Applicable regulatory framework and principal developments

Tariff Regulation in Italy

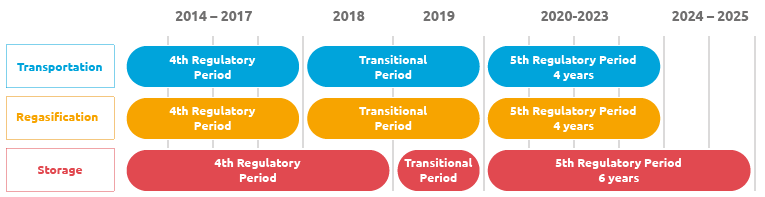

With resolutions 114/2019/R/gas, 474/2019/R/gas and 419/2019/R/gas the Authority defined the tariff criteria for the fifth regulatory period, respectively for transportation and regasification activities (1 January 2020-31 December 2023) and for storage activities (1 January 2020-31 December 2025) confirming the essential stability and continuity of the regulatory principles for the regulation in force through 31 December 2019, or during the transition period at the end of the fourth regulatory period.

The following are the primary tariff components for each of the regulated activities carried out by Snam, based on the regulatory framework in force as at 31 December 2020 and in the comparison period. More information about the main rate changes with respect to each business segment can be found in the section below, “Main rate changes with respect to each business segment”.

|

TRANSPORTATION |

REGASIFICATION |

STORAGE |

||

|---|---|---|---|---|---|

End of period of regulation (TARIFF) |

Transition period: |

Transition period: |

Transition period: |

||

|

5th period: |

5th period: |

5th period: |

||

Calculation of net capital invested recognised for regulatory purposes (RAB) |

Transition period: |

Transition period: |

Transition period: |

||

Confirmed for the 5th period |

Confirmed for the 5th period |

Confirmed for the 5th period |

|||

Return on net capital invested recognised for regulatory purposes (WACC pre-tax) |

Transition period: |

Transition period: |

Transition period: |

||

5th period: |

5th period: |

5th period: |

|||

Incentives for new Investments |

Transition period: |

Transition period: |

Transition period: |

||

Remuneration of investments t-1 offsetting time-lag regulatory |

Remuneration of investments t-1 offsetting time-lag regulatory |

Remuneration of investments t-1 offsetting time-lag regulatory |

|||

5th period: |

5th period: |

5th period: |

|||

Efficiency factor |

Transition period: |

Transition period: |

Transition period: |

||

|

5th period: |

5th period: |

5th period: |

||

|

|||||

The remuneration rate for net invested capital (WACC) as of 1 January 2016 was set by the Authority with resolution 583/2015/R/com of 2 December 2015 “Remuneration rate for capital invested in infrastructural services for the electric and gas sectors: criteria for determination and update”. The duration of the regulatory period for the WACC (TIWACC) for infrastructural regulations for the gas sector was set at six years (2016-2021) and a mechanism was established to adjust the rate halfway through the period, based on current trends. With resolution 639/2018/R/COM of 6 December 2018, the Authority updated the remuneration rate for capital invested in regulated infrastructural services for the gas sector for the year 2019. The respective resolutions defined the tariff adjustment criteria for the 5th regulatory period for this type of business, confirmed the value of the Beta parameter for all sectors for the year 2020, keeping the WACC unchanged for that year, in line with the TIWACC regulations.

With Resolution 380/2020/R/gas, published on 15 October 2020, the Authority began proceedings to determine the remuneration rate for capital invested (WACC) in the electricity and gas sectors for the second regulatory period, starting on 1 January 2022 (II PWACC). The document provides some general guidelines, which include:

- the duration of the II PWACC shall be no less than 4 years;

- an infra-period revision to allow adjustments to the WACC based on current trends;

- confirmation of the current general methodology (weighted average of Ke and Kd, use of CAPM and confirmation of the use of the Country Risk Premium as an addendum, which reflects the Country Risk Premium);

- identification of as detailed as possible criteria for estimating the Beta, to improve the predictability of the model and reduce the level of discretion;

- as part of preparatory activities to develop regulations for spending and service objectives, the start of a process to align regulations for electricity and gas infrastructure, in relation to criteria for recognition of capital invested and operating costs, to make the regulations as homogeneous as possible and avoid imbalances on returns on capital invested linked to differences in the regulatory treatment of specific operating cost items and capital.

The resolution establishes that documents will be made available for consultation containing the Authority’s guidelines, as well as the possibility to call for hearings to consult with interested entities and associations.