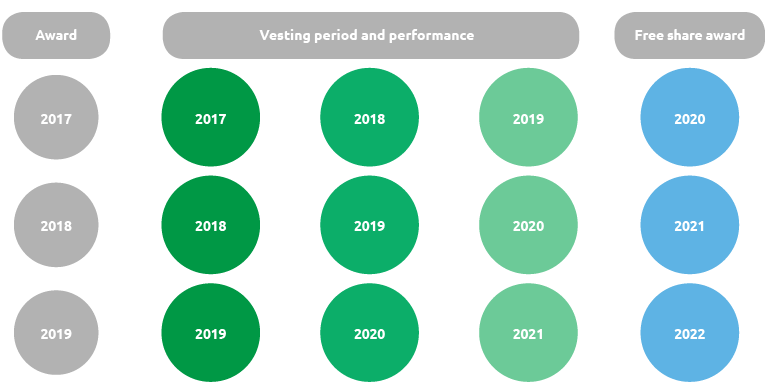

On 11 April 2017, the Shareholders' Meeting approved the 2017-2019 long-term stock incentive plan, conferring to the Board of Directors, every necessary power for the implementation of the Plan.

The plan, intended for the Chief Executive Officer and managers of Snam, identified as those with positions of major impact on the business results or of strategic relevance in terms of achieving Snam’s multi-year objectives, envisages three annual assignment cycles of three-year objectives (the “Rolling Plan”) for the years 2017, 2018 and 2019. At the end of the three-year performance period, if the Plan conditions are met, the beneficiary will be entitled to receive Company shares free of charge.

The maximum number of shares serving the plan is 3,500,000 shares for each fiscal year of the Plan. The Plan will be concluded in 2022, upon expiration of the Vesting Period for the last attribution made in 2019.

The number of shares accrued is subject to the achievement of performance conditions, calculated as the average of the annual performance of the parameters identified in the three-year vesting period, which affect EBITDA, adjusted net profit and sustainability.

The Plan also provides that beneficiaries receive, at the end of the vesting period, a Dividend Equivalent, or an additional number of shares equal to the ordinary and extraordinary dividends distributed by Snam during the vesting period which would be due to the number of shares effectively assigned to beneficiaries based on the levels of performance achieved under the terms and conditions set out in the Plan. In addition, a two-year lock-up period for 20% of the beneficiaries' shares, as recommended by the Corporate Governance Code, is envisaged for the Chief Executive Officer and for the other beneficiary managers.

Under this Plan, a total of 3,692,810 shares were assigned, of which 1,368,397 shares against the 2017 assignment and 2,324,413 shares against the 2018 assignment. The unit fair value of the share, determined by the value of the Snam security as at the grant date, is 3.8548 and 3.5463 euro per share, respectively for the 2017 and 2018 assignments. The cost relating to the long-term incentive plan, recorded as a component of the cost of labour, comes to 3 million euro (1 million euro in 2017), with an equivalent entry in the shareholders’ equity reserves.

Compensation paid to directors and statutory auditors, general managers and managers with strategic responsibilities, and investments held by each of these

Information on the compensation paid to directors and statutory auditors, general managers and managers with strategic responsibilities, and the equity investments held by each of these, can be found in the Remuneration Report, which is prepared in accordance with Article 123-ter of Legislative Decree 58/1998 (TUF). The Remuneration Report is available on the Snam website (www.snam.it) in the Governance section.

Relationships with related parties

Considering the de facto control of CDP S.p.A. over Snam S.p.A., pursuant to the international accounting standard IFRS 10 - Consolidated Financial Statements, based on the current Group ownership structure the related parties of Snam are represented by Snam's associates and joint ventures as well as by the parent company CDP S.p.A. and its subsidiaries and associates, and direct or indirect subsidiaries, associates and joint ventures of the Ministry of Economy and Finance.

Operations with these parties mainly involve the exchange of goods and the provision of regulated services in the gas sector.

These transactions are part of ordinary business operations and are generally settled at market conditions, i.e. the conditions which would be applied for two independent parties. All the transactions carried out were in the interest of the companies of the Snam Group.

Pursuant to the provisions of the applicable legislation, the Company has adopted internal procedures to ensure that transactions carried out by Snam or its subsidiaries with related parties are transparent and correct in their substance and procedure.

Directors and auditors declare their interests affecting the company and the group every six months, and/or when changes in said interests occur; they also inform the CEO (or the Chairman, in the case of the CEO), who in turns informs the other directors and the Board of Statutory Auditors, of individual transactions that the company intends to carry out and in which they have an interest.

No management or coordination activity of CDP S.p.A. has been formalised or exercised.

As at 31 December 2018, Snam manages and coordinates its subsidiaries, pursuant to Article 2497 et seq. of the Italian Civil Code.

The amounts involved in commercial, miscellaneous and financial relations with related parties, descriptions of the key transactions and the impact of these on the balance sheet, income statement and cash flows, are provided in Note 34 “Relationships with related parties” of the Notes to the consolidated financial statements.

Relations with managers with strategic responsibilities ("Key Managers") are shown in Note 27 “Operating costs” of the Notes to the consolidated financial statements.

Performance of subsidiaries

For performance information concerning the segments in which the Company operates wholly or in part through subsidiaries, please refer to the sections “Business segment operating performance” and “Financial review” within this Report.

Branch offices

As required by Article 2428, paragraph five of the Italian Civil Code, it is noted that Snam does not have branch offices.

Research and Development

Research and development activities performed by Snam are described in the section “Other operating information and results - Innovation for business development” of this Report.

43 For more information, refer to the chapter “Summary data and information - Main events” of this Report.

44 Calculated by multiplying the number of treasury shares by the period-end official price of 3.8198 euro per share.