Main changes in the tariff structure

Natural Gas Transportation

Regulation for the Fifth Regulatory Period 2020-2023

Tariff adjustment criteria for the natural gas transportation and metering service for the fifth regulatory period (2020-2023)

Through resolution 114/2019/R/gas, published on 29 March 2019, the Authority defined the regulation criteria of the natural gas transportation tariffs for the fifth regulatory period (1 January 2020-31 December 2023).

The duration of the regulatory period was confirmed as 4 years. The valuation of the net capital invested (RAB) is based on the revalued historical cost method. The net invested capital remuneration rate Beta parameter (WACC) remains fixed at 0.364, with the WACC remaining unchanged at 5.7% before tax for the years 2020-2021, in line with the TIWACC framework. Works in progress are included in the calculation of the RAB predicting a real pre-tax return of 5.3%. The inclusion in the RAB of investments made in the year t-1 for the purpose of remuneration to compensate the regulatory time-lag is also confirmed.

Limited to the interventions included in the Development Plans that will come into operation in the years 2020-2021-2022 with a cost/benefit ratio of more than 1.5, a greater WACC of +1.5% for 10 years is applied.

The revenue component relating to the return and amortisation and depreciation is updated on the basis of an annual recalculation of net invested capital (RAB) and additional revenue from the higher rate of return for investments realised in prior regulatory periods. Amortisation and depreciation are calculated based on the useful economic and technical life of the transportation infrastructure.

Operating costs recognised for 2020 are calculated based on effective recurring costs for 2017, increased by the greater efficiency achieved in the current period (50% profit sharing), with the possibility of including any recurring costs for 2018 if adequately justified. The application of the price-cap method for the purpose of updating operating costs is confirmed, envisaging an X-factor to return the greater efficiency achieved in the fourth regulatory period to users in 4 years.

It is expected that the largest transportation business will procure quantities of gas to cover self-consumption, leaks and unaccounted for gas (UFG) under the scope of the centralised market. The quantities of gas recognised are assessed based on the weighted average price of forward products with delivery to the PSV (Virtual Trading Point) in the reference tariff year. The resolution includes the recognition of the difference between the price recognised for these volumes and the effective procurement price, deferring the definition of the detail mechanism to the next provision. For more details, please see the section below, “UFG – Unaccounted for gas”.

With regard to tariff structure, the current methodology for determining the capacity/commodity split was confirmed, providing for capacity revenue to cover capital costs (return and amortisation and depreciation) and commodity revenue to cover recognised operating costs. The current revenue correction factor applied to the capacity component (100% guaranteed) and to the component related to transported volumes (allowance ±4%) is confirmed. With reference to the metering service, a mechanism to cover revenues similar to that of the transportation service (100% guaranteed) was introduced.

The tariff structure based on the entry/exit model is confirmed, including not only the domestic network but also the regional network in the reference price methodology. The entry and exit capacity fees are calculated using the capacity weighted distance methodology (CWD) with the revenues distributed between the entry and exit points 28/72.

A variable fee was introduced, applied to volumes transported, intended to cover the operating costs recognised, the costs relating to the Emission Trading system, ratifying the principle of neutrality adopted by the business in relation to price risk and incentivising virtuous behaviour aimed at reducing CO2 emissions, and the costs of procurement of quantities to cover self-consumption, leaks and UFG. This fee is applied to the transportation network entry points and is calculated annually based on the volumes effectively withdrawn in the year t-2.

Lastly, there are plans for the definition of the regulation criteria for the quality of the natural gas transportation service for the fifth regulatory period to be deferred, trialling the innovative use of transportation networks, as well as the restructuring of the metering service, following specific consultations carried out in 2019. In this regard, through resolution 554/2019/R/gas, published on 23 December 2019, the Authority approved the new Consolidated Act for the regulation of the quality of the gas transportation service which contains provisions on the continuity of the service, security and commercial quality, valid for the fifth regulatory period 2020-2023.

Approval of 2020 Revenues

By means of Resolution 201/2019/R/gas, published on 28 May 2019, the Authority approved the revenue recognised and fees for the natural gas transportation and dispatching service for 2020. Revenue recognised for the natural gas transportation service for 2020 amounted to € 2,096 million euros. The RAB used to calculate 2020 revenue for transportation, dispatching and metering amounts to 16.4 billion and includes estimated investments for the year 2019.

Approval of revenues for the year 2021

By means of Resolution 180/2020/R/gas, published on 26 May 2020, the Authority approved the revenue recognised and fees for the natural gas transportation and dispatching service for 2021. Revenue recognised for the natural gas transportation service for 2021 amounted to 2,121 million euros. The RAB used to calculate 2021 revenue for the transportation, dispatching and measurement business was 16.8 billion, and included the investments estimated for 2020.

10-Year Gas Transportation Network Plan

With Resolution No. 539/2020/R/gas, published on 15 December 2020, the Authority expressed its evaluations on the 10-Year Gas Transportation Network Plan for the years 2019 and 2020. The Authority also made some adjustments to Resolution No. 468/2018/R/gas regarding the minimum requirements of the Plans applicable from 2021. In order to guarantee coordination between sectors, Snam and Terna will publish, by 31 January 2021, a joint document containing descriptions of the scenarios to be used as a basis for the 2021 Plans. The submission deadline applicable to the 2021 Plans was postponed until 31 March 2021.

Provision on metering fees for the transportation service for 2020 and 2021

With resolution 597/2020/R/gas, published on 29 December 2020, the Authority clarified the criteria for determining and applying the fees for the metering service, establishing that the Cmcf fee applies to redelivery points supplying end users for which ownership of the metering system is held by the transportation company, regardless of whether this ownership has been constant or is acquired. Therefore, the Authority redetermined the CMt and Cmcf fees for the year 2021, and established that the fees for 2020 would not be redetermined (including specific company ones), also in consideration of the negligible impact – it being expected that any changes would be covered through the corrective factor for metering revenues.

UFG – Unaccounted For Gas

Determination of charges for the purchase of gas to cover unaccounted-for gas

With Resolution 291/2020/R/gas, published on 29 July 2020, the Authority concluded its investigation, recognising an additional volume of UFG for the years 2018-2019 totalling 182 million cubic metres, equal to a total value of about 42 million euros, which will be recognised by the CSEA, net of the amount already received on account for the year 2018. In addition, it has initiated a procedure, to be completed by the end of 2020, to refine the UFG recognition criteria for the 5th regulatory period (2020-2023), aimed at strengthening the consistency of the mechanism’s operation and its stability, providing that the incentive force of the mechanism is in any case determined on the basis of predefined unit fees proportionate to the remuneration of the metering service, rather than the price of gas.

Revision of criteria for recognising Unaccounted For Gas on transportation networks

With resolution 569/2020/R/gas, published on 22 December 2020, the Authority introduced an incentive mechanism relative to the difference between the UFG recognised in one year and the effective one for the same year. In particular, the incentive is calculated by applying a unit fee, of 3.3 €/MWh (3.5 c€/SCM), to the difference between the effective and recognised UFG, with a cap equal to the value of the remuneration of the metering service.

Balancing and Gas Settlement

Amendments to the Integrated Text on Balancing (TIB)

By Resolution No. 45/2020/R/gas, the AEEG approved several amendments to the Integrated Text for balancing and the Integrated Text for monitoring the wholesale natural gas market, which are functional to the definition of the parameters for the incentive system of the Balancing Manager for the fourth incentive period from 20 February 2020 to 31 December 2021.

The measure confirmed the incentive scheme in place, based on three performance indicators (p1, p2, p3) that measure respectively the goodness of the System’s forecasts of requirements (p1) and the efficiency of the Balancing Manager’s balancing actions (p2 linked to the intervention prices of the Balancing Manager and p3 on the residual balance sheet), providing for profit sharing with the System of part of the annual bonus. Two new performance indicators have also been introduced (p4 already defined with Res. 208/2019/R/gas and p5), linked to the start of the new Settlement regime, which measure Snam Rete Gas’s efficiency in supplying the quantities of gas needed to operate the network.

In addition, the Authority refers to further evaluations and to the examination of the performance results for 2020, the introduction of a new incentive based on the forecast by the person in charge of Balancing withdrawals during the gas day.

Liquefied Natural Gas (LNG) Regasification

Regulation for the Fifth Regulatory Period 2020-2023

Criteria for adjusting the tariffs for the liquefied natural gas regasification service for the fifth regulatory period (2020-2023)

Through resolution 474/2019/R/gas, published on 21 November 2019, the Authority defined the criteria for calculating the revenues recognised and the tariffs for the regasification service for the fifth regulatory period (1 January 2020-31 December 2023).

The duration of the regulatory period was confirmed as 4 years. The valuation of the net capital invested (RAB) is based on the revalued historical cost method.

The net invested capital remuneration rate Beta parameter (WACC) remains fixed at 0.524, with the WACC remaining unchanged at 6.8% before tax for the years 2020-2021, in line with the TIWACC framework.

Works in progress (LIC) remain excluded from the calculation of the RAB, at the same time as the recognition of financing expenses (IPCO). The operating costs recognised are calculated based on the recurring effective costs for the last available year (2018), plus the greater efficiencies achieved in the current period (50% profit sharing), with the size of the efficiency factor (X factor) designed to restore the greater efficiencies achieved in the fourth period to consumers in the fifth regulatory period. The revenue guarantee mechanism is confirmed as 64% of revenues recognised for a duration of 20 years starting from the first year in which the business offers the regasification service or, if prior to that, from the first year of ownership of the guarantee factor pursuant to resolution ARG/gas 92/08.

In order to incentivise the range of flexible services offered, there are plans that a share of 40% of revenues from the offering of these services can be retained by the regasification business to cover the revenues not subject to the revenue guarantee factor, up to the recognised revenues.

Recognition of variable electricity costs will be introduced (dependent on the unloading of ships and regasification of LNG) through a fee applied to users. Costs relating to electricity for the basic operation of the terminal continue to be recognised in the reference revenues.

There are plans to recognise costs relative to the Emission Trading System (ETS), ratifying the neutrality principle for the business in relation to price risk and incentivising virtuous behaviour aimed at CO2 emissions.

Approval of 2020 Revenues

With resolution 43/2020 / R / gas “Approval of the tariffs for the LNG regasification service for 2020 and amendments and additions to the RTRG”, published on 19 February 2020, the Authority approved the revenues recognized for the service of regasification for 2020 on the basis of the proposal presented by GNL Italia. The tariffs were determined on the basis of reference revenues of 25.1 million euros and on energy costs of approximately 3.1 million euros. The revenue coverage factor has been set at 64% of the reference revenue. The RAB for LNG regasification activity is 121.8 million euros.

At the same time, the Authority published the definitive 2019 revenues with a total amount of 26.8 million euros, based on the final 2018 balance sheet data.

Approval of revenues for the year 2021

By means of Resolution no. 229/2020/R/gas “Approval of tariffs for the LNG regasification service for the year 2021 and provisions relating to the revenue coverage factor for 2019”, published on 26 June 2020, the Authority approved the revenues recognised for the regasification service for the year 2021 based on the proposal submitted by GNL Italia. The tariffs were determined on the basis of reference revenues of 26.6 million euros and energy costs of approximately 4.3 million euros. The revenue coverage factor has been set at 64% of the reference revenue. The RAB for LNG regasification activities was 129 million euros.

At the same time, the Authority gave the go-ahead for the payment by the CSEA of the amounts due in relation to the revenue coverage factor for the year 2019 for an amount of approximately 11 million euros.

Natural Gas Storage

Regulation For The Fifth Regulatory Period 2020-2023

Criteria for adjusting the tariffs for the natural gas storage service for the fifth regulatory period (2020-2023)

Through resolution 419/2019/R/gas, published on 23 October 2019, the Authority defined the criteria for calculating the revenues recognised for the storage service for the fifth regulatory period (1 January 2020-31 December 2025).

The duration of the regulatory period will be extended from 4 to 6 years. The valuation of the net capital invested (RAB) is based on the revalued historical cost method. The net invested capital remuneration rate Beta parameter (WACC) remains fixed at 0.506, with the WACC remaining unchanged at 6.7% before tax for the years 2020-2021, in line with the TIWACC framework.

Works in progress (LIC) remain excluded from the calculation of the RAB, at the same time as the recognition of financing expenses (IPCO). The operating costs recognised are calculated based on the recurring effective costs for the last available year (2018), plus the greater efficiencies achieved in the current period (50% profit sharing), with the size of the efficiency factor (X factor) designed to restore the greater efficiencies achieved in the fourth period to consumers in the fifth regulatory period.

The mechanism for hedging revenues will be extended to cover 100% of the reference revenues, also predicting the storage businesses can optionally access an updated incentive system following the remodelling of the share of revenue recognised subject to the hedge factor. The methods for recognising renewal costs are confirmed.

There are plans to recognise the costs relating to the Emission Trading System (ETS), ratifying the neutrality principle of the business in relation to the price risk and incentivising virtuous behaviour aimed at reducing CO2 emissions.

Lastly the resolution approves the regulatory provisions for the quality of the storage service for the period 2020-2025.

Approval of 2020 Revenues

By means of Resolution 535/2019/R/gas, published on 19 December 2019, the Authority approved the revenue recognised for the storage service for 2020. The recognised revenues amounted to 491 million euros. The RAB for storage activities was 4.0 billion.

Approval of 2021 Revenues

By means of Resolution 275/2020/R/gas, published on 23 July 2020, the Authority approved the revenue recognised for the natural gas storage service for 2021. The recognised revenues amounted to 486 million euros. The RAB used for the calculation of revenues 2021 is 3.95 billion and includes the estimated investments for the year 2020.

Resolution 232/2020/R/Gas – Amendments to the RAST and definition of incentive parameters for the year 2020 for Stogit S.p.A.

With Resolution no. 232/2020/R/Gas, the Authority extends to 31 December 2020 the incentive scheme that provides for (i) a 50% profit sharing on the sale of short-term storage services and for the remodulation of the injection profile and (ii) the withholding of 100% of the revenues deriving from the sale of the remodulation services. The resolution requires storage companies to submit an incentive proposal for the following calendar year by 30 November each year. The Authority also envisages that storage companies can access on a voluntary basis an enhanced incentive mechanism that increases the level of profit sharing applied to revenues from the sale of short-term services against a reduction in guaranteed revenues. Storage companies may apply for access to the enhanced incentive mechanism for 2021-2022 by 30 November 2020.

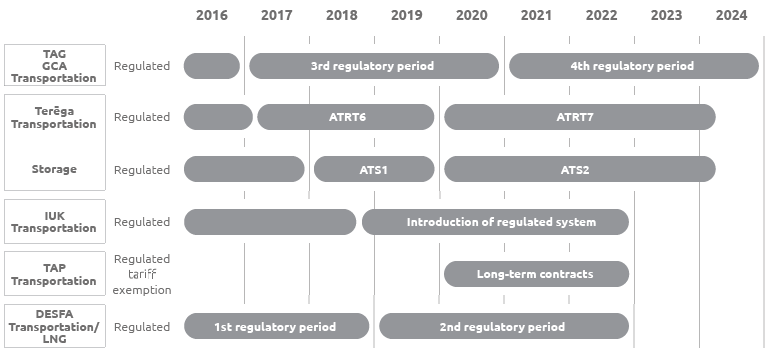

Regulation in European Countries of Interest to Snam: Main Features

Snam constantly monitors developments in the regulations within the various European countries in which it has a presence through international equity investments. Below is a summary of the main drivers with regards to the regulatory structures of reference:

Transportation

- Regulatory revision for the fourth period (2021 – 2024) completed in June 2020

- RAB differentiated between equity financed portion (Revalued Historical Cost) and debt financed portion (Book Value). Additionally, different treatments are established for old assets (prior to 2012) and new investments;

- Different remuneration rates are established for the portion of RAB financed with equity (Cost of Equity(*) 8.94 Real Pre Tax) and the portion financed with debt (Cost of Debt 1.61 Nominal Pre Tax).

Transportation

- RAB annually revalued using inflation (Consumer Price Index), taking new investments and amortisation/depreciation into account (Current economic cost method);

- WACC remuneration rate of 4.25% Real Pre-Tax.

Storage

- Storage under regulated regime from January 2018;

- WACC remuneration rate of 4.75% Real Pre-Tax; RAB of around 1.3 billion.

Transportation

- Under an exemption regime until October 2018;

- Switch from an exemption regime to a regulated regime without volume risk protection, upon maturity of long-term contracts (October 2018).

Transportation

- Third Part Access exemption on initial capacity (10bcm/y);

- Exemption from tariff regulation on initial capacity and expansion.

Transportation/LNG

- RAB based on historic cost, Work in Progress remunerated by WACC;

- Nominal Pre-Tax Remuneration rate 2019-2022 period: 8.22%, 7.84%, 7.52%, 7.44%

- RAB approximately 0.8 billion euros (Transportation + LNG)

- Socialisation of the cost of LNG in the transportation tariff (50% from 2020 vs. previous 75%)

- Recovery of the old Recoverable Difference accumulated between 2006 – 2016, around 326 million euros, distributed over 16 years, from 2017 – 2032

(*) This value includes a 3.5% risk premium linked to commercialisation of capacity.