Applicable rate framework and principal developments

Tariff regulation in Italy

By means of Resolutions 514/2013/R/gas, 438/2013/R/gas and 531/2014/R/gas, the Energy Grid and Environment Regulatory Authority (ARERA) defined the tariff criteria for the fourth regulatory period, in force from 1 January 2014, for transportation and regasification activities, and from 1 January 2015 for storage activities. Furthermore, with resolutions 575/2017/R/gas, 653/2017/R/gas and 68/2018/R/gas, the Authority defined tariff criteria for the transport and re-gasification sectors respectively for the transitional period 1 January 2018 – 31 December 2019, and 1 January 2019 – 31 December 2019 for the storage sector.

| Download XLS (17 kB) |

Transport |

4 years + 2 years (transitory period) |

January 2014 |

December 2019 |

Regasification |

4 years + 2 years (transitory period) |

January 2014 |

December 2019 |

Storage |

4 years + 1 years (transitory period) |

January 2015 |

December 2019 |

The following graphic shows the main tariff components for each of the regulated activities carried out by Snam, based on the regulatory framework in force as at 31 December 2017.Further information regarding major new rate developments occurred, with respect to each business sector, is provided in the chapter “Business segment operating performance – Tariff regulations” of this Report.

|

Transportation |

Regasification |

Storage |

||

|

|||||

|

|

|

|

||

End of regulatory period (TARIFFS) |

Current period: |

Current period: |

Current period: |

||

Transitional period: |

Transitional period: |

Transitional period: |

|||

Calculation of net invested capital recognised for regulatory purposes (RAB) |

Revalued historical cost |

Revalued historical cost |

Revalued historical cost |

||

Return of net invested capital recognised for regulatory purposes |

5.4% 2016-18 (*) |

6.6% 2016-18 (*) |

6.5% 2016-18 (*) |

||

Incentives on new investments |

Current period |

Current period |

Current and transitional period: |

||

Efficiency factor |

Current period: |

Current period |

Current period: |

||

Transitional period: |

|

Transitional period: |

|||

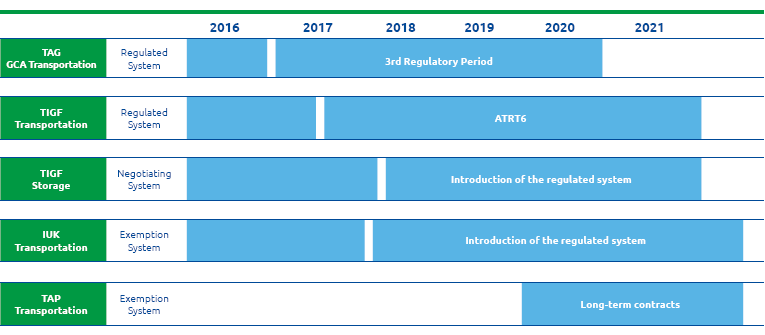

Regulation in European countries of interest to Snam: main features

The countries of interest where Snam operates through international investments have implemented tariff regimes with distinct reference parameters by context, or negotiated regimes that are, therefore, non-regulated from a tariff standpoint. Snam constantly monitors the regulatory evolution in these contexts.

TAG

GCA Transportation

- Differentiated RAB between Revalued Historical Cost and Book Value There is also different treatment of (pre-212) old assets and new investments;

- There are differentiated return rates for the share of RAB financed through Equity (Cost of Equity(*) 8.92% Actual Pre-Tax) and for the share financed through Debt (Cost of Debt 2.7% Nominal Pre-Tax).

TIGF

Transportation

- RAB revalued annually using inflation (Consumer Price Index) taking into account new investments and amortisation and depreciation (Current economic cost method);

- WACC return rate equal to 5.25% Actual Pre-Tax.

Storage

- Storage under regulated system from January 2018:

- WACC return rate equal to 5.75% Actual Pre-Tax; RAB around €1.2 billion.

IUK

Transportation

- Exemption system until October 2018;

- Shift from an exemption system to a regulated system at the expiry of the long-term contracts (October 2018).

TAP

Transportation

- Third Part Access exemption on the initial capacity (10 bcm/y);

- Exemption from tariff regulation on the initial and expansion capacity.

(*) This value includes a premium for the risk related to the marketing of capacity equal to 3.5%.