Corporate governance system and rules

Snam issues shares which are quoted on the MTA managed by Borsa Italiana S.p.A. and therefore fulfils all legislative and regulatory obligations related to stock market listing.

The Bylaws define the Company’s governance model and the main rules for the functioning of corporate bodies57. Snam adopts a traditional administration and control system.

The Bylaws outline the functions and activities of the following corporate bodies:

- Shareholders’ Meeting;

- Board of Directors;

- Board of Statutory Auditors.

Shareholders’ Meeting

The Shareholders’ Meeting is the shareholders’ decision-making body, and appoints the Board of Directors and the Board of Statutory Auditors. In addition to the matters irrevocably assigned to it by law, pursuant to Article 12 of the Bylaws, the Ordinary Shareholders’ Meeting is also exclusively responsible for passing resolutions concerning disposal, contribution, leasing, usufruct and any other act of disposition (including those that apply to joint ventures), or subjection to restrictions, of the Company or of strategically important business units related to gas transportation or dispatching activities.

The Extraordinary Shareholders’ Meeting passes resolutions on matters assigned to it by law, without prejudice to the descriptions given below, by means of a favourable vote from at least three quarters of the share capital represented at the Shareholders’ Meeting.

The Bylaws stipulate that the Board of Directors is responsible for passing resolutions on:

- mergers in the cases referred to in Articles 2505 and 2505-bis of the Italian Civil Code, as well as those mentioned for demergers;

- establishment, modification and elimination of secondary offices;

- the reduction in share capital when a shareholder withdraws;

- compliance of the Bylaws with regulatory provisions;

- the transfer of the registered office within Italy.

In accordance with the provisions of the Corporate Governance Code, the Shareholders’ Meeting of the Company is governed by dedicated regulations that provide for the meetings to take place in an orderly, functional fashion and guarantee that each shareholder is entitled to express his/her opinion about the issues being discussed.

Board of Directors

The Board of Directors is appointed by the Shareholders’ Meeting, in compliance with the applicable laws regarding a balance between genders and based on the lists presented by the shareholders in which the candidates are listed by progressive number, and in a number no greater than the members of the body to be elected.

The Shareholders’ Meeting of 26 March 2013 set the number of directors at nine and their term of office at three financial years, expiring on the date of the Shareholders’ Meeting called to approve the separate financial statements at 31 December 2015.

The following table lists the current members of the Board of Directors, indicating the lists from which they were elected and the directors for whom it was expressly indicated on the list that they meet the independence requirements pursuant to the TUF and the Corporate Governance Code.

| Download XLS (23 kB) |

|

Director |

Position |

List from which he/she was appointed |

||

|

||||

|

Lorenzo Bini Smaghi |

Non-executive director and Chairman |

CDP Reti S.r.l. |

||

|

Carlo Malacarne |

Chief Executive Officer |

CDP Reti S.r.l. |

||

|

Sabrina Bruno |

Non-executive director (1) |

List presented jointly by minority shareholders |

||

|

Alberto Clô |

Non-executive director (1) |

CDP Reti S.r.l. |

||

|

Francesco Gori |

Non-executive director (1) |

List presented jointly by minority shareholders |

||

|

Roberta Melfa |

Non-executive director |

CDP Reti S.r.l. |

||

|

Andrea Novelli |

Non-executive director |

CDP Reti S.r.l. |

||

|

Elisabetta Oliveri |

Non-executive director (1) |

List presented jointly by minority shareholders |

||

|

Pia Saraceno |

Non-executive director (1) |

CDP Reti S.r.l. |

||

The Shareholders’ Meeting of 26 March 2013 confirmed Lorenzo Bini Smaghi in the role of Chairman of the Board of Directors58. The Chairman is not the Chief Executive Officer or a controlling shareholder.

At its meeting on 26 March 203, the Board of Directors confirmed Carlo Malacarne in the role of Chief Executive Officer59, assigning him the functions pertaining to that position and granting him all functions and powers not reserved for the Board or the Chairman.

On 26 March 2013, the Board of Directors approved a set of Regulations governing the Board that aim to regulate the terms concerning (i) convocation of meetings, (ii) performance of directors’ duties, and (iii) drawing up meeting minutes. On the same date, the Board of Directors confirmed Marco Reggiani, the Head of Legal and Corporate Affairs and Compliance, in the role of Secretary to the Board of Directors. The Board shall periodically, and at the time of appointment, evaluate the independence and integrity of the directors, as well as the lack of grounds for ineligibility or incompatibility.

The Board of Directors is vested with the broadest powers of ordinary and extraordinary administration of the Company, and is authorised to carry out any acts that it considers expedient to the achievement of the corporate purpose. The Board of Directors may delegate powers to one or more of its members and may establish Committees.

At its meeting on 27 February 2014, the Board of Directors, pursuant to the Corporate Governance Code for Listed Companies, expressed its opinion on the size, composition and functioning of the Board and its Committees.

Following the appointment of the Board of Directors and the Board of Statutory Auditors in March 2013, board induction sessions were held, in which all members of both the aforementioned bodies attended the board induction session. Pursuant to the Corporate Governance Code for Listed Companies, one meeting of the independent directors was held in 2013.

Committees instituted by the Board of Directors

The Board of Directors has: (i) set up the following Committees, (ii) appointed their members and (iii) approved the relevant regulations, in accordance with the provisions of the Corporate Governance Code and the Bylaws:

- Compensation Committee;

- Appointments Committee;

- Control and Risk Committee.

The composition of the Compensation Committee is as follows:

| Download XLS (22 kB) |

|

Member |

Status |

||

|

|||

|

Elisabetta Oliveri |

Independent non-executive (1); Chairman |

||

|

Pia Saraceno |

Independent non-executive (1) |

||

|

Andrea Novelli |

Non-executive |

||

The Board of Directors has verified that at least one member has adequate knowledge and experience of financial matters or pay policies.

The composition of the Appointments Committee is as follows:

| Download XLS (22 kB) |

|

Member |

Status |

||

|

|||

|

Alberto Clô |

Independent non-executive (1); Chairman |

||

|

Elisabetta Oliveri |

Independent non-executive (1) |

||

|

Roberta Melfa |

Non-executive |

||

The composition of the Control and Risk Committee is as follows:

| Download XLS (22 kB) |

|

Member |

Status |

||||

|

|||||

|

Francesco Gori |

Independent non-executive (1); Chairman |

||||

|

Sabrina Bruno |

Independent non-executive (1) |

||||

|

Pia Saraceno |

Independent non-executive (1) |

||||

|

Andrea Novelli (2) |

Non-executive |

||||

The Snam Board of Directors has verified that more than one member of the Committee has adequate experience in accounting and financial matters and risk management.

Board of Statutory Auditors

The Board of Statutory Auditors oversees compliance with the law and the deed of incorporation, as well as observance of the principles of proper administration in the performance of corporate activities; it also monitors the adequacy of the organisational, administrative and accounting structure adopted by the Company and the functioning thereof. Pursuant to Legislative Decree 39 of 27 January 2010, the Board of Statutory Auditors also performs supervisory functions in its capacity as “Committee for internal control and account auditing”.

In compliance with the provisions of the law and the Bylaws, Snam’s Board of Statutory Auditors is composed of three statutory auditors and two alternate auditors, who are appointed by the Shareholders’ Meeting for three-year terms and may be re-elected at the end of their term of office. Like the Board of Directors and in line with applicable provisions, the Bylaws provide for the auditors to be appointed by list vote, except when they are replaced during their term in office.

Statutory auditors are chosen from among those who meet the professionalism and honesty requirements indicated in the Decree of the Ministry of Justice 162 of 30 March 2000. For the purposes of this Decree, the Company’s business areas are commercial law, business administration and corporate finance. Likewise, the sector pertaining to its business is the engineering and geological sector.

The current Board of Statutory Auditors was appointed by the Shareholders’ Meeting of 26 March 2013 for a three-year term and, in any case, until the date of the Shareholders’ Meeting called to approve the separate financial statements for the 2015 financial year:

| Download XLS (22 kB) |

|

Member |

Status |

||||

|

|||||

|

Massimo Gatto (1) |

Statutory auditor and Chairman |

||||

|

Leo Amato (2) |

Statutory auditor |

||||

|

Stefania Chiaruttini (2) |

Statutory auditor |

||||

|

Maria Gimigliano (2) |

Alternate auditor |

||||

|

Luigi Rinaldi (1) |

Alternate auditor |

||||

Independent auditors

As required by law, the Company’s financial statements are audited by independent auditors included in the relevant register and appointed by the Shareholder’s Meeting based on a proposal issued by the Board of Statutory Auditors.

The Shareholders’ Meeting of 27 April 2010 appointed Reconta Ernst & Young S.p.A. to audit the Company’s accounts for the 2010-2018 period.

Further information and details can be found in Sections I and III of the 2013 governance report.

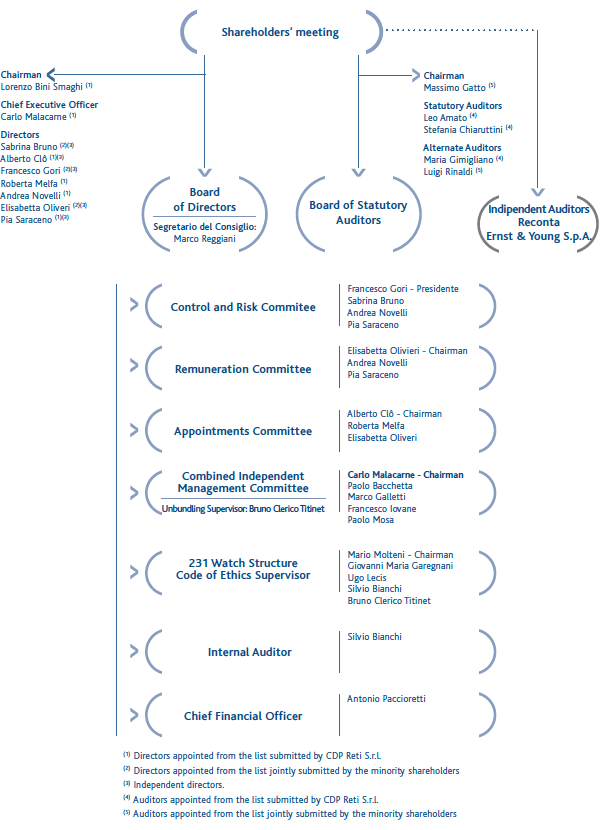

Graphic summary of the corporate governance structure

Please find below a graphic summary of the governance structure of the Company:

The internal control and risk management system

Code of Ethics and principles of the internal control and risk management system

Snam has adopted and is committed to promoting and maintaining an adequate internal control and risk management system, to be understood as a set of all of the tools necessary or useful in order to direct, manage and monitor business activities with the objective of ensuring compliance with laws and company procedures, protecting corporate assets, managing activities in the best and most efficient manner and providing accurate and complete accounting and financial data.

The Code of Ethics defines the guiding principles that serve as the basis for the entire internal control and risk management system, including: (i) the segregation of duties among the entities assigned to the processes of authorisation, execution or control; (ii) the existence of corporate determinations capable of providing the general standards of reference to govern corporate activities and processes; (iii) the existence of formal rules for the exercise of signatory powers and internal powers of authorisation; and (iv) traceability (ensured through the adoption of information systems capable of identifying and reconstructing the sources, the information and the controls carried out to support the formation and implementation of the decisions of the Company and the methods of financial resource management).

Over time, the internal control and risk management system has been subjected to verification and updating in order to continually ensure its suitability and to protect the main areas of risk in business activities. In this context, as well as for the purpose of implementing the provisions of the Corporate Governance Code, Snam has adopted an Enterprise Risk Management (ERM) system60.

The Board of Directors, in its most recent meeting of 29 October 2013, approved the “Guidelines of the Board of Directors on Internal Auditing” (the “Guidelines”) that define the system of internal control and risk management as a set of organisational structures, rules and procedures to enable the identification, measurement, management and monitoring of the main risks. An effective system of internal control and risk management assists in leading the Company in line with pre-established goals, promoting reasoned decision-making.

The responsibility for the establishment and maintenance of an effective system of internal control and risk management, in line with the objectives of business and of process, the matching of the methods of risk management to the containment plans defined, pertains to the director in charge and to those in charge of management. The Snam Board of Directors has identified the Company’s Chief Executive Officer as the director in charge of the internal control and risk management system, carrying out the activities provided for in the Corporate Governance Code.

The Board of Directors, subject to the opinion of the Control and Risk Committee, assesses, at least annually, the adequacy of the internal control and risk management system with regard to the characteristics of the Company and of the Group and the risk profile assumed, as well as its efficacy.

The Board of Directors – subject to the favourable opinion of the Control and Risk Committee and considering the opinion of the Board of Statutory Auditors, upon the proposal of the director in charge, in agreement with the Chairman of the Board of Directors – appoints the Internal Auditor. The role, duties and responsibilities of the Internal Audit are defined and formalised by the Board of Directors within the Guidelines. The Internal Auditor, within an organisational structure that reports to the Chief Executive Officer, performs audit activities in full independence in accordance with the instructions of the Board of Directors61; the Control and Risk Committee oversees the activities of the Internal Audit. The Internal Audit activities are carried out ensuring the maintenance of the necessary conditions for independence and the necessary objectivity, competence and professional diligence provided for in the international standards for the professional practice of the Internal Audit and in the code of ethics issued by the Institute of Internal Auditors62, as well as the principles contained in the Code of Ethics63.

The Board of Statutory Auditors, also in the capacity of a “committee for internal control and account auditing” within the meaning of Legislative Decree 39/2010, monitors the effectiveness of the internal control and risk management system.

The internal control and risk management system is subject over time to verification and updating, in order to continually ensure its suitability to protect the main risk areas of the Company’s activities, with respect to the characteristics of its operating sectors and its organisational configuration, and in keeping with any new legislative or regulatory developments.

As provided for in Article 16 of the Bylaws, the Board of Directors appoints the Chief Financial Officer in accordance with Article 154-bis of the TUF upon the proposal by the Chief Executive Officer, by agreement with the Chairman and subject to the favourable opinion of the Board of Statutory Auditors64.

On 26 March 2013 the Board of Directors, in accordance with the procedures and requirements provided for in the Bylaws, confirmed Dr Antonio Paccioretti as Chief Financial Officer, who had first been appointed to that office on 29 October 2007 and also holds the position of Director of Planning, Administration, Finance and Control of Snam.

The Board of Directors annually verifies the adequacy of the powers and resources at the disposal of the Chief Financial Officer to perform the duties assigned, and every half-year verifies the observance of existing administrative and accounting procedures.

For more information and details, please see Section III of the 2013 governance report.

Principal characteristics of the risk management and internal control system in the financial reporting process

The internal control and risk management system and the system for the financial reporting process of the Snam Group are elements of the same “System” meant to ensure the reliability65, accuracy, dependability and timeliness of the financial reporting and the ability of the financial statement preparation process to produce financial information in keeping with generally accepted accounting principles.

Snam has adopted a body of rules that define the standards, methods, roles and responsibilities for designing, implementing and maintaining the internal control system over time on the financial reporting of Snam itself as well as of its subsidiaries, and on the evaluation of its efficacy over time.

In addition to Snam, the control model has indeed been applied to other subsidiaries based on their relevance in the preparation of financial information. Snam subsidiaries adopt the control model defined as a reference to design and institute their own internal financial information control system and tailor it to their size and the complexity of the activities that they undertake.

The model of risk management and internal control over financial reporting adopted by Snam was defined in accordance with the provisions of Article 154-bis of the TUF and is based on the COSO Framework, which is the reference model at the international level for the establishment, updating, analysis and evaluation of an internal control system (the “COSO Framework”66).

In the course of 2013, a project to review and update this model was initiated in order to maintain reliability and adequacy, and in response to the elimination of Eni from its role in this regard, which it has performed up to 2012; the increasing complexity of the structure and organisation of Snam and subsidiaries; and the need to reflect the changes introduced by the update of the aforementioned “COSO Framework”, published in May 2013.

The design, institution and maintenance of the financial information control system are provided by: the activities of scoping, identifying and assessing the risks and controls (at the business level and process level through the activities of risk assessment and monitoring) and the related information flows (reporting).

The controls, both at the entity level and process level, are subject to regular evaluation (monitoring) to verify the adequacy of the design and actual operability over time. For that purpose, there is provision for ongoing monitoring activities, assigned to the management responsible for the relevant procedures/activities, as well as independent monitoring (separate evaluations), assigned to the Internal Audit, which operates according to a plan agreed with the Chief Financial Officer and aimed at defining the scope and objectives of its intervention through agreed audit procedures.

The results of the monitoring activities form the subject of periodic reporting on the status of the control system, which involves all levels of Snam’s organisational structure and its significant subsidiaries, from business operation heads and department heads to administrative directors and to Chief Executive Officers.

Evaluations of all the controls implemented within Snam and its subsidiaries are brought to the attention of the Chief Financial Officer, who, on the basis of this information, prepares a half-year report on the adequacy and effective application of the control system, which is shared with the Chief Executive Officer and copied to the Board of Directors, after notice is given to the Control and Risk Committee and the Board of Statutory Auditors. This enables the Board of Directors itself to perform the functions of oversight along with the assessments within the competence thereof on the internal financial information control system, as well as on the basis of the external opinion received as to the adequacy of the control system in connection with the preparation of the separate and consolidated financial statements.

For more information and details, please see Section III of the 2013 governance report.

Code of Ethics

On 30 July 2013, the Board of Directors approved a new version of the Code of Ethics, which defines a shared system of values and expresses the business ethics culture of Snam, as well as inspiring strategic thinking and guidance of business activities.

The Code of Ethics (i) states the principles that have inspired and served as the basis for the business done by Snam, such as observance of the law, fair competition, honesty, integrity, propriety and good faith in respecting the legitimate interests of customers, employees, shareholders and business and financial partners, as well as the communities in which the Company conducts its business; (ii) contains the general principles of sustainability and corporate responsibility; and (iii) has as its subject matter, inter alia, the workplace, relations with stakeholders and suppliers and protection of personal data

Among other things, the Code of Ethics reflects a compulsory general principle of the organisation, management and control model adopted by Snam pursuant to the Italian system of the “liability of legal entities for administrative offenses arising from crime” contained in Legislative Decree 231 of 8 June 2001. The Board of Directors has assigned to the Supervisory Body , established pursuant to Legislative Decree 231/2001, the role of Supervisor of the Code of Ethics, to which the following may be submitted: (i) requests for clarifications and interpretations of the principles and contents of the Code; (ii) suggestions with regard to applying the Code of Ethics; and (iii) reports of violations of the Code of Ethics detected directly or indirectly.

Model 231 and the Supervisory Body

The Board of Directors has adopted its own organisation, management and control model pursuant to Legislative Decree 231 of 8 June 2001 (“Model 231”) for the prevention of the offenses referred to in the rules on corporate administrative liability for offenses committed in the interest or for the benefit of the Company (Legislative Decree 231/2001), and it has appointed a Supervisory Body equipped with autonomous powers of initiative and control, in accordance with legal provisions.

The Board of Directors, most recently on 30 July 2013, approved the new text of Model 231, updated for the new offenses of “corruption between private parties”, “undue inducement to give or promise benefits” and “employment of citizens of other countries whose presence is unlawful”, as well as for the change in the corporate organisational structure of Snam.

The subsidiaries have also adopted their own Model 231 commensurate with their own characteristics, appointing their own Supervisory Body charged with monitoring that Model 231 is implemented and applied effectively.

The Supervisory Body consists of the Internal Auditor, the Head of Coordination of Legal and Corporate and Compliance Affairs and three external members, one of whom acts as Chairman, who are legal, corporate and business economics and organisation experts. The following table shows the members of that body:

| Download XLS (22 kB) |

|

Member |

Status |

|

Mario Molteni |

Chairman – External Member |

|

Giovanni Maria Garegnani |

External Member |

|

Ugo Lecis |

External Member |

|

Silvio Bianchi |

Internal Auditor |

|

Bruno Clerico Titinet |

Head of Coordination of Legal and Corporate and Compliance Affairs |

For more information and details, please see Section III of the 2013 governance report.

Snam rules system

Snam, consistent with an evolutionary process aimed at continually improving the efficiency and effectiveness of the internal control and risk management system, has adopted its own rules system composed of the following regulatory levels: (i) Corporate System Framework (1st regulatory level), (ii) Procedures (2nd regulatory level) and (iii) Operating Instructions (3rd regulatory level).

In addition, an integral part of the regulatory system is represented by the documents pertaining to the certified management systems (according to the International Organisation for Standardisation) on the subject of Health, Safety, Environment and Quality (Policies, Manuals, Procedures and Operating Instructions). Lastly, there are the regulatory circulars for governing specific topics (sometimes applicable at given times).

These regulatory tools are part of an efficient handling of the Management and Coordination activities performed by Snam concerning subsidiaries, and they are subject to periodic reporting to the Boards of Directors of the subsidiaries.

For some specific matters (e.g. matters relating to health, safety and the environment and/or those within the competence of the Boards of Directors of Snam and the subsidiaries) that involve specific responsibility directly held by the subsidiaries according to the applicable provisions of law, formal adoption by them is provided for.

For more information and details, please see Section III of the 2013 governance report, which also contains details on the following:

- Procedure for allegations, even anonymous ones, received by Snam and by subsidiaries;

- Anti-corruption procedure;

- Antitrust Code of Conduct;

- Procedure for transactions in which directors and auditors have an interest and transactions with related parties;

- Procedure in relation to market abuse.

Shareholder and investor relations

Snam has adopted a communication policy designed to open an ongoing dialogue with shareholders, institutional investors, socially responsible investors, analysts and all financial market traders, and to guarantee the systematic dissemination of exhaustive and timely information on its activity, limited solely by the confidentiality requirements which some information may impose. In this regard, reporting to investors, the market and information bodies is ensured through press releases, regular meetings with institutional investors, the financial community and the press, and through extensive documentation made available and continually updated on the Company website.

Information regarding reports, events/significant transactions, as well as procedures issued by Snam on corporate governance are disclosed to the public in a timely manner and posted on the Company website. On the website one can also consult the Company’s press releases, the documentation used during the meetings with financial analysts, notices to shareholders, as well as information and documentation regarding the topics on the agenda of the shareholders’ meetings, including their minutes.

Relations with shareholders and all financial market traders are maintained by the “Investor Relations” unit. The information of interest to them is available on the Company website and can also be requested by e-mail at investor.relations@snam.it.

Relations with the news media are handled by the Institutional Relations and Communications Department.

For more information and details, please see Section III of the 2013 governance report.

57 The Snam Extraordinary Shareholders’ Meeting of 26 March 2013 approved certain amendments to the Bylaws intended to adapt the Bylaws to comply with the regulatory changes introduced and to simplify Shareholders’ Meeting proceedings. Further information on the aforementioned changes to the Bylaws can be found in Section I of the 2013 governance report.

58 The Board of Directors appointed Lorenzo Bini Smaghi as Chairman of the Board of Directors for the first time on 15 October 2012.

59 The Board of Directors appointed Carlo Malacarne as Chief Executive Officer for the first time on 8 May 2006.

60 With reference to the initiatives carried out during 2013 for the continuous improvement of the internal control and risk management system, of particular note is the establishment of the Enterprise Risk Management unit resulting from a specific project that has enabled the implementation of an Enterprise Risk Management system comprised of organisational structures, rules and procedures for the identification, measurement, management and monitoring of the main risks that could affect the achievement of strategic objectives.

61 In accordance with criterion 7.C.5 letter b) of the Code of Corporate Governance valorising the power exclusively reserved to the Board of giving instructions to the Internal Auditor.

62 The international standards for the professional practice of the Internal Audit are available at the following address: http://www.unesco.org/new/fileadmin/MULTIMEDIA/HQ/IOS/temp/IPPF_Standards%20ENG.pdf.

63 See the “Code of Ethics” paragraph below.

64 The Chief Financial Officer must be selected from among persons who do not hold any office on the control or management bodies of, nor any managerial post in, Eni and its subsidiaries, and who do not have any relation, whether direct or indirect, of a professional or equity nature with such companies. As provided for in Article 16 of the Bylaws, the Chief Financial Officer must be chosen from among people who have performed in the following capacity for at least three years:

a) administration or control or management activity at a company listed on regulated markets in Italy, other States of the European Union or other countries belonging to the OECD which have a share capital of no less than €2 million;

b) audit activity at the companies mentioned above at letter a);

c) professional or tenured university teaching activity in finance or accounting;

d) managerial functions at public or private entities with financial, accounting or control responsibilities.

The Board of Directors sees to it that the Chief Financial Officer has adequate powers and resources for performing the duties assigned to him, as well as for the effective observance of administrative and accounting procedures.

Reliability (of the information): information characterised by accuracy and compliance with generally accepted accounting principles which meets the legal and regulatory requirements applied.

The document “Internal Control - Integrated Framework” published by the Committee of Sponsoring Organisations of the Treadway Commission (www.coso.org).

65 Reliability (of the information): information characterised by accuracy and compliance with generally accepted accounting principles which meets the legal and regulatory requirements applied.

66 The document “Internal Control - Integrated Framework” published by the Committee of Sponsoring Organisations of the Treadway Commission (www.coso.org).