Corporate governance GRI - G4: 34, 40, 42, 44, 45, 46, 48

Snam’s management and control system is based on a “traditional” arrangement, with the Shareholders’ Meeting, Board of Directors and Board of Statutory Auditors as the key corporate bodies. The activities and functions of each of these bodies are set out in the bylaws.

The Shareholders’ Meeting is the shareholders’ deliberative body, and appoints the Board of Directors, the Board of Statutory Auditors and the Independent Auditor. As well as matters that are mandatory by law, the Shareholders’ Meeting has exclusive responsibility, under the bylaws, for resolutions relating to acts of disposal, including those that apply to joint ventures, and subjection to business restrictions or strategically important business units in terms of activities connected to gas transportation and dispatching.

The Board of Directors is the central body in Snam’s corporate governance system. It is vested with the broadest possible powers of ordinary and extraordinary management, with the sole exception of acts that are reserved for the Shareholders’ Meeting, either by law or in accordance with the bylaws. In particular, the Board plays a central role in defining policies on matters relating to sustainability, and also reviews and approves the Sustainability Report.

The Board currently in office was appointed by the Shareholders’ Meeting of 26 March 2013. It has nine members, and will remain in place for three financial years, until the date of the Shareholders’ Meeting called to approve the financial statements for the year as at 31 December 2015. Lorenzo Bini Smaghi has held the post of Chairman since 15 October 2012, while Carlo Malacarne has been Chief Executive Officer since 8 May 2006.

The majority of Board directors are independent (five out of nine), with a strong female presence (three out of nine), which exceeds the level stipulated by the gender representation rules in force.

Our governance and management systems

Corporate Governance

The corporate governance system defines the body of rules that govern and guide the management and control of the Company.

Internal control and risk management

The internal audit and risk management system comprises the body of rules, procedures and organisational structures aimed at managing the main business risks.

Administrative liability

Snam and its subsidiaries have adopted the organisation, management and control model pursuant to Legislative Decree 231/01 and established their own Watch Structure.

Procedures

These formalise and govern the business processes by defining roles, duties, responsibilities and coordination activities.

| Download XLS (23 kB) |

|

COMPOSITION OF THE BOARD OF DIRECTORS GRI – G4: 38, 39 |

||||||||

|

|

|

|

||||||

|

Director |

Post |

List from which elected |

||||||

|

||||||||

|

Lorenzo Bini Smaghi |

Non-executive director and Chairman |

CDP RETI list |

||||||

|

Carlo Malacarne |

Chief Executive Officer (1) |

CDP RETI list |

||||||

|

Sabrina Bruno |

Non-executive director (2) |

List presented jointly by minority shareholders |

||||||

|

Alberto Ciô |

Non-executive director (2) |

CDP RETI list |

||||||

|

Francesco Gori |

Non-executive director (2) |

List presented jointly by minority shareholders |

||||||

|

Yunpeng He |

Non-executive director |

Coopted on the recommendation of CDP RETI (3) |

||||||

|

Andrea Novelli |

Non-executive director |

CDP RETI list |

||||||

|

Elisabetta Oliveri |

Non-executive director (2) |

List presented jointly by minority shareholders |

||||||

|

Pia Saraceno |

Non-executive director (2) |

CDP RETI list |

||||||

To more effectively carry out its duties, Snam’s Board of Directors has set up, within its membership, the following three Committees required by the Corporate Governance Code that operate in accordance with the Corporate Governance Code and company bylaws:

- The Control and Risk Committee provides recommendations and advice to the Board by making suitable enquiries to support its decisions concerning the internal control and risk management system, as well as those relating to the approval of financial reports. For the performance of duties assigned by the Board of Directors as a part of the Procedure called “Transactions Involving the Interests of Directors and Statutory Auditors and Related-Party Transactions”, only the independent directors of the Committee meet;

- The Remuneration Committee provides recommendations and advice to the Board of Directors in the area of director compensation and prepares the annual Remuneration Report to be submitted to the Board, and later to the Shareholders’ Meeting, for approval;

- The Appointments Committee provides recommendations and advice to the Board of Directors in identifying candidates for the position of director if one or more directors no longer hold their office during the year, and it ensures compliance with requirements on the minimum number of independent directors and on quotas reserved for the less represented gender; it submits candidates to the Board of Directors for the corporate bodies of subsidiaries included in the scope of consolidation and of strategic foreign companies owned by the Company. Among other things, it prepares and proposes procedures for the annual self-evaluation of the Board and its Committees.

The Board of Statutory Auditors oversees compliance with the law and with the deed of incorporation, as well as adherence to the principles of proper administration in the performance of company activities; it also evaluates the adequacy of the organisational, administrative and accounting structure adopted by the Company, and how it functions in practice. The Board of Statutory Auditors also oversees the effectiveness of the internal control and risk management system.

| Download XLS (22 kB) |

|

COMPOSITION OF THE BOARD OF STATUTORY AUDITORS |

|||||

|

|

|

||||

|

Member |

Position |

||||

|

|||||

|

Massimo Gatto (1) |

Statutory auditor and Chairman |

||||

|

Leo Amato (2) |

Statutory auditor |

||||

|

Stefania Chiaruttini (2) |

Statutory auditor |

||||

|

Maria Gimigliano (2) |

Alternate auditor |

||||

|

Luigi Rinaldi (1) |

Alternate auditor |

||||

| Download XLS (22 kB) |

|

ACTIVITIES OF THE CORPORATE BODIES |

||

|

|

|

|

|

Director |

Meetings (no.) |

Average member attendance (%) |

|

Board of Directors |

10 |

93.3 |

|

Control and Risk Committee |

15 |

94.5 |

|

Remuneration Committee |

6 |

100.0 |

|

Appointments Committee |

5 |

100.0 |

|

Board of Statutory Auditors |

18 |

94.4 |

The audit of the Company’s financial statements is entrusted to a specialised company on the appropriate register and appointed by the Shareholders’ Meeting on the basis of a reasoned proposal from the Board of Statutory Auditors.

On 27 April 2010, the Shareholders’ Meeting appointed Reconta Ernst & Young S.p.A. to audit the Company for the 2010-2018 period.

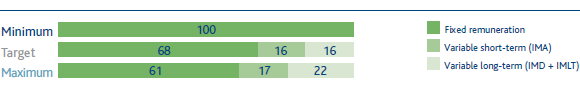

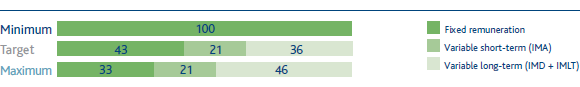

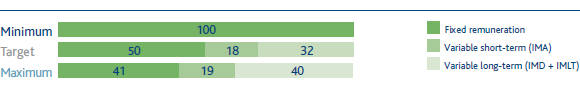

Remuneration of management GRI – G4: 52

The 2013 remuneration policy guidelines determine a pay mix in line with the managerial position held, with greater weighting for the variable component, for posts typically having a greater impact on business results, as shown in the pay-mix chart set out below, calculated by considering the enhancement of short- and long-term incentives in the event of on-target results. Snam’s corporate data sheet, which presents performance targets for the Chief Executive Officer and contributes to the formulation of the performance targets of managers with strategic responsibilities, also includes a specific target, accounting for 10% of the total, for the accident frequency rate among employees and contractors.

For managers with strategic responsibilities, the annual variable incentive plan is also based on specific sustainability targets that relate to the scope of responsibility of the role performed.

The policies implemented were assessed, in terms of positioning and pay mix, using remuneration benchmarks provided by specialist consultancy companies.

(Detailed information on compensation is provided in the “Remuneration Report” document on the website www.snam.it)

PAY-MIX (%)

Chief Executive Officer

Managers with strategic responsibilities

Other managerial staff