Snam and the financial markets

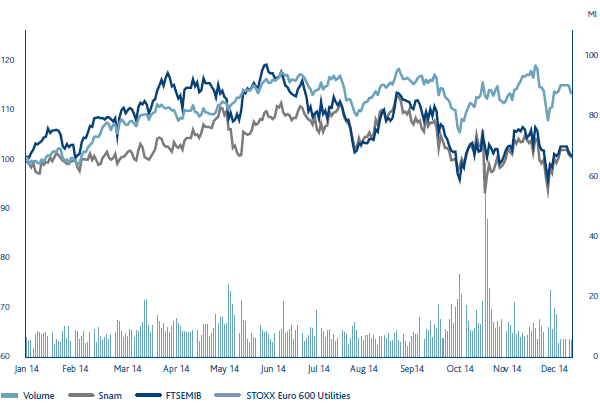

European stock markets were extremely volatile in 2014. The upward trend recorded in the first half of the year, boosted by signs of confidence in an economic recovery on Europe’s peripheries and expansive monetary policies from the US Federal Reserve and the European Central Bank (ECB), more or less ground to a halt in the second half. This came on top of weak macroeconomic figures from Europe, geopolitical tensions with Russia and a sharp fall in the price of crude oil. Towards the end of the year, the risk of a Greek exit from the eurozone created further uncertainty on stock markets. These negative factors, which characterised the second half of 2014, were essentially offset by positive macroeconomic figures from the US and the Federal Reserve’s accommodating approach to the timing of interest rate rises.

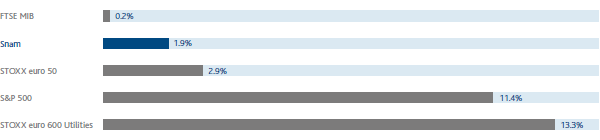

The Stoxx Europe 600 index closed 2014 up 4.4% compared with the end of 2013, while at national level, Spain’s IBEX index rose by 3.7% and the German DAX index reached a historic high, closing up 2.7%. The London-based FTSE 100 recorded an increase of 2.0%, while Italy’s FTSE MIB and France’s CAC 40, which were affected by weaker macroeconomic figures, were more or less unchanged, recording changes of +0.2% and −0.5% respectively.

The European utilities sector also ended 2014 with higher share prices than a year earlier. The Stoxx Europe 600 Utilities index rose by 13.3%, due mainly to shares in regulated Spanish companies and companies operating in the water sector in the UK, which benefited from the positive conclusion to the tariff revision process.

Snam shares closed 2014 at an official price of €4.11, up 1.9%16 from the €4.04 recorded at the end of the previous year. The strong performance of the stock in the middle part of the year, thanks mainly to confidence in the group’s strategic plan and its quarterly results, as well as investors’ preference for high-yield and more defensive stocks in a context of downward revisions to European economic growth estimates, meant that Snam shares reached their highest price in early September. Subsequently, the share price gradually fell, due to both a general downward trend in stock markets and a greater perception of regulatory risk.

Around 2.6 billion Snam shares were traded on Borsa Italiana’s electronic platform in 2014, with an average of 10.2 million shares traded daily, in line with 2013.

The expansive measures implemented by the ECB, together with expectations of a securities buying programme intended to stimulate the economy and prevent any aggravation of the deflationary trend caused by economic stagnation and falling crude oil prices, caused interest rates to fall to record lows throughout the eurozone (with the exception of Greece, which struggled with political instability and new fears of an exit from the currency union). The yield of 10-year Italian government bonds (BTPs) fell from 4.1% at the end of 2013 to 1.9% at the end of 2014. During 2014, the yield of 10-year German government bonds (Bunds) decreased from 1.9% to 0.5% and, in a volatile context, the spread between 10-year BTPs and Bunds fell from around 220 bps to approximately 130 bps at the end of 2014. In line with the downward trend of sovereign-bond yields, all Snam bonds also recorded a lower yield.

The different phases of the economic cycle under way in the US and the eurozone, together with the gradual conclusion of monetary stimulus measures by the Federal Reserve and expectations of a quantitative easing programme by the ECB, caused the euro/dollar exchange rate to fall from 1.37 to 1.21, the lowest rate for around nine years.

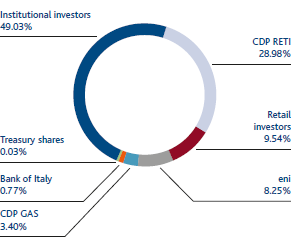

Shareholders

The share capital as at 31 December 2014 consisted of 3,500,638,294 shares with no indication of nominal value (3,381,638,294 as at 31 December 2013), with a total value of €3,696,851,994 (€3,571,187,994 as at 31 December 2013).

The capital increase followed the acquisition of the equity investment held by CDP GAS in Trans Austria Gasleitung GmbH (TAG), which was approved by Snam’s Board of Directors on 12 September 2014. In exchange for the transfer to Snam of the entire equity investment in TAG held by CDP GAS (84.47% of the share capital, equivalent to 89.22% of the economic rights), Snam issued 119,000,000 ordinary shares17, with no nominal value, at an issue price of €4.218 per share inclusive of share premium, and paid CDP GAS the sum of €3.1 million. The capital increase was worth a total of €501,942,000.00, of which €125,664,000.00 pertained to the share capital and €376,278,000.00 to the share premium.

As at 31 December 2014, Snam held 1,127,250 treasury shares (1,672,850 as at 31 December 2013), equal to 0.03% of its share capital (0.05% as at 31 December 2013), with a book value of approximately €5 million.

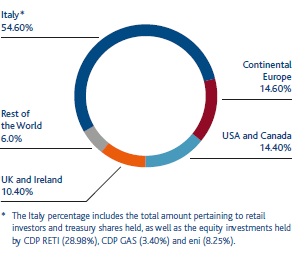

At year end, based on entries in the Shareholders’ Register and other information gathered, CDP Reti S.p.A. held 28.98% of share capital, eni S.p.A. held 8.25%, CDP Gas S. r.l. held 3.40%18, Snam S.p.A. held 0.03% in the form of treasury shares, and the remaining 59.34% was in the hands of other shareholders.

SNAM - COMPARISON OF PRICES OF SNAM, FTSE MIB AND EURO STOXX 600 UTILITIES (1 JANUARY 2014 - 31 DECEMBER 2014)

SNAM - COMPARISON OF SNAM’S PERFORMANCE WITH THE MAIN STOCK MARKET INDICES

SUSTAINABILITY INDICES ON WHICH THE SNAM SHARE IS PRESENT

SNAM OWNERSHIP STRUCTURE BY TYPE OF INVESTOR

SNAM OWNERSHIP STRUCTURE BY REGION

16 The percentage change was calculated by taking as a reference the year-end official price per share, rounded off to three decimal places.

17 The shares have been freely tradable since 27 January 2015, when the Snam Board of Directors performed the checks required pursuant to Article 2343, paragraph three of the Italian Civil Code.

18 As at February 2015, the stake had decreased to 1.807%.