Summary

Established in 1941, as Società Nazionale Metanodotti, later known as Snam, the company is the leading operator in Italy and Europe in the creation and integrated management of natural gas infrastructure. Over the years, the Company has developed a sustainable and technologically advanced network guaranteeing supply security, facilitating the energy transition and supporting development in the areas in which it operates.

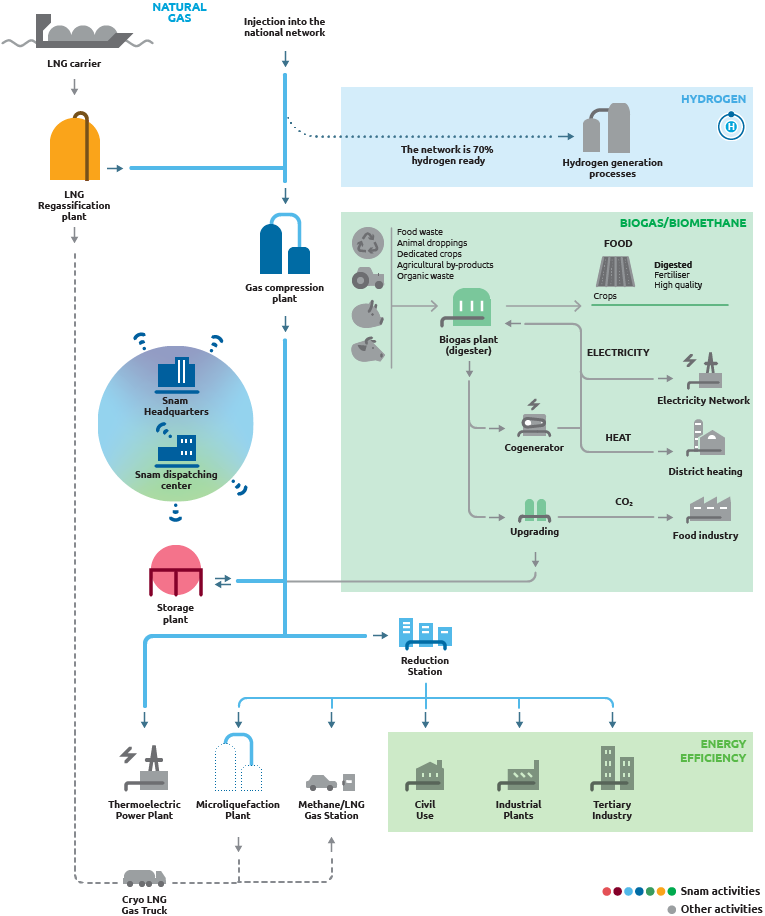

In Italy, Snam is responsible for natural gas transportation, dispatching and storage as well as regasification of liquefied natural gas (LNG). With respect to the these three core business sectors, Snam is the largest in Europe in terms of the size of its transmission network (over 41,000 km, including international assets) and in terms of natural gas storage capacity (around 20 billion cubic metres, including international assets). Relative to regasification business, Snam is one of the largest continental operators through the Panigaglia terminal and its equity investments in the Livorno (OLT) and Rovigo (Adriatic LNG) systems, as well as in Revithoussa (DESFA) in Greece, for total pro quota regasification capacity of around 8.5 billion cubic metres annually.

In addition to those three areas which have characterised Snam since its establishment, the Company has begun to invest many and ever increasing resources in new businesses: biomethane, energy efficiency, sustainable mobility and hydrogen. Thanks to these, Snam contributes to the decarbonisation of the Italian system, constructing compressed (CNG and bio-CNG) and liquefied (LNG, bio-LNG and small scale LNG – SSLNG) natural gas distributors, as well as biomethane infrastructure making use of organic and agricultural and agro-industrial waste, and providing energy efficiency services to condominiums, public administrations, and industry, while creating a foundation for hydrogen-based infrastructure.

Within Europe, Snam is notable for its agreements with the leading industry players and direct equity investments in the share capital of various companies. Additionally, the Group exports its know-how, offering engineering and technical/operational services to other gas operators, both domestically and internationally.

Through its international subsidiaries it operates in Albania (AGSCo), Austria (TAG, GCA), China (Snam Gas & Energy Services Beijing), United Arab Emirates (ADNOC Gas Pipelines), France (Terēga), Greece (DESFA), and the United Kingdom (Interconnector UK). Snam is also one of the main shareholders of TAP (Trans Adriatic Pipeline), the final section of the Southern Energy Corridor for gas.

Through its subsidiary Snam Gas & Energy Services, based in Beijing, Snam is involved in the development of the gas market in China through the distinctive skills it holds in this sector.

As can be seen in the amendments made to the Articles of Association in February 2021, Snam is committed to supporting the energy transition by making use of resources and energy sources that are compatible with protecting the environment and progressive decarbonisation, pursuing sustainable success.

Snam is a capital-intensive business and mainly focuses on regulated activities. Regulation makes provision for tariff systems that cover the costs incurred by the operator and for a fair return on invested capital. This means the Group is able to maintain a generally limited risk profile and remunerate shareholders sustainably, while also guaranteeing the provision of services to all operators along the chain with non-discriminatory criteria, establishing and respecting high quality and safety standards.

Snam’s business model, which integrates environmental, social and governance aspects with an eye to a sustainable development model, is intended to make use of talent and ensure transparency with local communities and stakeholders, through constant dialogue and the social initiatives promoted by Fondazione Snam. In line with this view, Snam has kicked off a number of projects to promote an increasingly sustainable energy system not just in the sector in which it operates, but throughout the entire domestic system. At the same time, the Group has developed initiatives and projects for energy efficiency, compressed natural gas (CNG), liquefied natural gas (LNG), biomethane and hydrogen. Snam’s approach to these new businesses is intended to support independence, through the creation of dedicated business units with the aim of concentrating knowledge, expertise and know-how within individual projects to optimise results. 2020 saw a continuation of that begun by Snam in 2019, a year known as the “year of hydrogen”, thanks to multiple national and EU policies which, with reference to Italy, suggest 2% hydrogen on the network in 2030 and 5% in 2040. In this context, Snam signed various agreements and partnerships (including complementary ones with De Nora and ITM) with the objective of continuing to develop its own position in the hydrogen sector, serving as a leader not just in Italy, but also in international markets.

Since 2001, Snam has been listed on the Italian stock exchange and can be found on the Italian FTSE MIB and on some of the main international indices (Stoxx Europe 600 and Stoxx Europe 600 Utilities). Given the importance of sustainability in Snam’s business and in its strategic decisions, the Group is also found on some of the most prestigious sustainability indices, including FTSE4Good. Turning to ESG ratings, Snam finds itself at the top of MISCI (MISCI World ESG and MSCI ACWI ESG), Sustainalytics, ECPI, Ethibel, Vigeo. In 2020, it was again included on the Gender-Equality Index (GEI) established by Bloomberg and was promoted to the CDP A List (former Carbon Disclosure Project).

An important event during the year was the presentation of the new 2020-2024 Strategic Plan, which renewed Snam’s commitment to three fundamental pillars: strengthening core business, internationalisation, and contributing to the energy transition. The new plan, called “Towards Net Zero”, establishes long-term objectives, which see the Company working to achieve carbon neutrality by 2040, in advance of the targets set by the European Union. Investments are increased, dedicated to the energy transition focussing on technological development, innovation, and new business, going from 400 million euros to over 700 million euros. Objectives linked to reducing direct greenhouse gas emissions (Scope 1) and indirect ones (Scope 2) presented at the same time as the 2020-2024 Strategic Plan are challenging and ambitious. In fact, Snam plans to reduce these emissions by 50% by 2030, becoming a carbon neutral company by 2040.

Additionally, the new Strategic Plan also saw the creation of the ESG Scorecard, a tool designed to ensure disclosure of the main environmental, social and governance aspects, while evaluating the Group’s performance relative to certain targets established for the next three years, confirming the fact that Snam fully integrates social, environmental and governance issues into its decisions about its business plan, working to improve both sustainability and financial performance.

Over the years, the role played by the fight against climate change and by sustainability has grown, to elements which are profoundly integrated into the Group’s business strategies. These range from development of new business, directly associated with the commitment to the energy transition, to investments in regulated energy infrastructure focussed on hydrogen ready replacements, to digitalisation and decarbonisation. From integrating sustainability objectives in its financial strategy, to the growing impact of sustainable finance within available funding, Snam works constantly to operate in an environmentally respectful manner and to support decarbonisation with concrete actions, creating long-term value for stakeholders.

This commitment has been formalised and added to the Articles of Association, a significant decision which highlights Snam’s positioning as a company which is not content merely to be a simple constructor and operator of energy infrastructure, but desires to contribute to society, investing today to achieve tangible results tomorrow.

The world of gas