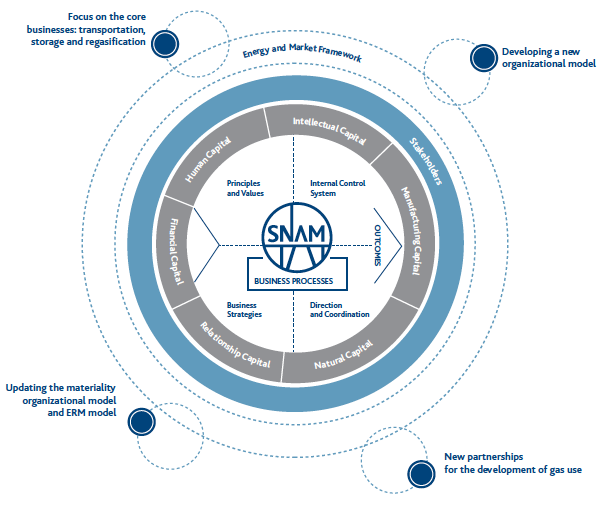

Evolution of the sustainable business development model

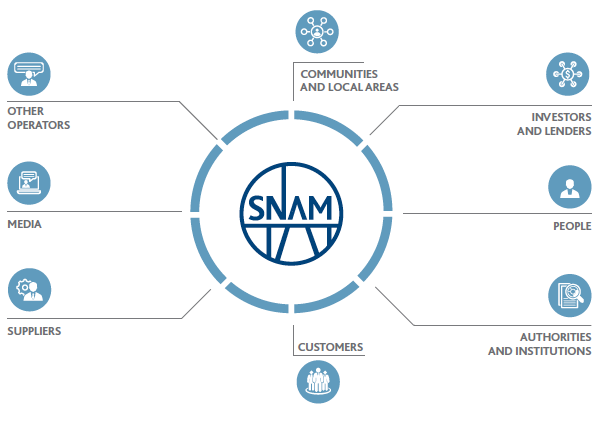

Snam operates with a business development model that pursues profitable and stable company growth, the creation of value for all stakeholders and attractive and sustainable returns for our shareholders.

For value creation purposes, the model indicates the importance of interpreting changes in the energy environment, and more generally the relevant framework, and the importance of knowing how to implement in the field coherent and consistent business development strategies and plans, through an examination in conjunction with the institutions, gas system operators and all other stakeholders involved in corporate operations. The latter have a fundamental and essential role in providing various forms of capital, not only financial capital, but also and especially human and relationship capital, which the enterprise needs in order to be able to operate.

Besides the revision of strategic guidelines, which are specified in the 2017-2021 plan, Snam has updated other important components of its model, in a manner consistent with the exit of the distribution business from the corporate scope of consolidation: Snam is now focused on the gas transportation, storage and regasification segments, it has specifically acquired a new organisational model for conducting business operations and is working on updating risk mapping and assessment in a manner consistent with the provisions of the ERM model.

The separation of Italgas

This represents a strategic transaction which, first of all, shall enable Snam to focus its investments on taking advantage of new growth opportunities and, secondly, shall enable the enhancement of Italgas resources and know-how, with the objective of strengthening its leadership in the Italian market and significantly increasing its market share, in view of the initiation of tender processes to award contracts for distribution services.

Snam maintains its own presence in the ownership structure of Italgas, with a stake of 13.5% and a presence on the Board of Directors. This represents, first of all, a symbol of continuity for Italgas and, secondly, a strategic capital.

In regard to debt, the separation of Italgas resulted in a reduction in Snam’s net financial debt of approximately €3.6 billion and a cash-in for the Company of approximately €3.2 billion, net of approximately €0.4 billion in EIB loans for Italgas projects that were undertaken by the latter.

Following that transaction, Snam recalibrated and redesigned the structure of its liabilities. In that context, the Company successfully completed a Liability Management transaction, the largest to date in Europe, by buying back bonds on the market with a total nominal value of €2.75 billion.

Toward a “One Company” organisational model

With the exit of distribution from the corporate scope of consolidation, business operations have been reorganised in order to improve control mechanisms for strategic plan policies and enable more efficient and effective operational management, including through a simplification of decision-making processes.

Snam’s new organisational model provides for three business units reporting directly to the Chief Executive Officer and also institutes at a central level a single mechanism for corporate services, including strategic supply chain management.

Italian Assets BU

This shall have the objective of coordinating strategies and processes that cut across natural gas transportation, storage and regasification business activities, facilitating integrated exploitation and development of technical know-how.

Foreign Assets BU

This shall provide oversight of the management of assets and subsidiaries abroad, with the objective of promoting the increasing interconnection of European infrastructures and further contributing to the creation of a single energy market.

Commercial, Regulation and Development BU

This shall manage the evaluation of new businesses and services, opportunities connected to emerging natural gas uses and business development operations.

Partnerships for the development of uses for gas

Methane automotive uses

Snam shall contribute to an increase in the use of methane for automotive fuel by providing its consolidated experience in the sector to promote the expansion of supply facilities and a more balanced distribution thereof across Italy.

Snam’s commitment is part of the framework of collaboration with FCA and IVECO, which intend to further expand their respective product lines of natural gas vehicles, as well as with the API group, which intends to construct new facilities within its point-of-sale network.

The project shall make it possible to double the road and highway distribution network, currently consisting of 1,100 service stations, to reach up to more than 2,000 in 10 years; to improve the quality of the service provided to users; and to ensure a more balanced distribution of stations in the various regions of the country, in accordance with procedures and development priorities that are synergistic with the expansion of the fleet of light and heavy vehicles currently in operation. The initiative shall also provide additional impetus to the natural gas business segment in the transport sector, which represents technological and environmental excellence that is recognised worldwide and can further leverage Europe’s more extensive and accessible network of methane pipelines, which are more than 32,000 kilometres in length.

Biomethane transportation

Snam, the Italian Biogas Consortium and Confagricoltura prepared and publicly presented a common manifesto in support of the Italian biomethane business, as renewable energy (heat, electricity, biofuels and bioplastics) that can be generated from agricultural and agribusiness biomasses. The document, addressed to the Government and the European Commission, was published on the occasion of Biogas Italy and demonstrates the strategic role of biomethane in the energy transition towards an economy based on sustainability and circularity in the use of resources.

The manifesto specifically indicates the need to pace the implementation of incentives, by establishing an annual biomethane target to be introduced into the network by 2030; the updating of national laws and regulations on advanced biofuels; and the introduction of a system that enhances and develops the role of the biomethane business segment in the overall CO2 emission reduction strategy.

Materiality (GRI: G4-24,27)

Materiality is a key factor in enhancing and strengthening Snam’s sustainability strategy. It defines the areas of engagement with stakeholders, which underline the dynamics of value creation, both in terms of risk mitigation and opportunities to be seized.

Material issues guide the determination of sustainability objectives that shall be pursued through specific projects and initiatives with various time horizons and, through the Business Model, are stated and represented within the Report. The separation of Italgas has not caused significant changes in the assessment of material issues.

Material issues

Financial/governance

- Creation of sustainable value

- Corporate governance management

- Risk and Crisis Management

- Management transparency

- Anti-Corruption

- Relations with regulatory authorities

- Technology innovation

Social

- Health and safety

- Developing and promoting human capital

- Employment and safeguarding jobs

- Quality and development of services

- Supply chain management

Environmental

- Protecting the local area and biodiversity

- Climate change

- Protection of the air