Snam and the financial markets

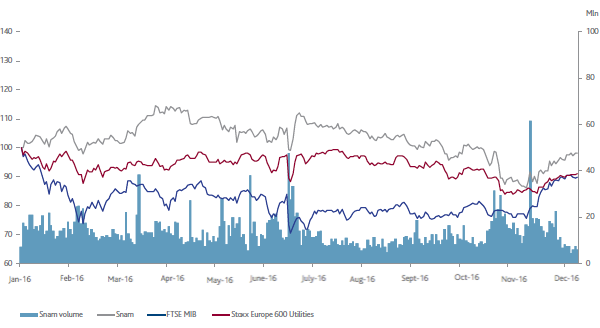

European stock market trends were mainly downwards in 2016. In the first half-year a sharp fall was recorded, penalised by the deterioration of economic prospects and oil prices at their lowest for 10 years, as well as fears generated by the result of the Brexit referendum.

In the second part of the year share indices partly recovered both on account of the recovery in oil prices, supported by the possibility of an agreement between the major global producers for a freeze on production levels, and the confirmation of accommodating monetary policies by central banks. In the last part of the year the political uncertainties generated by the American elections increased market volatility.

The STOXX Europe 600 index ended 2016 down 1.2% compared with the end of 2015, while the national FTSE MIB index recorded one of the worst performances at European level (-10.2%), burdened particularly by the under-performance of bank stock as a result of the difficulties encountered in solving the outstanding receivables problem. The STOXX Europe 600 utilities index ended 2016 down 8.9%, adversely affected by the prospect of interest rate increases; internally, the performance of regulated companies was above average (-4.6%).

Snam share performance

Snam shares closed 2016 at an official price of €3.923, down 1.97% from the price of €4.002 recorded at the end of the previous year14.

The stock increased in the first half-year, reaching its historical maximum on 30 March (€4.56, adjusted price), supported by a clear and stable regulatory framework, the product of the regulatory revision which concluded in December 2015, solid company fundamentals, confirmed by the 2015 annual results and by the presentation on 29 June 2016 of the Italgas demerger transaction and the 2016-2020 Strategic Plan, both well received by the financial community.

The trend was reversed in the second half of the year, caused by the downgrading of the Italian economic growth estimates and a recovery in interest rates from September. Over the course of the year the stock, however, over-performed both in its reference sector and on the Italian market, as evidence of the way investors welcome the sound business model of the Company and a strategy that envisages sustainable returns in the long term.

SNAM - COMPARISON OF PRICES OF SNAM, FTSE MIB AND STOXX EUROPE 600 UTILITIES (1 JANUARY 2016 - 31 DECEMBER 2016)

Relations with the financial community and investor relations policy

Snam’s communications policy has always focused on an ongoing dialogue with the entire financial community. The Company’s goal is to establish a relationship of trust with shareholders, investors, analysts and all financial market operators, and to provide them with regular, complete and prompt information to ensure an excellent understanding of the Group’s performance and strategy.

An active policy of engaging investors, supported by clear and transparent communications, contributes to the enhancement of the Company’s reputation, and Snam considers this a strategic factor in creating value in terms of shareholder satisfaction, understanding their expectations concerning corporate governance and enhancing the knowledge of all stakeholders who are called upon to make decisions that impact the Company.

This communications policy takes the form of many economic and financial publications concerning business performance and sustainability developments, in addition to ongoing meetings and events, which throughout 2016 included the following:

- 17 roadshows to meet shareholders and institutional investors in the major financial centres of Europe and North America;

- 3 industry conferences allowing investors specialising in the utilities and infrastructure sectors to meet the Company’s senior management;

- 77 one-to-one meetings between management and investors, in addition to numerous group meetings (20);

- conference calls upon the publication of the Company’s results (annual, semi-annual and quarterly) and the presentation of the Business Plan.

Inclusion of Snam stock in sustainability indices

In 2016, for the eighth consecutive year, Snam stock was again included by RobecoSAM (one of the most important sustainability rating agencies at global level) in the Dow Jones Sustainability World Index, the main international equity index formed on the basis of the performance of companies in the area of economic, social and environmental sustainability. In January 2017, for the third consecutive year, RobecoSAM placed Snam in the Silver Class of the Sustainability Yearbook 2017, a distinguished group of companies, which in the industrial sector concerned includes companies with a high score in terms of sustainability.

Reconfirmation also took the form of inclusion in the prestigious FTSE4Good index, which the Company has been in since 2002. Snam was also included for the fourth consecutive year among the highest scorers of CDP. The Company was also included in the A List, the highest score of the CDP evaluation model, which in 2016 was only awarded to 193 companies globally.

Lastly, Snam stock is included in the two MSCI World ESG and MSCI ACWI ESG indices.

Snam stock is also included in the following sustainability indices:

Debt management and credit rating

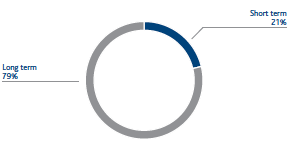

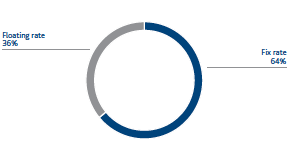

At 31 December 2016, the Group’s net financial position was €11,056 million, resulting from a financial debt of €11,090 million and liquid assets of €34 million. Snam’s goal is to achieve a debt structure consistent with business requirements in terms of loan term and interest rate exposure.

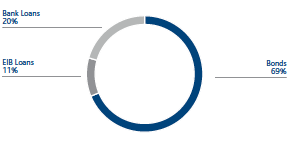

On the debt side, the separation of Italgas, effective from 7 November 2016, led to a reduction in Snam’s debt of approximately €3.6 billion and a cash-in for the Company of approximately €3.2 billion, net of approximately €0.4 billion in EIB funding relating to Italgas projects transferred to the latter. Following this transaction, Snam recalibrated and redesigned its liabilities structure.

In this context, the Company successfully concluded a liability management transaction, the largest to date in Europe, through the buyback on the bond market for a total value of approximately €2.75 billion, with an average coupon of approximately 3.3% and a remaining term of around 3 years, and the simultaneous issue of two new bond loans for a total of €1.75 billion, with an average coupon of 0.625% and an average maturity of around 8.3 years.

Additionally, in 2016 Snam extended by one year the terms of the syndicated loan of €3.2 billion at the same cost conditions. The two syndicated bank lines, amounting to €2.0 billion and €1.2 billion, shall expire in 2019 and 2021, respectively. In addition Snam reduced the amount of bilateral bank loans compared with 31 December 2015 by around €1 billion; and renegotiated the terms of existing agreements extending the term by two years and improving the cost conditions applied.

These transactions on both the banking and bond market made it possible to optimise medium- and long-term debt maturities by extending their average term and creating conditions for a reduction in average borrowing costs.

At 31 December 2016, Snam had unused long-term committed credit lines totalling around €3.2 billion. In addition, Snam as at 31 December 2016 entered into a Euro Medium Term Notes (EMTN) Programme which allows for the issuance, by 30 September 2017, of bonds for a maximum amount of €2.5 billion15.

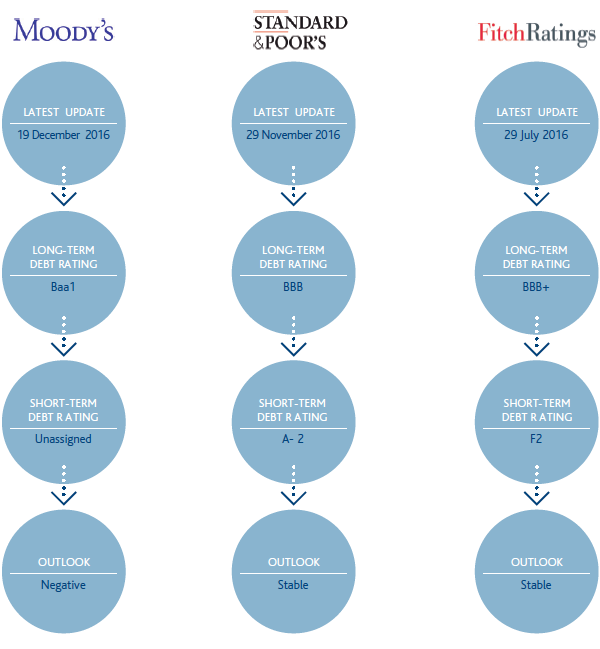

The separation of Italgas did not change the Company’s credit rating, which remains at investment grade, with a rating of BBB from Standard & Poor’s, Baa1 from Moody’s and BBB+ from Fitch. Snam’s long-term rating by Moody’s and Standard & Poor’s is a notch higher than that of Italian sovereign debt.

14 The price was adjusted following the operation separating Italgas from Snam according to the definition in the “Corporate action manual” of Borsa Italiana S.p.A., which provides that, in the case of extraordinary transactions, in order to restore the continuity and comparability of stock prices, an appropriate coefficient to adjust the historical series must be applied. Therefore, all the official prices of Snam stock for the financial years before the effective date of the separation operation (7 November 2016) were adjusted using the “K adjustment factor”, established by Borsa Italiana at a value of 0.82538045.

15 Considering, also, the additional bond issues made in January and February 2017, for a total nominal value of €800 million, the Programme allows for the issuance of bonds for a maximum amount of approximately €1.7 billion.