Snam and the financial markets

Snam share performance

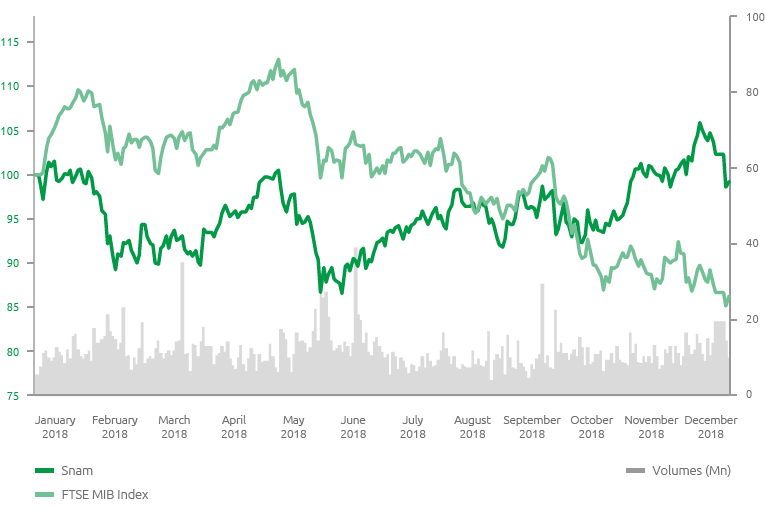

The Snam share price ended 2018 at a close price of 3.7354 euro, slightly lower than the one recorded at the end of the previous year, adjusted for the detachment of dividends, equal to € 3,7661. The change recorded led to a Total Shareholders Return (TSR) equal to -0.8%.

In 2018, the share suffered the rise in rates in Italy and, in particular, the spread, one of the main financial indicators used to determine the country risk, which reached 327 basis points in October, as well as the expectations for growth in interest rates and inflation.

After the announcement of the intention to present a new business plan in November, the share performed better than its peers and benchmarks.

After the plan was unveiled, also thanks to greater visibility of growth prospects of all financial and economic indicators, as well as the clear regulatory framework, it continued to perform well in the market context.

During the year, the company continued its usual investments, with the aim of improving the competitiveness and security of gas procurement, together with its commitment to guarantee shareholders profitable, remunerative growth.

Total Shareholders Return (TSR) - Comparison of Snam prices and FTSE MIB (01 January 2018 - 31 December 2018)

| Download XLS (17 kB) |

Consolitated company |

Shareholders |

% Ownership |

||

|

||||

Snam S.p.A. |

CDP Reti S.p.A. (a) |

30.37 |

||

Romano Minozzi |

5.91 |

|||

Snam S.p.A. |

4.85 |

|||

Other shareholders |

58.87 |

|||

|

|

100.00 |

||

Cassa Depositi e Prestiti (CDP), a financial institution controlled by the Ministry of Economy and Finance, whose mission is to promote the growth and development of the Italian economic and industrial system, is a major shareholder in Snam S.p.A.

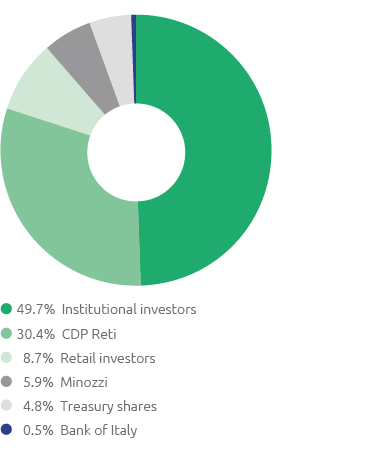

At end 2018, based on entries in the Shareholders’ Register and other information gathered, CDP Reti S.p.A. held 30.37% of share capital, Snam S.p.A. held 4.85% in the form of treasury shares, and the remaining 64.78% was in the hands of other shareholders.

The share capital as at 31 December 2018 consisted of 3,469,038,579 shares with no nominal value (3,500,638,294 shares as at 31 December 2017), with a total value of 2,735,670,475.56 euro (unchanged from 31 December 2017).

As at 31 December 2018, Snam held 168,197,663 treasury shares (85,915,616 as at 31 December 2017), equal to 4.85% of its share capital, with a book value of about 626 million euro (2.45% for a book value equal to 318 million euro as at 31 December 2017). More information on changes to treasury shares held in the portfolio in 2018 is given in the chapter entitled “More information - Treasury shares” of this Report.

Composition of Snam shareholders

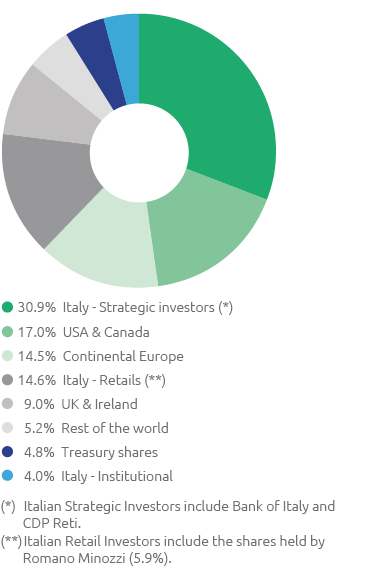

Snam ownership structure by geographic area

Relations with the financial community and investor relations policy

Snam believes that maintaining constant relations with investors and the entire financial community is of strategic importance for its reputation. In this respect, it endeavours to disseminate comprehensive and timely information, capable of effectively representing the business’s strategy and performance, particularly enhancing the dynamics that ensure the creation of value over time.

2018 Engagement Activity

In presenting the Strategic Plan and conference calls upon the publication of the Company’s results (annual, semi-annual and quarterly) during 2018, the following were carried out:

- 11 road shows to meet shareholders and institutional investors in the major financial centres of Europe, North America and Asia;

- 15 industry conferences allowing investors specialising in the utilities and infrastructure sectors to meet senior management;

- 117 one-to-one meetings between Snam’s management and investors, in addition to numerous group meetings (for a total of 161 meetings).

Inclusion of Snam stock in sustainability indices and ESG recognition

The number of investors including intangible elements, such as environmental, social and governance topics, in their investment choices, is growing significantly from year to year. With it, therefore, the demand also increases for disclosures towards companies, called to provide their financial stakeholders with ever clearer and more complete data and information, necessary to their investment choices. Again in 2018, the Snam share was included in the main international SRI stock market indices, an essential tool in terms of transparency towards the market and comparability with peers. This result helps improve the company’s visibility vis-à-vis investors, as well as the entire financial market.

The overall share of Snam’s institutional investors as at 31 December 2018 that include Corporate Social Responsibility criteria in their investment decisions stood at 9.7% of all institutional investors.

Snam’s presence in sustainability indices

For the tenth year in a row, Snam’s stock is listed in the Dow Jones Sustainability World Index, the world’s most important stock market index assessing corporate social responsibility.

Snam’s is once again present in the FTSE4Good, where it has been listed since 2002, an index created by the FTSE Group to encourage investment in companies that meet globally recognised social responsibility standards and is an important point of reference to establish benchmarks and ethical portfolios.

Snam listing is confirmed in the Ethibel Sustainability Index (ESI) Excellence Europe and in the Ethibel Sustainability Index (ESI) Excellence Global. Also reconfirmed in the Ethibel PIONEER and in the Ethibel EXCELLENCE Investment Registers: the Forum Ethibel decision indicates that the company can be characterised as an industry leader in terms of CSR.

Snam’s listing has been confirmed for the fourth year running in the two sustainability indexes MSCI ACWI SRI Index and MSCI ACWI ESG Leaders, by MSCI, an international leader providing IT tools to support the investment decisions of global investors. The MSCI Global Sustainability indices include companies having high sustainability ratings in their affiliated sectors.

The Snam stock, for the ninth year in the row, is included in the STOXX Global ESG Leaders Indices, a group of indexes based on a transparent process of selection of performances, in terms of sustainability, of 1800 companies listed worldwide.

Snam is included in five of the main ECPI sustainability indexes. Snam’s inclusion in the family of ECPI indices dates back to 2008. The ECPI methodology consists in screening based on testing more than 100 ESG (Environmental, Social and Governance) indicators.

ESG Awards

Included, for the sixth year running, among the top scoring companies of CDP, one of the leading international non-profit organizations dealing with climate change, from whom it was also recorded in the “A List”.

Snam was also listed, in 2018, for the fifth year running, in the United Nations Global Compact 100 index (GC 100), developed by the United Nations Global Compact with the research firm Sustainalytics, which includes the 100 companies that have distinguished themselves at the global level both for attention to sustainability issues and to financial performance, and that adhere to the ten fundamental principles of the United Nations on the human rights, labour, environment and anti-corruption issues.

Again in 2018, Snam is confirmed as included in the (Europe, Eurozone, World) NYSE Euronext Vigeo 120 indices, managed by Vigeo, a leading company on a European level in rating companies with regard to CSR issues.

In 2018, Snam was confirmed at “PRIME” level (with rating B-) by Oekom research, a leading international agency rating socially responsible investments, which operates on behalf of institutional investors and financial services companies.

Snam is also confirmed on the Sustainalytics index, a leading ratings agency in evaluating companies in terms of ESG, to which the company has belonged since 2013.

Debt management and credit rating

Snam’s goal is to achieve a debt structure consistent with business requirements in terms of loan term and interest rate exposure.

As at 31 December 2018, the Group’s net financial position was 11,548 million euro, resulting from a gross financial debt of 13,420 million euro and liquid funds and equivalents of 1,872 million euro.

With reference to the capital market, in January 2018, Snam issued a two-year bond for 350 million euro, at a variable rate (Euribor 3m +15bps), converted into fixed-rate bonds with an overall negative return, as part of the company’s short/medium-term funding strategy. In September, Snam issued a fixed-rate bond, maturing on 18 September 2023, of an amount of 600 million euro, coupon of 1%. In December 2018, Snam had successfully completed the buy-back on the bond market, for a total par value of 538 million euro with an average coupon of around 2.6% and a residual maturity of around 3.7 years. The buy-back price, including commission paid to intermediaries and interest accrued (7 million euro), equal to a total of 580 million euro, was partly financed through a reopening of an operation for 300 million euro of the September fixed-rate bond issue with the same maturity and same coupon as the original issue.

With reference to the banking market, in July and October, Snam increased the net amount of its bilateral banking facilities for an additional 450 million euro, at very competitive conditions and below the prevalent conditions available at that time on the market, at the same time also extending the average term (previously set to November 2019) by approximately two years.

As at 31 December 2018, Snam has unused committed long-term credit facilities for an amount of approximately 3.2 billion euro. During the year, as part of the process to optimise the financial structure of group, their duration was extended, without increasing margins, and the transformation into a sustainable loan was completed. This is the third largest sustainable loan stipulated in the world and the first by a gas utility company. This loan envisages bonus/malus mechanisms according to the achievement of certain ESG (Environment, Social, Governance) KPIs.

Following the renegotiation, the two syndicated lines, amounting to 2.0 billion euro and 1.2 billion euro, will expire in July 2022 and December 2023, respectively, with an extension of one year with respect to the previous duration. In addition, on the same date, Snam has a Euro Medium Term Notes (EMTN) programme for a total maximum nominal value of 10 billion euro6, of which around 8.0 billion euro are being used7.

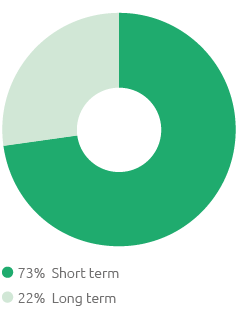

Breakdown by maturity (%)

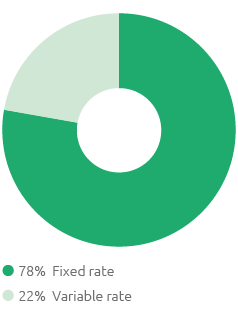

Breakdown by type of rate (%)

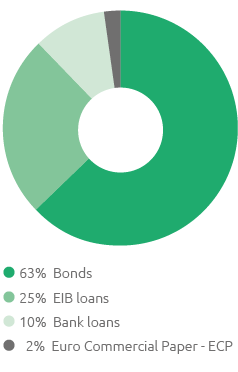

Breakdown by type of funding (%)

Snam also has a Euro Commercial Paper (ECP) Programme for a maximum total nominal value of 1 billion euro. As at 31 December 2018, the ECP Programme was used for a total nominal value of 225 million euro, as part of the company’s short/medium-term funding strategy.

These transactions on both the banking and bond market made it possible to optimise medium- and long-term debt maturities by extending their average term and creating conditions for a reduction in average borrowing costs in 2019.

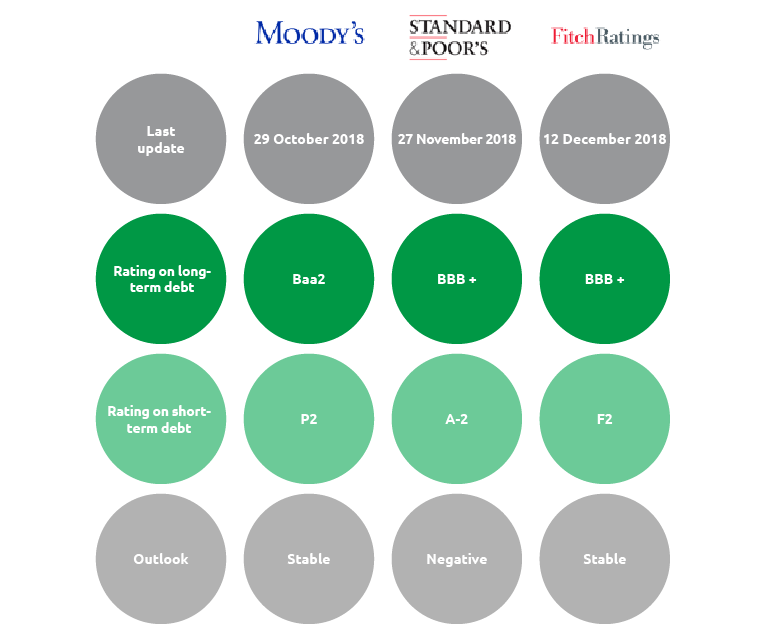

At the same time, the communication activity continued with the rating agencies Moody’s, Fitch and Standard & Poor’s, with the maintenance of the creditworthiness rating at the solid investment grade level by Moody’s (Baa2 with stable outlook), Fitch (BBB+ with stable outlook), and Standard & Poor’s (BBB+ with negative outlook).

The October downgrade by one notch (from Baa1 to Baa2) by Moody’s followed a similar deterioration by one notch in the rating of the Italian Republic. Moreover, during Snam’s launch of the Commercial Paper programme, the agencies assigned the company a short-term rating of P-2 for Moody’s, A-2 for S&P and F-2 for Fitch.

Snam’s long-term rating by Moody’s, Fitch and Standard & Poor’s is a notch higher than that of Italian sovereign debt.

6 On 02 October 2018, the Board of Directors of Snam resolved to renew the EMTN Programme for a maximum value of 10 billion euro. The renewal of the programme allows for the issue, by 02 October 2019, of bonds worth up to 1.74 billion euro, to be placed with institutional investors operating mainly in Europe.

7 It should be noted that the convertible bond issued in March 2017, for a value of 400 million euro, is not part of the EMTN Programme.