Sustainable finance and SDG investments

In recent years, sustainable finance and its related instruments has taken on an increasingly significant role within the global financial landscape. This has given Snam the opportunity to enhance its own role and work as a sustainable company, guaranteeing broad access to financial markets at competitive costs, with positive effects on its economic and statement of financial position and reputation. In addition, with the aim of aligning the financing strategy with its sustainability targets and expanding its investor base, in 2018 Snam had already finalised the transformation into syndicated credit lines of 3.2 billion euros into Sustainable Loans, introducing environmental, social and governance (ESG) objectives. These objectives were met in 2019 and 2020, meaning Snam could benefit from a reduced interest rate on its Sustainable Loan.

For the 2020-2024 Plan, the Group aims at increasing the weight of sustainable finance up to 60% of the funding available within the scope of the plan. To promote this increase, the Euro Commercial Paper programme was renewed and increased from 2 to 2.5 billion euros, involving it in the ESGs that are in line with the Sustainable Loan (obtaining, for the instrument, an ESG rating of EE, assigned by the ESG Ratings company, Standard Ethics).

In recognition of the Group efforts, Snam joined the Nasdaq Sustainable Bond Network, a sustainable finance platform managed by Nasdaq, that unites investors, issuers, investment banks and specialist organisations. During 2020, Snam also increased its meetings and relations with socially responsible investors who are becoming increasingly important within the financial market. There is a total of 245 investors classified as ESGs within Snam’s shareholding, representing 34.1% of the total number of Snam’s institutional shareholders at September 2020 (Nasdaq analysis), and 13.8% of the overall number.

Since 2018, Snam has been a member of the Corporate Forum on Sustainable Finance (CFSF). In November 2020, the Forum confirmed the role of sustainable finance as a crucial support in projects with a positive social and environmental impact, but it also highlighted certain challenges for sustainable finance:

- further integration of the sustainability policies with the company’s financial strategies;

- working in synergy with the investors to stimulate the development of a more sustainable economy through innovative financial instruments;

- increasing the company’s presence in international and Italian forums that contribute to the development of sustainable financial markets;

- actively participating in the definition of regulatory standards and frameworks that govern the sustainable financial instruments;

- collaborating with rating companies to more deeply incorporate the ESG criteria into the assessment of the long-term financial sustainability of companies;

- building on expertise and promote best practices that realise the impact of the strategies applied.

The complementary activities and sustainable financial instruments implemented by Snam over the years contribute to a common objective: making the Company more transparent, attracting a wider range of investors and highlighting its constant and growing involvement in ESG issues and efforts to achieve SDGs.

Climate Action and Transition Bonds issued by Snam

In 2019, Snam was one of the first companies in the world to issue a Climate Action Bond, with a reference framework dating back to 2018. The aim of the Climate Action Bond was to better align its financial strategy with the Group’s sustainability targets, consolidate Snam’s role in energy transition within Europe, raise the awareness of investors around their own ESG initiatives and investments and diversify the investor base. The funds obtained with the Climate Action Bond were used to finance and, in part, refinance the Eligible Projects defined in the Climate Action Bond Framework and reported in the table below. The projects cover a broad spectrum of initiatives aimed at reducing emissions or using renewable energy, energy efficiency and protecting the local area and biodiversity.

The bond issued was also certified by DNV GL that confirmed the bond’s alignment with the suitable categories defined in the framework.

Eligible Category |

Description |

SDGs |

|---|---|---|

Carbon & Emission Reduction Projects |

Infrastructure, equipment, technology, systems and processes that show a reduction in the use/loss of energy and a reduction in emissions of the industrial structures. |

|

Renewable Energy Projects |

Development of new biomethane plants and updating of existing biogas plants, in Italy and abroad. |

|

Energy Efficiency Projects |

Energy efficiency projects for Snam’s corporate structures or the supply chain. |

|

Green Construction Projects |

Development and maintenance of conservation areas, protection of the natural capital and development and maintenance of green areas/buildings. |

|

In 2020, Snam reconfirmed that it was fully committed to further integrating the Group’s sustainability objectives with the company’s financial strategy by implementing and issuing two Transition Bonds. The first was issued in June for 500 million euros, for a duration of ten years, and the second, issued in Europe, was the first to be issued by a gas transportation utility. The second Transition Bond was issued in November for 600 million euros for a duration of eight years, the longest bond issue with a coupon of 0% issued by an Italian issuer.

The Eligible Categories perimeter, already identified in the Climate Action Bond Framework, now includes the new category “Retrofit of gas transmission network”, or any activity on the gas network aimed at improving the integration of hydrogen and other low-carbon gases, as defined in the Transition Bond Framework published in June 2020.

This last category was inserted with the intention to align Snam’s initiatives with the mitigation criteria identified by the Taxonomy of the European Commission on sustainable finance.

In March 2021, as part of the Environmental Finance Bond Awards, Snam’s Transition Bond Framework, published in June 2020, was recognised in the Award for Innovation – Use of Proceeds (Green Bond) category, demonstrating the market’s recognition of the company’s commitment to sustainable finance.

The Transition Bond further expands Snam’s investor base and also establishes the rules around the issue of bond loans aimed at financing environmental sustainability investments, in line with the key role, attributed to renewable gases, of achieving the long-term decarbonisation goals, and with the role that can be assumed by the existing infrastructure facilitating this transition.

The table below reports the list of Eligible Projects envisaged by Snam’s Transition Bond.

Eligible Category |

Description |

SDGs |

|---|---|---|

Carbon & Emission Reduction Projects |

Infrastructure, equipment, technology, systems and processes that show a reduction in the use/loss of energy and a reduction in emissions of the industrial structures. |

|

Renewable Energy Projects |

Acquisition and development of new biomethane plants and updating of existing biogas plants, in Italy and abroad. |

|

Energy Efficiency Projects |

Energy efficiency projects for Snam’s corporate structures or the supply chain. |

|

Green Construction Projects |

Development and maintenance of conservation areas, protection of the natural capital and development and maintenance of green areas/buildings. |

|

Retrofit of gas transmission network |

Activities and projects carried out for the purpose of adapting Snam’s gas network and making it ready to transport a growing percentage of hydrogen and/or other low-carbon gases, in keeping with what is indicated in the European Taxonomy. |

|

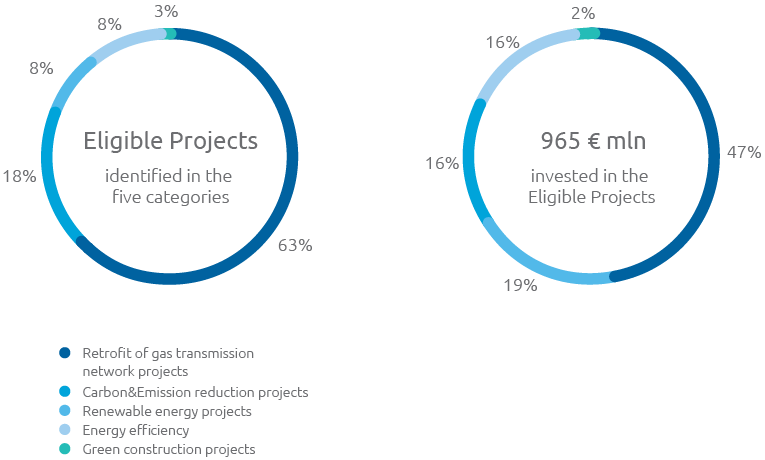

At 31 December 2020, Snam financed eligible projects worth approximately 965 million euros12 (vs 235 million euros in 2019), equal to approximately 60% of the bond issues concluded by 2020. As shown in the two graphs below, around 47% of the total amount financed was allocated to the fifth category of the current Framework (i.e., Retrofit of gas transmission network), which included more than 60% of all the eligible projects.

TEP Energy Solutions and the Nearly Zero Energy buildings

In 2020, TEP Energy Solution implemented the complete restructuring of two residential buildings in Ponte di Legno (BS), hence developing its first “Nearly Zero-Energy Buildings”: buildings that consume very little energy and that are able to generate the amount of energy required directly on-site from renewable sources thanks to the sustainable technologies and materials used to build them.

The intervention is part of a TEP commitment to support the requalification of urban centres and the economic and social development of territories, with the help of local businesses. The project, involving 80 residential units and worth a total of 15 million euros, will allow for the recovery of a structurally compromised area in Valcamonica, a winter and summer tourist destination. The buildings, dating back to the first half of the 1970s, will be rebuilt in compliance with the new seismic regulations and will undergo further improvements, including: acoustic isolation, eliminating architectural barriers to improve accessibility, renovating surrounding areas and reducing impact on the landscape.

Post-intervention, the buildings will be classified under energy class A4, the highest according to the current regulations in force. For energy saving, external thermal insulation and integrated photovoltaic plants will be installed and the buildings will be connected to the city’s district heating network. The interventions will benefit from Sismabonus and Ecobonus tax incentives that will considerably reduce investment costs.

This project was made possible thanks to the CasaMia programme created by TEP to promote the energy efficiency of residential buildings and help protect them from seismic events through tax incentives.

The CFO Taskforce and investments in support of SDGs

In 2009, Snam had already made it clear that it was committed to a sustainable business development model, to observing and protecting human and working rights and to protecting the environment by complying with the UN Global Compact, the largest-scale worldwide voluntary initiative on sustainability issues.

For Snam, this commitment also involves the integration and alignment of financial planning procedures with the SDGs, an objective further strengthened through active participation in the UN Global Compact CFO Taskforce, of which Snam is a founding member. The initiative involves different actors in the business sector: investors, banks, financial institutions and credit rating agencies to make the market more efficient, broader and fluid and to promote the flow of capital to activities that contribute significantly to these goals.

In September 2020, the Taskforce launched the first principles integrated and supported by the United Nations for investment and finance, developed to guide companies to align their sustainability commitments with corporate financial strategies to generate a significant impact on SDGs. As a member of the CFO Taskforce, Snam is committed to adopting these guidelines, implementing specific KPIs and sharing experiences to help create a transparent and efficient SDG financial market.

Description |

SDGs |

||

|---|---|---|---|

Increasing the production of energy from renewable resources, including biomethane, and improving the energy efficiency of Snam’s operations, avoiding or reducing the impact on the environment, the landscape and the cultural heritage. Snam will achieve this goal through Snam 4 Environment and Snam 4 Efficiency: the former is specialised in the biomethane production infrastructure and in the promotion of green activities, while the second is one the main Italian operator in energy efficiency services for the residential, industrial, and public administration sectors. Both leverage on the technical competencies acquired thanks to businesses which are leaders in the sector, in particular Renerwaste and Iniziative Biometano for the biomethane business and TEP, Mieci, and Evolve for the energy efficiency business. |

|

||

Building a more resilient and sustainable infrastructure through investments aimed at making the infrastructure Hydrogen ready and at converting the compression stations into dual fuel, and at digitalising the business, allowing Snam to become the most technologically advanced gas transport company in the word and to guarantee ever increasing security and sustainability of its operational activities. |

|

||

Snam has created Snam 4 Mobility, a company dedicated to promoting sustainable mobility using CNG, LNG and renewable gases (bio-CNG and bio-LNG), which has the objective of strengthening the infrastructure for sustainable mobility (CNG/LNG refuelling stations), of expanding the offering for heavy vehicles and of creating the first hydrogen stations in the national territory. |

|

||

With the goals of playing a crucial role in the energy transition and with a long-term vision aligned to the purpose “Energy to inspire the world” and to the European objectives, Snam will be one of the first businesses in the Oil & Gas sector to achieve the carbon neutrality by 2040, giving a concrete contribute to decarbonisation of the system through the development of green gas and, in particular, of hydrogen. Snam has created the business unit Hydrogen with the goal of acting in the forefront in a sector with great growth opportunities, the hydrogen one, through collaborations, strategic partnerships, and the launch of new pilot projects. |

|

||

|

|||

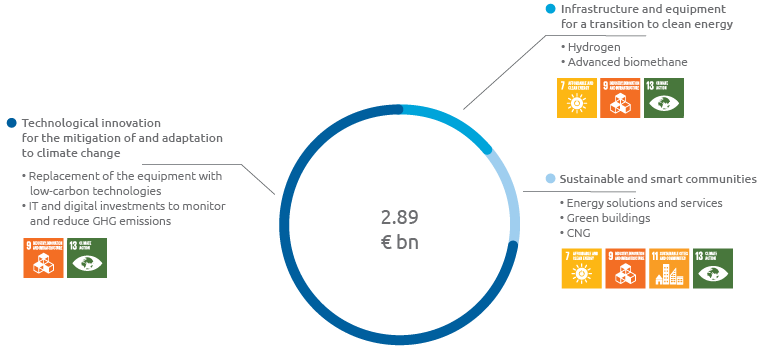

At the same time as approving the 2020-2024 Plan, the Group carried out an analysis to confirm the alignment between the SDGs and the investments included in the strategic Plan. This analysis highlighted the SDGs that the Plan would impact most significantly, showing alignment between the investments and the Group’s priority ESGs. In particular, while contributing transversally to many of the United Nations SDGs, the 2020-2024 Plan will have an effective and significant impact on SDGs 7, 13, 9 and 11 (in order of priority).

Breakdown of the investments aligned with the SDGs in the 2020-2024 Plan

Snam’s strategies to align with the European Taxonomy system

The EU Taxonomy is a classification system integrated throughout Europe and aimed at creating a common language that investors and businesses can use when investing in economic activities with a substantial positive impact on the climate and the environment. The Taxonomy links the Paris Agreement with investment practices, clearly defining the types of activities that are consistent with the transition towards a low-emissions economy and adapting to climate change, as well as other environmental targets. This instrument aims to drive the flow of capital to activities able to contribute to a zero greenhouse gas emissions economy by 2050.

The implementation process is still underway: by 2021, we can expect the approval of Delegated Acts that define the technical criteria relative to the first two of six environmental targets established in the Taxonomy – “climate change adaptation” and “climate change mitigation”.

To demonstrate its commitment to align with the EU Taxonomy, when defining its investment choices in its strategic Plan, Snam analysed the sum of the investments envisaged (approx. total of 7.4 billion euros in the period 2020-2024) that demonstrated around 40% alignment with the technical criteria of the most recent version of the Delegated Acts.

The importance of a growing alignment with the EU Taxonomy is also relevant to Snam’s use of sustainable financial instruments under conditions that benefit its investments, with the intention to expand its green investor base at the same time.

Snam is actively monitoring the Taxonomy evolution process with the aim to implement the disclosure indications envisaged.

12 For more details, you can refer to the “Climate Action and Transition bonds Report” available at the following link: www.snam.it/export/sites/snam-rp/it/investor-relations/debito_credit_rating/file/Snam_Climate_Action_and_Transition_bonds_Report_2021.pdf