The best goods, works and services for tomorrow's infrastructure

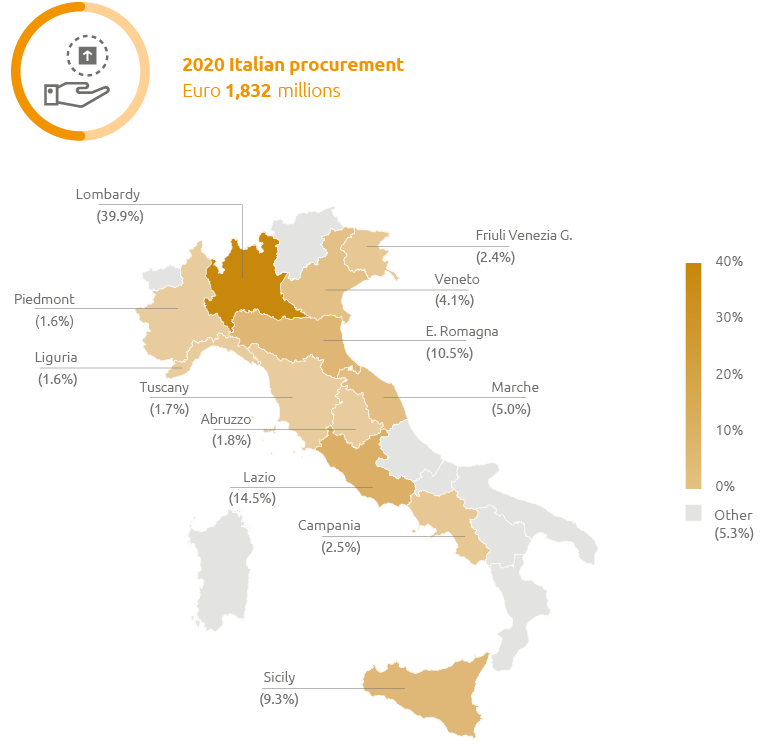

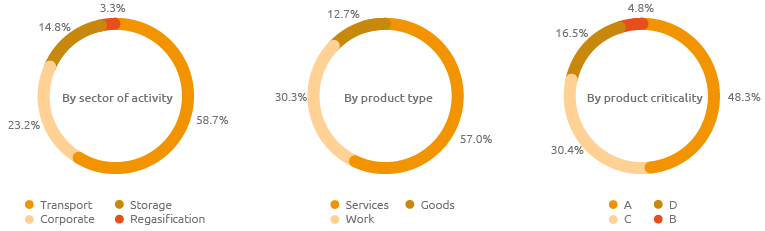

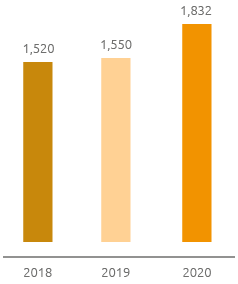

In 2020, goods, works and services were purchased for a total value of Euro 1,832 million (+18% compared to 2019): 71% of these related to the public sector (Euro 1,302 million) and 29% to the private sector.

During the year, contracts were registered with 541 suppliers, of which 377 were categorised as Small and Medium-sized Enterprises – SMEs (69% of the total), and 1,338 procurement contracts (and their revisions) were concluded, of which 61% were in favour of SMEs. The latter represent one of the main players in the Italian economy and, thanks to their flexibility, adaptability and widespread presence throughout the country, are particularly well suited to working with Snam to meet its needs (private-sector procurement by Italian SMEs accounts for 17% of the total).

In line with the targets included in the ESG Scorecard, the percentage of spending on local suppliers on total procurement for 2020 is 37% (+7 percentage points compared to 2019), confirming the Group’s commitment to the development of the communities in which it operates.

Procurement

Value procured (Euro millions)

Snam interfaces with a wide variety of suppliers from different product sectors (goods, services and works) and, in order to assess their strategic importance for the business, classifies them in terms of criticality, technological complexity and impact on company performance. In 2020, there were 90 suppliers classified as more strategic and with higher levels of criticality, with a relative procurement value of Euro 973 million (53% of the total).

As in 2019, the most significant raw material among those purchased is steel, with more than 84,000 tonnes as part of the supply of pipes, valves and fittings, mainly used for the gas transport business.

Geographically, more than 96% of the goods, works and services were purchased in Italy, involving suppliers located in almost the entire national territory (19 regions).

Snam’s supply activity is an important driver for the activation of the national economy and employment, moving a series of economic flows that transfer wealth to the economic system of the companies in its supply chain and to the national economic system.

Suppliers and the energy transition

In the current phase of progressive decarbonisation, in the context of which Snam has strategically chosen to focus both on high-tech initiatives (innovation, research and development in support of large national and international transportation networks) and on green economy businesses (sustainable mobility, renewable gas-biomethane, hydrogen, energy efficiency), the Group has focused on creating added value, in synergy with suppliers related to more traditional and consolidated activities and with those related to product categories linked to the energy transition and Snam’s new businesses; in addition, the department is defining new management models suitable for supporting new strategic development scenarios. In 2020, as regards TEP, IES Biogas, Cubogas and Snam4Envirnoment with subsidiaries, goods and services of Euro 189 million were procured from more than 1,000 suppliers in the new business sector (mobility, biomethane, hydrogen).

Material management for investment projects

The governance of material flows is increasingly strategic in supply chain management: a continuous process of innovation, the constant use of digitalisation of operations and the activation of increasingly effective synergies are required to better manage the processing of requests for goods.

In 2020, more than 950 km of line pipes were acquired and more than Euro 130 million of goods were entered into Snam’s warehouses. The funds allocated for the material management of investment projects exceeded Euro 136 million (+30% compared to 2019), an increase partly due to the objectives of modernising the network. The material flow management system has also been adequately prepared for the upcoming management of hydrogen ready materials.