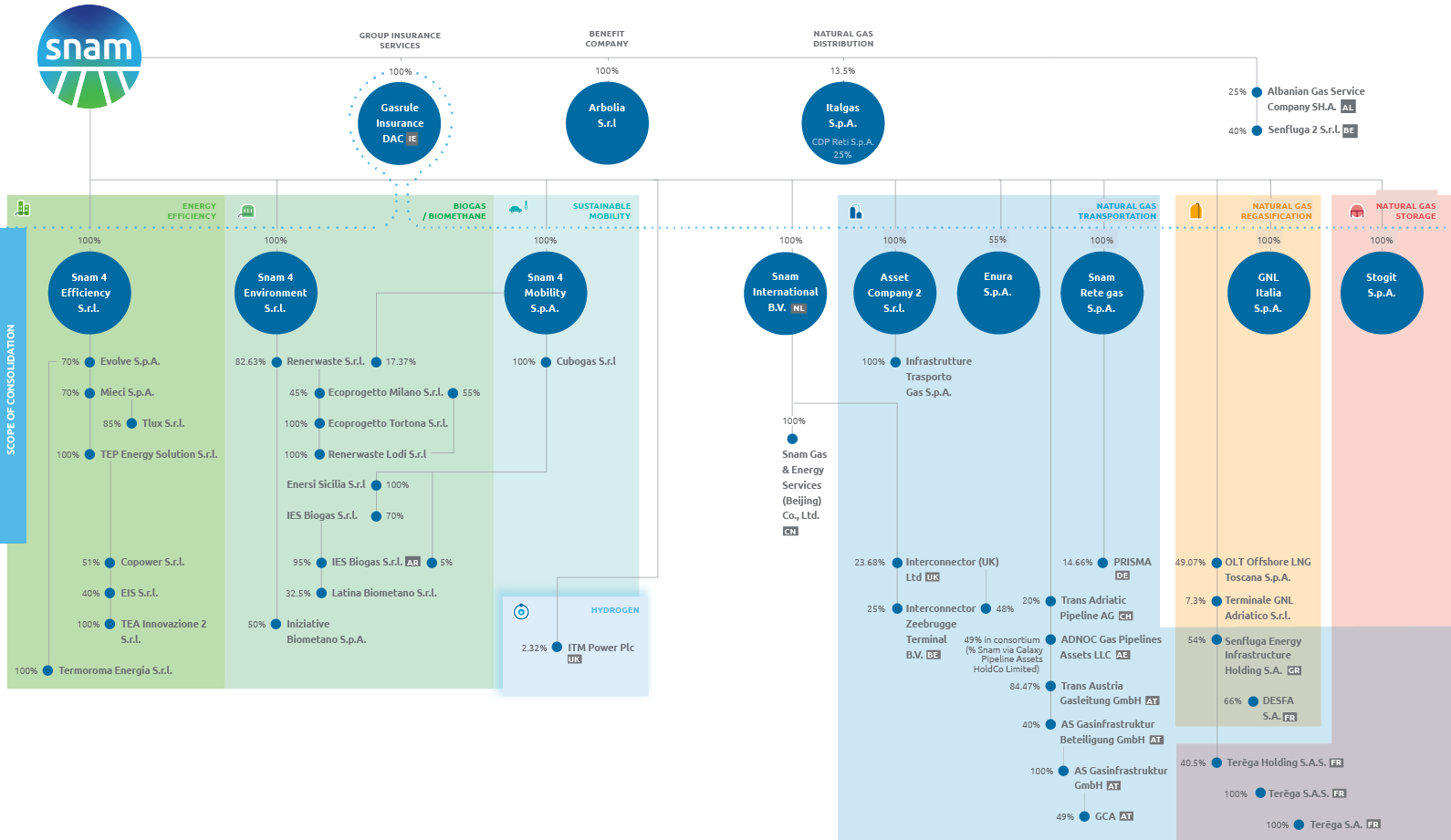

Group structure at 31 December 2020

The changes in the Snam Group’s scope of consolidation as of 31 December 2020, with respect to that as of 31 December 2019, involve the acquisition on 5 October 2020, through the subsidiary Snam 4 Efficiency, of 70% of two companies working in the energy efficiency sector in Italy, Mieci S.p.A. and Evolve S.p.A.

The main equity investment transactions during 2020*, which had no impacts on the Group’s scope of consolidation, involved:

- the sale, on 13 January 2020, of a 6% equity investment in the associate company Senfluga, after which Snam’s stake in the company amounts 54%. This sale resulted from agreements signed by Senfluga shareholders to sell a total stake equal to 10%, in amounts proportional to the stakes held by each shareholder;

- the completion on 26 February 2020 of the acquisition of a 49.07% stake in OLT (Offshore LNG Toscana), based on which Snam obtained joint control over the regasification terminal with First State Investments International Ltd;

- the increase in the equity investment held in Tep Energy Solution S.r.l. (TEP) from 82% to 100% of share capital, through the exercising of a call option relative to the stakes held by minority interests (equal to 18%)**, carried out on 6 March 2020;

- the acquisition on 15 July, in a consortium with five international funds, of 49% of ADNOC Gas Pipeline LLC, a company which holds 20 year management rights for 38 gas pipelines in the United Arab Emirates;

- the acquisition on 30 September 2020, through the subsidiary Snam 4 Environment, of a 50% stake in the share capital of Femogas S.p.A., with joint control held with Iniziative Biometano S.p.A., a company which manages biogas and biomethane systems which use agricultural biomass obtained in Italy;

- entry into the share capital of ITM Power PLC in November 2020, one of the largest global producers of electrolyzers, gaining a stake of 2.318%.

* Additionally, on 18 November, the entry of Snam as a significant minority shareholder of Industrie De Nora was announced. The transaction was finalised on 8 January 2021.

** The controlling equity investment in TEP (82%), acquired in May 2018, on the basis of the contractual terms with the exercise of the put and call cross options on the interests of third-party (equal to 18%) is regulated as if Snam had acquired 100% control of TEP, without therefore detecting the interests of third parties shareholders.