Abstract

Member |

Aims and characteristics |

Criteria and conditions for implementation |

Values |

||||

|

|||||||

Fixed remuneration |

Adequately compensates the skills, professionalism and contribution required from the position held, with the goal of also supporting motivation for retention purposes |

Fixed remuneration is calculated based on the position and the responsibilities assigned, with reference to the levels adopted for equivalent positions on the market with possible annual adjustments established for merit (continuity of individual performance) or for progression in the position/ |

Chairman: € 270,000 (including annual fixed pay for directors established by the Shareholders’ Meeting) |

||||

Short-term variable incentive (Annual Monetary Incentive) |

Provided annually in a monetary form, it is an instrument that is helpful in motivating and directing management’s action in the short-term, in line with the corporate targets set by the Board of Directors. |

Corporate/CEO Targets: |

Incentives provided depending on the results achieved in the previous year and evaluated in accordance with a performance scale of 70/130 points, with a minimum level for incentives equal to an overall performance of 85 points |

||||

Share-based long-term variable incentive (Long-Term Incentive-LTI)** |

Reserved for those holding positions with the most direct responsibility for company results, guarantees greater alignment between the interests of shareholders and the actions of management |

Plan with annual granting and three-year vesting period |

CEO: the maximum possible incentive is 210% of the fixed remuneration |

||||

Benefits |

They are an integral part of the remuneration package and, by their nature, mainly involve healthcare or pensions |

Continuously defined with the Policy implemented in recent years and in compliance with what is required by national negotiations and supplementary corporate agreements for senior management |

The following are assigned to the entire senior management: |

||||

Pay mix

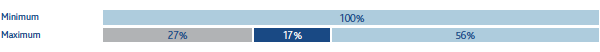

The guidelines of the 2017 Remuneration Policy contain a pay mix consistent with the managerial position exercised. In the case of the CEO the weighting of the variable component is accentuated, compared with the rest of the managerial structure, which takes precedence over the fixed component. The pay mix for 2017 calculated with the minimum and maximum variable incentive levels is reported below.

Pay mix of the CEO

Shareholders’ meeting vote on section I of the 2016 Remuneration Report

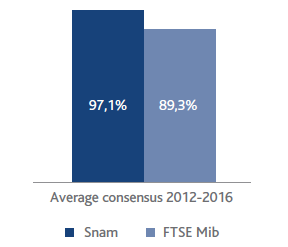

As laid down by existing legislation, in 2016, the Snam Shareholders’ Meeting also took a vote in an advisory capacity on the first section of the Remuneration Report. The percentage of votes in favour was 95.80% of those present. Compared with previous years an increase in attendance was recorded for the third consecutive year. Compared with 2015, there was a significant increase in the presence of institutional investors which rose from 31.96% to 38.88%

Total votes

in favour

Votes in favour -

minority interests

In the five years of the implementation of the say on pay in Italy, Snam always obtained votes in favour of more than 95% of votes cast. The average consensus reached in the five-year reference period, equal to 97.08%, confirms Snam’s best practice role compared with the panel considered (FTSE MIB companies with: capitalisation of more than € 3 billion, total minority shareholders present at the meeting of more than 15%).

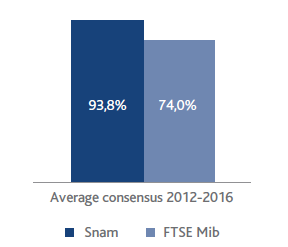

Even the average of votes in favour cast by minority interests (93.83%) confirms the high level of approval obtained (source: Georgeson).