Corporate governance system and rules

Corporate governance system

Snam issues shares that are listed on the MTA managed by Borsa Italiana S.p.A., and therefore fulfils all legislative and regulatory obligations related to stock market listing.

The Bylaws define the Company’s governance model and the main rules for the functioning of corporate bodies. Snam has adopted a traditional administration and control system.

The Bylaws outline the functions and activities of the following corporate bodies:

- Shareholders’ Meeting;

- Board of Directors;

- Board of Statutory Auditors.

Shareholders’ Meeting

The Shareholders’ Meeting is the shareholders’ decision-making body, and appoints the Board of Directors and the Board of Statutory Auditors. In addition to the matters irrevocably assigned to it by law, pursuant to Article 12 of the Bylaws, the Ordinary Shareholders’ Meeting is also exclusively responsible for passing resolutions concerning transfer, contribution, leasing, usufruct and any other act of disposal (including those that apply to joint ventures), or subjection to restrictions, of the Company or of strategically important business units related to gas transportation or dispatching activities.

The Extraordinary Shareholders’ Meeting passes resolutions on matters assigned to it by law, without prejudice to the descriptions given below, by means of a favourable vote from at least three quarters of the share capital represented at the Shareholders’ Meeting.

The Bylaws stipulate that the Board of Directors is responsible for passing resolutions on:

- mergers in the cases referred to in Articles 2505 and 2505-bis of the Italian Civil Code, as well as those mentioned for demergers;

- establishment, modification and elimination of secondary offices;

- the reduction in share capital when a shareholder withdraws;

- compliance of the Bylaws with regulatory provisions;

- the transfer of the registered office within Italy.

In accordance with the provisions of the Code of Corporate Governance, the Shareholders’ Meeting is governed by dedicated regulations that provide for the meetings to take place in an orderly, functional fashion and guarantee that each shareholder is entitled to express his/her opinion about the issues being discussed.

Board of Directors

The Board of Directors is appointed by the Shareholders’ Meeting, in compliance with the applicable laws regarding a balance between genders and based on the lists presented by the shareholders in which the candidates are listed by progressive number, and in a number no greater than the members of the body to be elected.

The Shareholders’ Meeting of 26 March 2013 set the number of directors at nine and their term of office at three financial years, expiring on the date of the Shareholders’ Meeting called to approve the separate financial statements at 31 December 2015.

The following table lists the current members of the Board of Directors, indicating the lists from which they were elected and the directors for whom it was expressly indicated on the list that they meet the independence requirements pursuant to the TUF and the Code of Corporate Governance.

| Download XLS (24 kB) |

|

Director |

Position |

List from which he/she was appointed |

||||||

|

||||||||

|

Lorenzo Bini Smaghi |

Non-executive director and Chairman |

CDP RETI list |

||||||

|

Carlo Malacarne |

Chief Executive Officer |

CDP RETI list |

||||||

|

Sabrina Bruno |

Non-executive director (1) |

List presented jointly by minority shareholders (2) |

||||||

|

Alberto Clô |

Non-executive director (1) |

CDP RETI list |

||||||

|

Francesco Gori |

Non-executive director (1) |

List presented jointly by minority shareholders |

||||||

|

Yunpeng He |

Non-executive director |

Co-opted at the proposal of CDP RETI (3) |

||||||

|

Andrea Novelli |

Non-executive director |

CDP RETI list |

||||||

|

Elisabetta Oliveri |

Non-executive director (1) |

List presented jointly by minority shareholders |

||||||

|

Pia Saraceno |

Non-executive director (1) |

CDP RETI list |

||||||

The Shareholders’ Meeting of 26 March 2013 confirmed Lorenzo Bini Smaghi in the role of Chairman of the Board of Directors72. The Chairman is not the Chief Executive Officer or a controlling shareholder.

At its meeting on 26 March 2013, the Board of Directors reappointed Carlo Malacarne as Chief Executive Officer73, assigning him the functions pertaining to that position and conferring on him all responsibilities and powers not reserved for the Board or the Chairman.

On the same date, the Board of Directors reappointed Marco Reggiani, the Head of Legal and Corporate Affairs and Compliance, as Secretary to the Board of Directors.

Finally, on 26 January 2015 the Board of Directors approved its own Regulations, which are intended to regulate procedures for (i) the convocation of meetings, (ii) the performance of directors’ duties, and (iii) the drawing up of meeting minutes.

The Board, at the time of its appointment and periodically thereafter, evaluates the independence and integrity of the directors, as well as the lack of grounds for ineligibility or incompatibility.

The Board of Directors is vested with the broadest powers of ordinary and extraordinary administration of the Company, and is authorised to carry out any acts that it considers expedient to the achievement of the corporate purpose. The Board of Directors may delegate powers to one or more of its members and may establish Committees.

At its meeting on 11 March 2015, pursuant to the Code of Corporate Governance, the Board of Directors expressed its opinion on the size, composition and functioning of the Board and its Committees.

Following the appointment of the Board of Directors and the Board of Statutory Auditors, board induction sessions were held, attended by the members of both of these boards. In February 2015, a board induction session was held for director Yunpeng He, co-opted on 26 January 2015.

Committees instituted by the Board of Directors

The Board of Directors has set up the following Committees, appointing their members and approving the related regulations, in accordance with the provisions of the Code of Corporate Governance and the Bylaws:

- Remuneration Committee;

- Appointments Committee;

- Control and Risk Committee

The composition of the Remuneration Committee is as follows:

| Download XLS (22 kB) |

|

Member |

Position |

||

|

|||

|

Elisabetta Oliveri |

Independent, non-executive(1); Chairman |

||

|

Andrea Novelli |

Non-executive |

||

|

Pia Saraceno |

Independent, non-executive(1) |

||

The Board of Directors has verified that at least one member has adequate knowledge and experience of financial matters or pay policies.

The composition of the Appointments Committee is as follows:

| Download XLS (22 kB) |

|

Member |

Position |

||||

|

|||||

|

Alberto Clô |

Independent, non-executive(1); Chairman |

||||

|

Lorenzo Bini Smaghi(2) |

Non-executive |

||||

|

Elisabetta Oliveri |

Independent, non-executive(1) |

||||

The composition of the Control and Risk Committee is as follows:

| Download XLS (22 kB) |

|

Member |

Position |

||

|

|||

|

Francesco Gori |

Independent, non-executive(1); Chairman |

||

|

Sabrina Bruno |

Independent, non-executive(1) |

||

|

Andrea Novelli |

Non-executive |

||

|

Pia Saraceno |

Independent, non-executive(1) |

||

Snam’s Board of Directors has verified that more than one member of the Committee has adequate experience in accounting and financial matters and risk management.

Board of Statutory Auditors

The Board of Statutory Auditors oversees compliance with the law and the deed of incorporation, as well as observance of the principles of proper administration in the performance of corporate activities; it also monitors the adequacy of the organisational, administrative and accounting structure adopted by the Company and the functioning thereof. Pursuant to Legislative Decree No. 39 of 27 January 2010, the Board of Statutory Auditors also performs supervisory functions in its capacity as “Committee for internal control and account auditing”.

In compliance with the provisions of the law and the Bylaws, Snam’s Board of Statutory Auditors is composed of three statutory auditors and two alternate auditors, who are appointed by the Shareholders’ Meeting for three-year terms and may be re-elected at the end of their term of office. As for the Board of Directors and in line with applicable provisions, the Bylaws provide for the auditors to be appointed by list vote, except when they are replaced during their term of office.

Statutory auditors are chosen from among those who meet the professionalism and integrity requirements indicated in Decree No. 162 of the Ministry of Justice of 30 March 2000. For the purposes of this Decree, the Company’s business areas are commercial law, business administration and corporate finance. Likewise, the sector strictly pertaining to its business is the engineering and geological sector.

The current Board of Statutory Auditors was appointed by the Shareholders’ Meeting of 26 March 2013 for a three-year term and, in any case, until the date of the Shareholders’ Meeting called to approve the separate financial statements for the 2015 financial year:

| Download XLS (22 kB) |

|

Member |

Position |

||||

|

|||||

|

Massimo Gatto(1) |

Statutory auditor and Chairman |

||||

|

Leo Amato(2) |

Statutory auditor |

||||

|

Stefania Chiaruttini(2) |

Statutory auditor |

||||

|

Maria Gimigliano(2) |

Alternate auditor |

||||

|

Luigi Rinaldi(1) |

Alternate auditor |

||||

Independent auditors

As required by law, the Company’s financial statements are audited by independent auditors included in the relevant register and appointed by the Shareholder’s Meeting based on a proposal issued by the Board of Statutory Auditors.

On 27 April 2010, the Shareholders’ Meeting appointed Reconta Ernst & Young S.p.A to audit the Company’s accounts for the 2010-2018 period.

For more information and details, please see Section III of the 2014 Governance report.

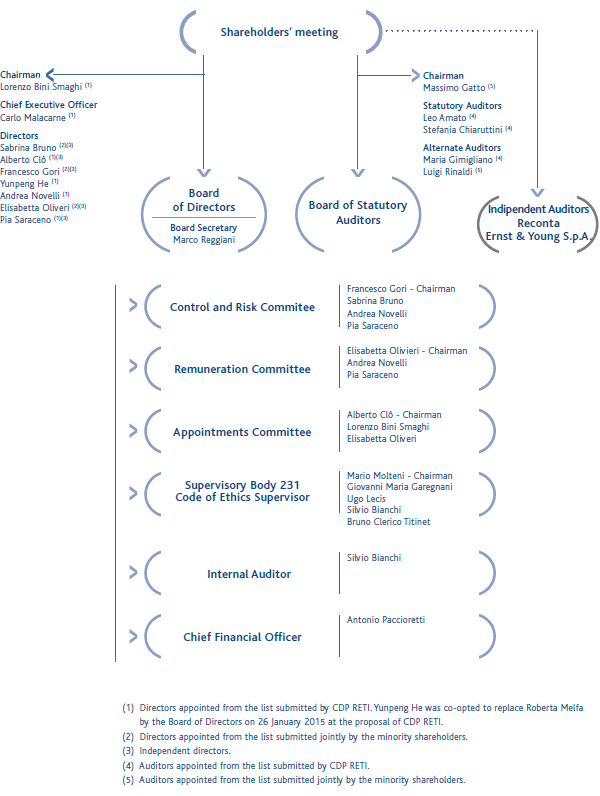

Graphic summary of the corporate governance structure

Please find below a graphic summary of the governance structure of the Company:

The internal control and risk management system

Principles of the internal control and risk management system

Snam has adopted and is committed to promoting and maintaining an adequate internal control and risk management system, to be understood as a set of all of the tools necessary or useful in order to direct, manage and monitor business activities with the objective of ensuring compliance with laws and company procedures, protecting corporate assets, managing activities in the best and most efficient manner and providing accurate and complete accounting and financial data.

The Code of Ethics defines the guiding principles that serve as the basis for the entire internal control and risk management system, including: (i) the segregation of duties among the entities assigned to the processes of authorisation, execution or control; (ii) the existence of corporate determinations capable of providing the general standards of reference to govern corporate activities and processes; (iii) the existence of formal rules for the exercise of signatory powers and internal powers of authorisation; and (iv) traceability (ensured through the adoption of information systems capable of identifying and reconstructing the sources, the information and the controls carried out to support the formation and implementation of the decisions of the Company and the methods of financial resource management).

Over time, the internal control and risk management system has been subjected to verification and updating in order to continually ensure its suitability and to protect the main areas of risk in business activities. In this context, as well as for the purpose of implementing the provisions of the Code of Corporate Governance, Snam has adopted an Enterprise Risk Management (ERM) system74.

The results of the risk mapping activities of the ERM unit are subject to quarterly reporting, which concerns the Control and Risk Committee and all levels of the organisational structure of Snam and its subsidiaries, including process owners, department managers and Chief Executive Officers.

The Board of Directors, in its most recent meeting of 29 October 2013, approved the “Guidelines of the Board of Directors on Internal Auditing” (the “Guidelines”) that define the system of internal control and risk management as a set of organisational rules, procedures and structures to enable the identification, measurement, management and monitoring of the main risks. An effective system of internal control and risk management assists in leading the Company in line with pre-established goals, promoting reasoned decision-making.

The responsibility for the establishment and maintenance of an effective system of internal control and risk management, in line with the objectives of business and of process, and the matching of the methods of risk management to the containment plans defined, pertains to the director in charge and to those in charge of management. The Snam Board of Directors has identified the Company’s Chief Executive Officer as the director in charge of the internal control and risk management system, carrying out the activities provided for in the Code of Corporate Governance.

The Board of Directors, subject to the opinion of the Control and Risk Committee, assesses, at least annually, the adequacy of the internal control and risk management system with regard to the characteristics of the Company and of the group and the risk profile assumed, as well as its efficacy.

The Board of Directors – subject to the favourable opinion of the Control and Risk Committee and considering the opinion of the Board of Statutory Auditors, upon the proposal of the director in charge, in agreement with the Chairman of the Board of Directors – appoints the Internal Audit Manager. The role, duties and responsibilities of Internal Audit are defined and formalised by the Board of Directors within the Guidelines. The Internal Audit Manager, within an organisational structure that reports to the Chief Executive Officer, performs audit activities in full independence in accordance with the instructions of the Board of Directors75; the Control and Risk Committee oversees Internal Audit activities. Internal Audit activities are carried out ensuring the maintenance of the necessary conditions for independence and the necessary objectivity, competence and professional diligence provided for in the international standards for professional internal auditing practice and in the code of ethics issued by the Institute of Internal Auditors76, as well as the principles contained in the Code of Ethics77.

The Board of Statutory Auditors, also in the capacity of a “committee for internal control and account auditing” within the meaning of Legislative Decree 39/2010, monitors the effectiveness of the internal control and risk management system.

As provided for in Article 16 of the Bylaws, the Board of Directors appoints the Chief Financial Officer in accordance with Article 154-bis of the TUF at the proposal of the Chief Executive Officer, by agreement with the Chairman and subject to the favourable opinion of the Board of Statutory Auditors78.

On 26 March 2013, the Board of Directors, in accordance with the procedures and requirements provided for in the Bylaws, reappointed Antonio Paccioretti as Chief Financial Officer. Mr. Paccioretti, who was first appointed to this office on 29 October 2007, also holds the position of Director of Planning, Administration, Finance and Control of Snam.

The Board of Directors annually verifies the adequacy of the powers and resources at the disposal of the Chief Financial Officer to perform the duties assigned, and every half-year verifies the observance of existing administrative and accounting procedures.

For more information and details, please see Section III of the 2014 Governance report.

Principal characteristics of the risk management and internal control system in the financial reporting process

The internal control and risk management system and the corporate reporting process of the Snam Group are elements of the same “System” (the Corporate Reporting Internal Control System), which is meant to ensure the reliability79, accuracy80, dependability81 and timeliness of corporate disclosure with regard to financial reporting and the ability of the relevant business processes to produce this information in keeping with generally accepted accounting principles.

The reporting in question consists of all data and information contained in the periodic accounting documents required by law – the annual report, the half-year report, the interim directors’ report (including consolidated versions) – as well as any other documents or communications for external consumption, such as press releases and prospectuses prepared for specific transactions, which are subject to the certifications required by Article 154-bis of the TUF, introduced by Law No. 262 of 28 December 2005. The reporting includes both financial and non-financial data and information; the purpose of the latter is to describe the significant aspects of the business, comment on the financial results for the year, and/or describe the outlook.

Snam has adopted a body of rules that define the standards, methods, roles and responsibilities for designing, implementing and maintaining over time the Group’s Corporate Reporting Internal Control System, which is applied to Snam and its subsidiaries, taking account of their significance in terms of their contribution to the consolidated financial statements of the Snam Group and the riskiness of the activities carried out.

The internal control and risk management model adopted by Snam and its subsidiaries with regard to corporate reporting was defined in accordance with the provisions of the above-mentioned Article 154-bis of the TUF and is based, in methodological terms, on the “COSO Framework” (“Internal Control – Integrated Framework”, issued by the Committee of Sponsoring Organisations of the Treadway Commission), the international reference model for the establishment, updating, analysis and assessment of the internal control system, for which an update was published in May 2013.

2014 saw the completion of the SCIS Project, which started in the second half of 2013.

The project, implemented with the support of a leading consultancy firm, concerned the review and updating of the Snam Group Corporate Reporting Internal Control System, with a view to bringing it more into line with the group’s requirements and particularities, in the face of growing organisational and process complexity, and to strengthening its methodological framework, in order to allow the group to continue constantly improving the system and manage the dependability, reliability, timeliness and accuracy of corporate information.

In relation to the activities carried out within the framework of the SCIS Project, the “Snam Group Corporate Reporting Internal Control System Procedure” was issued to replace the previous Management System Guidelines (MSG). This defines, in the light of the developments of the project, the roles and responsibilities relating to the design, institution, application, maintenance over time, management and assessment of the effectiveness of the system as a whole. Detailed operating instructions were also defined that govern the methodology, the responsibilities and the activities to be carried out to implement the various components of the Corporate Reporting Internal Control System. These involve, in particular, defining the scope of application of the System (scoping), “company/entity-level controls” (CELCs), “process-level controls” (PLCs), “segregation of duties” (SoD), “information technology general controls” (ITGC), risk assessment for the process-level controls, management procedures for the results of the controls and the assessment of deficiencies, mapping the significant SCIS information applications, and the sampling method used in line monitoring activities.

The planning activities also involved, on the basis of what had been defined in terms of methodological approach and revision of analysis and assessment processes, reviewing and updating all the risks and controls of the individual components of the System.

The planning, institution and maintenance of the Corporate Reporting Internal Control System are achieved through: the activities of scoping, identifying and assessing the risks and controls (at the business level and process level through the activities of risk assessment and monitoring) and the related information flows (reporting).

The controls, both at the entity level and process level, are subject to regular evaluation (monitoring) to verify the adequacy of the design and actual operability over time. For this purpose, there is provision for ongoing monitoring activities, assigned to the management responsible for the relevant procedures/activities, as well as independent monitoring (separate evaluations), assigned to Internal Audit, which operates according to a plan agreed with the Chief Financial Officer and aimed at defining the scope and objectives of its intervention through agreed audit procedures.

Snam’s Board of Directors also appointed independent auditors Reconta Ernst & Young to examine the adequacy of the internal control system in relation to the preparation of financial information for the production of the financial statements and consolidated financial statements of Snam S.p.A., by conducting independent checks on the effectiveness of the design and functionality of the control system. This appointment, which is made voluntarily on an annual basis, reflects the need to keep attention constantly focused on the Corporate Reporting Internal Control System, even after removal of the obligation to comply with the Sarbanes Oxley Act, by which Snam had been bound when it was controlled by eni, a company listed on the New York stock exchange.

This appointment represents a best practice applied by leading companies and, like the US Sarbanes Oxley Act, provides for the issuance, by the independent auditors, of an annual report intended for the Board of Directors concerning the checks performed and the adequacy of the internal control system in relation to the preparation of the Snam Group’s financial information.

The results of the monitoring activities, the checks made on the controls and any other information or situations relevant to the Corporate Reporting Internal Control System are subject to periodic reporting on the state of the control system, which involves all levels of the organisational structure of Snam and its major subsidiaries, including operational business managers, heads of department, administrative managers and chief executive officers.

The assessments of all the controls instituted within Snam and its subsidiaries are brought to the attention of the Chief Financial Officer, who, on the basis of this information, draws up half-yearly and annual reports on the adequacy and effective application of the Corporate Reporting Internal Control System. These are shared with the Chief Executive Officer and communicated to the Board of Directors, after informing the Control and Risk Committee and the Board of Statutory Auditors, at the time of approval of the financial statements and the consolidated financial statements, as well as the consolidated half-year report, to allow the Board of Directors to perform its supervisory functions and to conduct the assessments that fall to its responsibility with regard to the Corporate Reporting Internal Control System, including on the basis of the results of the checks performed by the independent auditors on the adequacy of the control system in relation to the preparation of the financial statements and the consolidated financial statements.

For more information and details, please see Section III of the 2014 governance report.

Code of Ethics

On 30 July 2013, the Board of Directors approved a new version of the Code of Ethics, which defines a shared system of values and expresses the business ethics culture of Snam, as well as inspiring strategic thinking and guidance of business activities.

The Code of Ethics (i) states the principles that have inspired and served as the basis for the business done by Snam, such as observance of the law, fair competition, honesty, integrity, propriety and good faith in respecting the legitimate interests of customers, employees, shareholders and business and financial partners, as well as the communities in which the Company conducts its business; (ii) contains the general principles of sustainability and corporate responsibility; and (iii) has as its subject matter, inter alia, the workplace, relations with stakeholders and suppliers and protection of personal data.

Among other things, the Code of Ethics reflects a general, necessary principle of the organisation, management and control model adopted by Snam pursuant to the Italian rules governing the “liability of legal entities for administrative offences arising from crime” contained in Legislative Decree 231 of 8 June 2001 (“Legislative Decree No. 231 of 2001”). The Board of Directors has assigned to the Watch Structure, instituted pursuant to Legislative Decree No. 231 of 2001, the role of Code of Ethics Supervisor, to respond to the following: (i) requests for clarification and interpretation of the principles and contents of the Code; (ii) suggestions with regard to applying the Code of Ethics; and (iii) reports of violations of the Code of Ethics detected directly or indirectly.

Model 231 and the Watch Structure

The Board of Directors has adopted its own organisation, management and control model pursuant to Legislative Decree 231 of 8 June 2001 (“Model 231”) for the prevention of the offences referred to in the rules on corporate administrative liability for offences committed in the interest or for the benefit of the Company (Legislative Decree 231 of 2001), and it has appointed a Watch Structure equipped with autonomous powers of initiative and control, in accordance with legal provisions.

The Board of Directors, most recently on 30 July 2013, approved the new text of Model 231, updated for the new offences of “corruption between private parties”, “undue inducement to give or promise benefits” and “employment of citizens of other countries whose presence is unlawful”, as well as for the change in the corporate organisational structure of Snam.

The subsidiaries have also adopted their own Model 231 commensurate with their own characteristics, appointing their own Watch Structures charged with ensuring that Model 231 is implemented and applied effectively.

The Watch Structure consists of the Internal Audit Manager, the Head of Legal and Notarial Supplier and Support Process Management, and three external members, one of whom acts as Chairman, who are legal, corporate and business economics and organisation experts. The following table shows the members of that body:

| Download XLS (22 kB) |

|

Member |

Position |

|

Mario Molteni |

Chairman – External Member |

|

Giovanni Maria Garegnani |

External Member |

|

Ugo Lecis |

External Member |

|

Silvio Bianchi |

Internal Auditor |

|

Bruno Clerico Titinet |

Head of Legal and Notarial Supplier and Support Process Management |

For more information and details, please see Section III of the 2014 governance report.

Snam rules system

Snam, consistent with an evolutionary process aimed at continually improving the efficiency and effectiveness of the internal control and risk management system, has adopted its own rules system composed of the following regulatory levels: (i) Corporate System Framework (1st regulatory level), (ii) Procedures (2nd regulatory level) and (iii) Operating Instructions (3rd regulatory level).

In addition, an integral part of the regulatory system is represented by the documents pertaining to the certified management systems (according to the International Organisation for Standardisation) on the subject of Health, Safety, Environment and Quality (Policies, Manuals, Procedures and Operating Instructions). Lastly, there are the regulatory circulars for governing specific topics (sometimes applicable at given times).

These regulatory tools are part of the efficient handling of the Management and Coordination activities performed by Snam concerning subsidiaries, and they are subject to periodic reporting to the Boards of Directors of the subsidiaries.

For some specific matters (e.g. matters relating to health, safety and the environment and/or those within the competence of the Boards of Directors of Snam and the subsidiaries) that involve specific responsibility directly held by the subsidiaries according to the applicable provisions of law, formal adoption by them is provided for.

For more information and details, please see Section III of the 2014 governance report, which also contains details on the following:

- Procedure for allegations, even anonymous ones, received by Snam and by subsidiaries;

- Anti-corruption procedure;

- Antitrust Code of Conduct;

- Procedure for transactions in which directors and auditors have an interest and transactions with related parties;

- Procedure in relation to market abuse.

Shareholder and investor relations

Snam has adopted a communications policy designed to open an ongoing dialogue with shareholders, institutional investors, socially responsible investors, analysts and all financial market traders, guaranteeing the systematic dissemination of exhaustive and timely information on its activity, limited solely by the confidentiality requirements which some information may impose. To this end, the delivery of information to investors, the market and the news media is achieved through press releases and periodic meetings with institutional investors, the financial community and the press, as well as through the extensive documentation and numerous publications made available and constantly updated on the Company’s website.

Information regarding reports, events/significant transactions, as well as procedures issued by Snam on corporate governance are disclosed to the public in a timely manner and posted on the Company website. On the website one can also consult the Company’s press releases, the documentation used during the meetings with financial analysts, notices to shareholders, as well as information and documentation regarding the topics on the agenda of the shareholders’ meetings, including their minutes.

Relations with shareholders and all financial market traders are maintained by the “Investor Relations” unit. The information of interest to them is available on the Company website and can also be requested by e-mail at investor.relations@snam.it.

Relations with the news media are handled by the Institutional Relations and Communications Department.

For more information and details, please see Section III of the 2014 governance report.

72 The Board of Directors appointed Lorenzo Bini Smaghi as Chairman of the Board of Directors for the first time on 15 October 2012.

73 The Board of Directors appointed Carlo Malacarne as Chief Executive Officer for the first time on 8 May 2006.

74 During the course of 2013, to continuously improve the internal control and risk management system, the Enterprise Risk Management unit was established. This resulted from a specific project that enabled the implementation of an Enterprise Risk Management system comprising organisational rules, procedures and structures for the identification, measurement, management and monitoring of the main risks that could affect the achievement of strategic objectives.

75 Pursuant to application criterion 7.C.5 letter b) of the Code of Corporate Governance, taking advantage of the exclusive power reserved to itself by the Board of Directors to issue instructions to the Internal Audit Manager.

76 The international standards for professional internal auditing practice are available at the following address: http://www.unesco.org/new/fileadmin/MULTIMEDIA/HQ/IOS/temp/IPPF_Standards%20ENG.pdf.

77 See the “Code of Ethics” paragraph below.

78 The Chief Financial Officer must be selected from among persons who do not hold any office on the control or management bodies of, nor any managerial post in, eni and its subsidiaries, and who do not have any relation, whether direct or indirect, of a professional or equity nature with such companies. As provided for in Article 16 of the Bylaws, the Chief Financial Officer must be chosen from among people who have performed in the following capacity for at least three years:

a) administration or control or management activity at companies listed on regulated markets in Italy, other States of the European Union or other countries belonging to the OECD which have a share capital of no less than €2 million;

b) auditing activity at the companies mentioned above under letter a);

c) professional or tenured university teaching activity in finance or accounting;

d) managerial functions at public or private entities with financial, accounting or control responsibilities.

The Board of Directors sees to it that the Chief Financial Officer has adequate powers and resources for performing the duties assigned to him, as well as for the effective observance of administrative and accounting procedures.

79 Reliability of information: information that is correct, complies with generally accepted accounting standards and fulfils the requirements of the applicable laws and regulations.

80 Accurate information: information without errors.

81 Dependability of information: information that is clear and comprehensive, enabling investors to make informed investment decisions.