Summary of 2015 Remuneration Policy

|

Component |

Purposes and characteristics |

Criteria and conditions for implementation |

Amounts |

||||

|

|||||||

|

Adequately compensates the skills, professionalism and contribution required for the position held with the aim of providing motivation including for the purposes of retention |

Fixed remuneration is determined based on the position and responsibilities assigned with respect to levels used for equivalent positions in the market, and with possible annual adjustments established for merit (continuation of individual performance) or for promotions or increased responsibilities. |

Chairman: € 400.000 (including fixed annual compensation for directors set by the Shareholders' Meeting); |

|||||

|

Short-term variable incentives |

Paid annually in cash, this is a useful tool to motivate and guide management activities over the short term in keeping with corporate goals established by the Board of Directors. The amount of the short-term annual incentive is based on the position held and the company and individual performance achieved. |

Corporate/CEO grid objectives: |

Incentives paid according to results achieved in the prior year and assessed against a performance scale of 70-130 points with a minimum threshold for incentives equal to overall performance of 85 points. |

||||

|

Long-term variable incentives |

Reserved for executives who have achieved the individual objectives set in the previous year, and who are a part of the Leadership Development Program. These incentives provide support for management activities over the medium and long term in keeping with the strategic plan's objectives, and they also promote retention. |

Plan with annual assignment and three-year vesting period |

CEO: 45.5% of GAC for target performance; 77.4% of GAC for max performance |

||||

|

Long-term variable incentives |

Reserved for those holding positions with the most direct responsibility for the company's results; they ensure the best alignment between the interests of shareholders and management's conduct. |

Plan with annual assignment and three-year vesting period |

CEO: 50% of GAC for target performance; 65% of GAC for max performance |

||||

|

These are an integral part of the remuneration package, and are focused primarily on welfare and pension components. |

Continually determined using the policy implemented in recent years and in accordance with the national contract and supplementary company agreements for executives |

These are assigned to all executive staff: |

|||||

News in 2015

Claw-back clause (to be used for variable incentive instruments): “Subject to the right to compensation for any further damage, within the legally prescribed deadline, the Company may come back into possession (with the Participant’s resulting obligation to return the amount) of amounts already disbursed if it is determined that the achievement of objectives was due to malicious or grossly negligent conduct, or any actions carried out in violation of any applicable rules (whether corporate, legal, regulatory or from any other source) by the Participant, or if the above objectives were achieved on the basis of data that were later found to be patently false”. The procedure to specify the process and responsibilities connected with the implementation of this clause is being determined.

Introduction of the TSR, to apply to the Long-Term Monetary Incentive as an objective indicator of the creation of value for shareholders. Its use, together with adjusted net profit, increases the correlation with corporate strategy and improves the convergence of objectives between management and the shareholder base over the long term.

Update of the remuneration structure for the Internal Audit Manager:

- MBO grid with only functional and measurable quantitative objectives

- calculation of the annual monetary incentive relying only on that grid

- assignment of minimum, target and maximum performance levels, and assessment of results achieved to be carried out by the Control and Risk Committee

- standardisation of other forms of deferred monetary and long-term monetary incentives for the entire management structure.

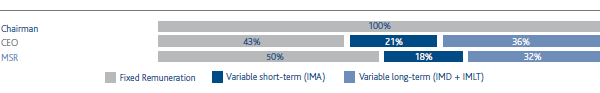

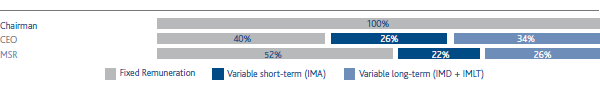

PAY mix

The guidelines of the 2015 Remuneration Policy call for a pay mix consistent with the management position held.

In the case of the CEO, there is greater emphasis on the variable component and it prevails over the fixed component even if results are equal to the target.

TARGET PAY MIX

PAY MIX USED IN 2014

Shareholders’ meeting vote on Section I of the 2014 Remuneration Report

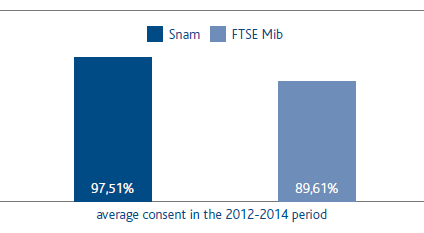

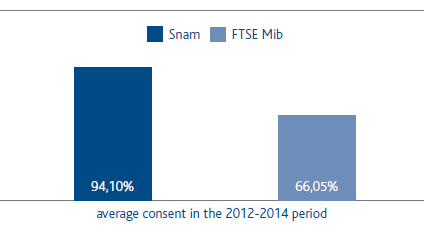

As provided for by the legislation in force, Snam’s Shareholders’ Meeting again voted in an advisory capacity on the first section of the Remuneration Report in 2014. The percentage of votes in favour was 96.46% of the meeting participants. Compared with previous years, there was a sharp increase in participation from 50.45% to 61% of the share capital, due in part to the increased presence of institutional investors.

TOTAL VOTES IN FAVOUR

VOTES IN FAVOUR INTERESTS

During the first three years of implementing “say on pay” in Italy, Snam achieved steady performance in terms of the favourable vote, and in any event, over 96% of votes cast. The average consensus achieved by Snam over the three-year reference period was 97.5%. Even if the vote of minority interests is taken into account, Snam confirmed high consensus percentages with 93.03% favourable votes in 2014 and a three-year average of 94.1%, which puts it in second place among FTSE MIB companies (source: Georgeson).