Snam and the financial markets

Snam share performance

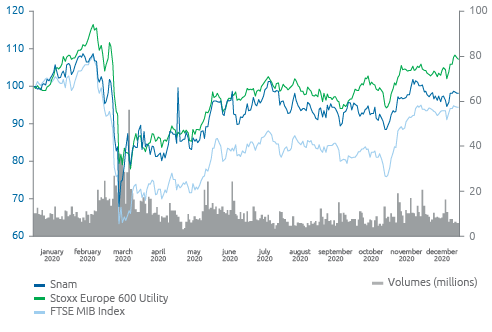

The Snam share price ended 2020 at an official price of 4.601, down 1.81% on the price recorded at the end of 2019, which was 4.686.

The average value of the share during the period was 4.417 euros, peaking at 5.1 euros in the second half of February.

The stock continued to benefit from both growth prospects in all the economic and financial indicators presented to the market in the strategic plan at the end of 2019 and confirmed in the 2020 plan, and clarity of the regulatory framework.

Since the beginning of March, the effects of the Covid-19 pandemic and lock-down measures have triggered strong tensions and volatility in financial markets and global equity indices have fallen sharply. The Snam share also fell in relation to the intensification of restrictive measures. Despite the restrictions imposed by the authorities on the mobility of people, the company has worked with great commitment and extraordinary measures to guarantee its essential energy security service.

The success of the issue of the first Transition Bond in June 2020, followed by two further issues in December 2020 and February 2021, whose funds will be used to finance projects in the energy transition sector, the agreement with ADNOC to join the networks of the Arab Emirates, the partnerships with the British ITM Power, one of the largest global producers of electrolysers, and through the partnership with De Nora, a global leader in alkaline electrodes, are factors that contributed to the recovery of the share in the last months of the year.

During the course of the year, the Company continued its investing activities both in its own regulated infrastructure, which is confirmed to be central to the energy transition to a low-emissions economy, and in the new energy transition activities in order to guarantee sustainable and profitable growth for shareholders.

SNAM – Comparison of Snam, FTSE MIB and STOXX Europe 600 Utilities listings (1 January 2020 – 31 December 2020)

| Download XLS (12 kB) |

Consolidating company |

Shareholders |

% ownership |

||

|---|---|---|---|---|

Snam S.p.A. |

CDP Reti S.p.A. (a) |

31.35 |

||

|

Mr. Romano Minozzi |

7.46 |

||

|

Snam S.p.A. |

2.70 |

||

|

Other shareholders |

58.49 |

||

|

||||

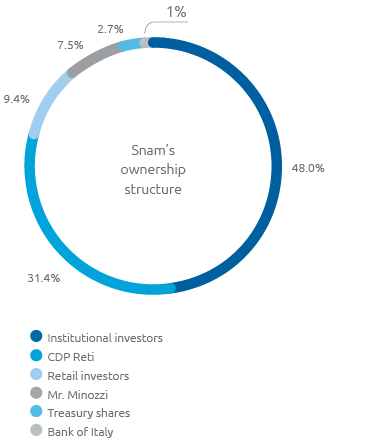

Cassa Depositi e Prestiti (CDP), a financial institution controlled by the Ministry of Economy and Finance, whose mission is to promote the growth and development of the Italian economic and industrial system, is a major shareholder in Snam S.p.A.

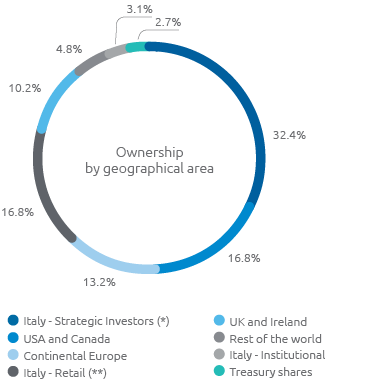

At the end of 2020, based on entries in the Shareholders’ Register and other information gathered, CDP Reti S.p.A. held 31.35% of share capital, Snam S.p.A. held 2.70% in the form of treasury shares, and the remaining 65.95% was in the hands of other shareholders.

The share capital at 31 December 2020 consisted of 3,360,857,809 shares without indication of nominal value (3,394,840,916 at 31 December 2019), with a total value of 2,735,670,475.56 euros (unchanged from 31 December 2019).

As at 31 December 2020, Snam’s portfolio contains 90,642,115 treasury shares (102,412,920 as at 31 December 2019), equal to 2.70% of its share capital, with a book value of about 361 million euros (3.02% for a book value of around 388 million euros at 31 December 2019). More information with regard to the changes in treasury shares in the portfolio in 2020 can be found in the chapter “Other information – Treasury shares” of this Report.

(*) Italy’s strategic investors include the Bank of Italy and CDP Reti.

(**)Italy’s retail investors include the shares held by Romano Minozzi (7.6%).

Relations with the financial community and investor relations policy

Snam believes that maintaining constant relations with investors and the entire financial community is of strategic importance for its reputation. In this respect, it endeavours to disseminate comprehensive and timely information, capable of effectively representing the business’s strategy and performance, particularly enhancing the dynamics that ensure the creation of value over time.

2020 Engagement Activity

In addition to the normal activities in presenting the Strategic Plan and conference calls upon the publication of the Company’s results (annual, half-year and quarterly) during 2020, and notwithstanding the restrictions on movement that emerged following the onset of the Covid-19 pandemic, Snam has virtually participated in:

- 10 roadshows to meet shareholders and institutional investors in the major financial centres of Europe and North America;

- 15 industry conferences allowing investors specialising in the utilities and infrastructure sectors to meet senior management.

Inclusion of Snam stock in sustainability indices and ESG recognition

As in previous years, Snam stock was included in the main international SRI (sustainable and responsible investment) stock market indices, an instrument that guarantees transparency in relation to the market and comparability in relation to the Group’s peers, in addition to making the Company visible to other investors and the financial market as a whole.

There are 245 investors within Snam’s shareholder composition that are classified as ESG, representing 34.1% of all institutional shareholdings in Snam and 13.8% of the total as of September 2020 (Nasdaq analysis).

Sustainability indices

Snam is once again present in the FTSE4Good index, where it has been listed since 2002, an index created by the FTSE Group to encourage investment in companies that meet globally recognised social responsibility standards and an important point of reference to establish benchmarks and ethical portfolios.

Snam’s listing is confirmed in the Ethibel Sustainability Index (ESI) Excellence Europe and in the Ethibel Sustainability Index (ESI) Excellence Global. Also reconfirmed in the Ethibel PIONEER and in the Ethibel EXCELLENCE Investment Registers: the Forum Ethibel decision indicates that the company can be characterised as an industry leader in terms of CSR.

Snam’s listing has been confirmed for the fourth year running in the two sustainability indexes MSCI ACWI SRI Index and MSCI ACWI ESG Leaders, by MSCI, an international leader providing IT tools to support the investment decisions of global investors. The MSCI Global Sustainability indices includes companies having high sustainability ratings in their affiliated sectors.

For the ninth consecutive year Snam stock has been included into the STOXX Global ESG Leaders Indices, a group of indices based on a transparent process of selection of the performance, in terms of sustainability, of 1,800 companies listed worldwide.

Snam is included in five of the main ECPI sustainability indexes. Snam’s inclusion in the family of ECPI indices dates back to 2008. The ECPI methodology consists in screening based on testing more than 100 ESG (Environmental, Social and Governance) indicators

Snam is confirmed to be included in 2020 as well in the (Europe, Eurozone, World) NYSE Euronext Vigeo 120 indices, managed by Vigeo, a leading company on a European level in rating companies with regard to CSR issues.

Snam was also listed, in 2020, for the fifth year running, in the United Nations Global Compact 100 index (GC 100), developed by the United Nations Global Compact with the research firm Sustainalytics, which includes the 100 companies that have distinguished themselves at the global level both for attention to sustainability issues and to financial performance, and that adhere to the ten fundamental principles of the United Nations on the human rights, labour, environment and anti-corruption issues.

Snam is for the second consecutive year among the companies included at the global level in Bloomberg’s Gender-Equality Index (GEI). The index includes this year 380 businesses, of which 18 belonging to the energy sector. The company, one of the leading operators of energy infrastructures in the world, obtained a total score of 71.21% improving the GEI score by 2.1 percent compared to the previous year.

In the context of the CSA assessment 2020, Snam was included in the Sustainability Yearbook 2021 which rewards companies included in the top 15% of their industry.

ESG ratings

Snam has been included again among the top-scoring companies of CDP, a non-profit organisation among the most important at the international level on the subject of climate change. In 2020, Snam came back to the global top, obtaining inclusion in the A List which comprises only 273 companies at the world level (8 in Italy), testifying to the strong commitment put into action on subjects related to climate change and the energy transition.

Snam joined for the second year the CDP supply chain programme, the CDP programme aimed at the involvement of its supply chain in the climate change questionnaire. Snam got a score of A-, demonstrating the commitment of its suppliers in engagement activities involving issues related to the reduction of emissions and the development of sustainable strategies. In 2020 the company widened the perimeter of analysis, involving a higher number of suppliers and obtaining from these a higher level of response compared to 2019 (60% of respondents vs. 56%). The quality of the responses of suppliers also improved.

In 2020, Snam was confirmed at “PRIME” level (with rating B-) by ISS ESG, which recently acquired the service Oekom Research, a leading international agency rating socially responsible investments, which operates on behalf of institutional investors and financial services companies.

Snam was also confirmed in 2020 in the Sustainalytics index, a leading ratings agency that evaluates companies from an ESG perspective and which the company has been part of since 2013. The score of 19.8 indicates a low level of risk of the company in the ESG field, compared to an average risk level in 2019.

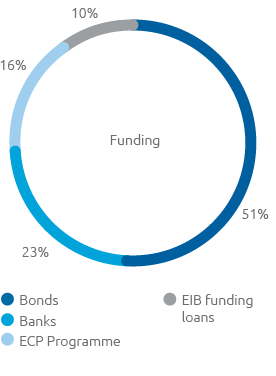

Debt management and credit rating

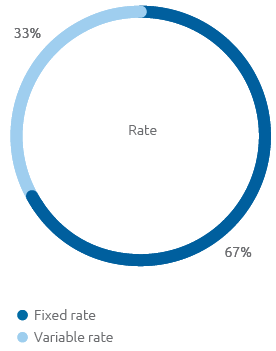

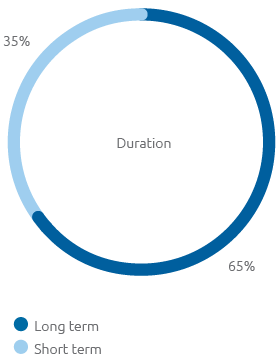

Snam’s goal is to achieve a debt structure consistent with business requirements in terms of loan term and interest rate exposure.

The Group’s net financial position at 31 December 2020 was 12,887 million euros, the result of a gross financial debt of 15,937 million euros and cash and cash equivalents of 3,050 million euros.

With reference to the capital market, in June 2020 Snam concluded the issue of its first Transition Bond, which followed the first Climate Action Bond, issued in 2019, for a sum of 500 million euros, with an annual coupon of 0.75% maturing on 17 June 2030. Moreover, in November 2020, Snam issued a second Transition Bond for a sum of 600 million euros, with an annual coupon of 0%, a re-offer of 99.728%, maturing on 7 December 2028. That issue was structured as the longest bond loan with a coupon equal to 0% to have ever been issued by an Italian issuer, when it was issued.

In December 2020, Snam successfully completed a buyback on the bond market of bonds (Liberty Management) with a total nominal value of around 629 million euros, with an average coupon of approximately 0.62% and a remaining maturity of approximately 2.80 years. The total disbursement resulting from the buy back of securities as part of the Liability Management transaction stood at 651 million euros, including the fees paid to intermediaries and accrued interest (4 million euros in total).

At 31 December 2020, Snam has unused committed long-term credit facilities (“Sustainable Loan”) for an amount of approximately 3.2 billion euros. During the year, as part of the process to optimise the financial structure of Group, their duration was extended without an increase in margins. Moreover, in May 2020 Snam maintained the reduction of the margin for the “Sustainable Loan” that had been obtained previously in April 2019 following the achievement of the objectives linked to social and environmental sustainability parameters.

In order to increase the proportion of total available funding represented by sustainable finance, the Euro Commercial Paper programme was renewed, rising from 2 billion to 2.5 billion euros, linking it to environmental and social sustainability targets in line with the Sustainable Loan and with the instrument obtaining an ESG rating of EE assigned by the ESG rating company Standard Ethics.

As at 31 December 2020, Snam had an active Euro Medium Term Notes (EMTN) programme with a total nominal maximum value of 11 billion euros, of which it has used approximately 7.8 billion euros.

These transactions on both the banking and bond market made it possible to optimise medium- and long-term debt maturities by extending their average term and creating conditions for a reduction in average borrowing costs in 2020.

As at 31 December 2020, sustainable sources of financing stood at around 7 billion and represented approximately 40% of Snam’s committed funding. This percentage is in line with the company’s ambition to increase the proportion of available funding represented by sustainable finance from the current 40% to 60%, over the life of the plan.

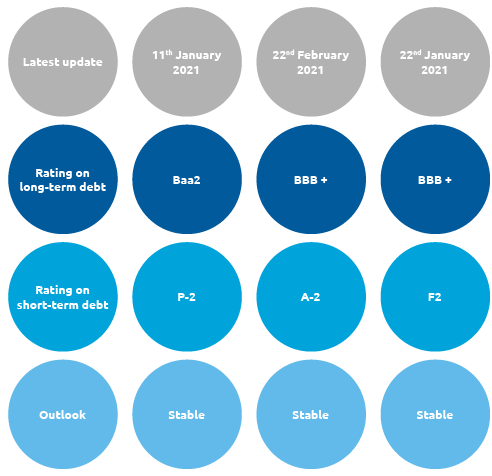

At the same time, the communication activity continued with the rating agencies Moody’s, Fitch and Standard & Poor’s, with the maintenance of the creditworthiness rating at the solid investment grade level by Moody’s (Baa2 with a stable outlook), Fitch (BBB + with stable outlook), and Standard & Poor’s (BBB + with a stable outlook).

In addition, when the Commercial Paper programme was renewed by Snam, the agencies confirmed the short-term rating of the company at P-2 for Moody’s, A-2 for S&P and F2 for Fitch. Snam’s long-term rating by Moody’s and Standard & Poor’s is a notch higher than that of Italian sovereign debt, while the rating assigned by Fitch is two notches higher.