Governance and Company governing bodies

Snam’s governance plays a crucial role in value creation dynamics. It helps to determine the conditions for the Company to interact properly and adequately with its reference environment, in particular by putting into practice the principles of integrity, transparency and compliance with internal and external rules, with the ultimate aim of reconciling the interests of our various stakeholders.

The governance system reflects the ‘traditional’ model and is developed in accordance with the applicable industry regulations (laws governing unbundling and listed companies), while also taking into account national and international best practice.

Snam operates within the framework of the Universal Declaration of Human Rights, the fundamental conventions of the ILO and the OECD Guidelines for Multinational Enterprises, and in compliance with its own Code of Ethics, which is also a key element of the Organisational Model of Legislative Decree 231/2001.

(More detailed information on governance can be found in the document “2016 Report on corporate governance and ownership structure”, which was published online at www.snam.it at the same time as the Annual Report).

(More detailed information on remuneration can be found in the document “2017 Remuneration Report”, which was published online at www.snam.it at the same as the Annual Report).

| Download XLS (17 kB) |

CONSOLIDATING COMPANY |

SHAREHOLDERS |

% OWNERSHIP |

||||

|

||||||

Snam S.p.A. |

CDP Reti S.p.A. (a) |

28.98 |

||||

|

CDP GAS S.r.l. (b) |

1.12 |

||||

|

Romano Minozzi |

4.37 |

||||

|

Bank of Italy |

0.53 |

||||

|

Snam S.p.A. |

0.85 |

||||

|

Other shareholders |

64.15 |

||||

|

|

100.00 |

||||

Cassa Depositi e Prestiti (CDP), a financial institution controlled by the Ministry of Economy and Finance, whose mission is to promote the growth and development of the Italian economic and industrial system, is a major shareholder in Snam S.p.A.

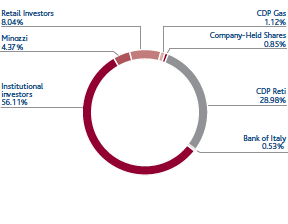

At the end of 2016, based on entries in the Shareholders’ Register and other information gathered, CDP Reti S.p.A. held 28.98% of share capital, CDP GAS S.r.l. held 1.12%, Bank of Italy held 0.53%, Snam S.p.A. held 0.85% in the form of treasury shares, and the remaining 68.52% was in the hands of other shareholders.

The share capital as at 31 December 2016 consisted of 3,500,638,294 shares with no indication of nominal value (unchanged from 31 December 2015), with a total value of €2,735,670,475.56 (€3,696,851,994.00 as at 31 December 2015). The €961,181,518.44 reduction is due to the effects of the partial and proportional spin-off of Snam S.p.A. in favour of Italgas S.p.A., through the allocation of 52.90% of the equity investment held by Snam S.p.A. in Italgas Reti S.p.A.

As at 31 December 2016, Snam held 29,905,180 treasury shares (1,127,250 as at 31 December 2015), equal to 0.85% of its share capital, with a book value of about €108 million (€5 million as at 31 December 2015). The purchase, in the 2016 financial year, of 28,777,930 Snam shares (representing 0.82% of the share capital) at a total cost of €103 million, was carried out pursuant to the share buyback programme initiated by Snam on 7 November 2016, as a result of the decision by the Shareholders’ Meeting of 1 August 20168.

SNAM SHAREHOLDER

STRUCTURE

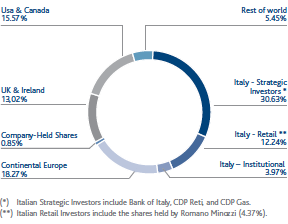

SNAM SHAREHOLDERS BY GEOGRAPHIC AREA

Membership and positions on the new Board of Directors, new duties and tasks assigned to the Sustainability Committee

The Shareholders’ Meeting of 27 April 2016 appointed a new Board of Directors, made up of nine directors who shall remain in office for three financial years, with their terms of office expiring on the date of the Shareholders’ Meeting that shall be called in 2019 to approve the financial statements of 31 December 2018. The majority of the directors are independent in accordance with the TUF and the Code of Corporate Governance (five out of nine). Currently women are represented on the Board of Directors by four out of nine members, a number that is consequently greater than the minimum established by applicable laws and regulations on gender balance (one third of members).

| Download XLS (17 kB) |

|

Last office |

Current office |

FTSE MIB average |

Number of directors |

9 |

9 |

12.3 |

Directors elected by the minority |

3 (33.3%) |

3 (33.3%) |

2 |

% the least-represented gender on the BoD |

33% |

44.4% |

29.4% |

% of indipendent directors |

56% |

56% |

57% |

Average age of directors |

56 |

53 |

57 |

Status of Chairman |

Non-executive |

Non-executive |

Non-executive 89.9% |

Existence of lead indipendent director |

no |

no |

27.8% |

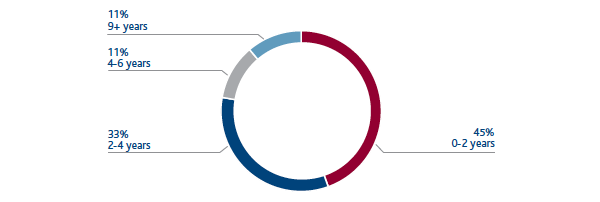

DIRECTORS' TIME IN OFFICE IN THE BOD

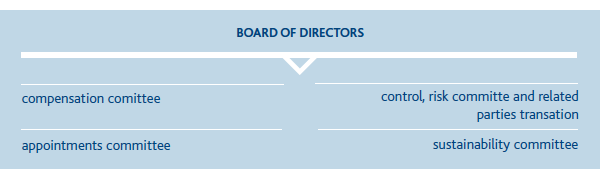

The Board is assisted by four committees. The Sustainability Committee was established in 2016, consisting of three non-executive directors, two of whom are independent.

The Sustainability Committee has advisory functions and makes recommendations to the Board of Directors regarding sustainability matters, which are understood to mean the processes, initiatives and activities aimed at controlling the Company’s commitment to sustainable growth along the value chain.

8 For further information on the characteristics of the programme please refer to the Chapter “Snam in 2016 – Main events” in this Report.