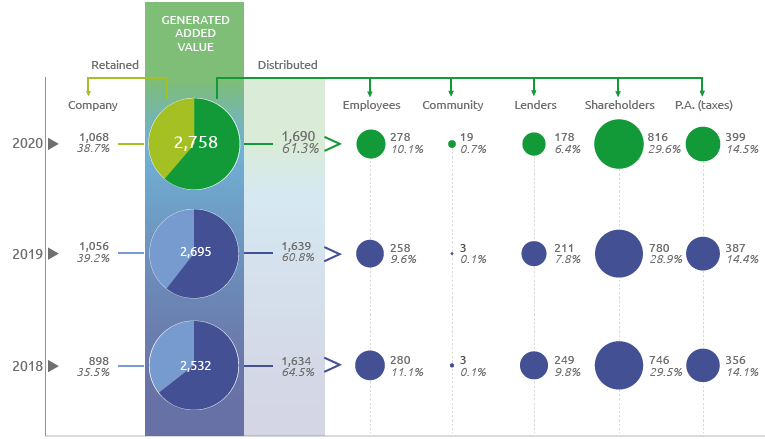

Added value produced and distributed

In 2020, Group revenues amounted to Euro 2,770 million (+4% compared to 2019), a value that Snam sees as a result of the value creation process carried out during the year and not only as a financial result.

For the Group, sustainability and creation of value are in fact closely related concepts: Sustainability creates value for the company and its stakeholders, correlating business and corporate social responsibility. Through its activities, the Company produces wealth, Added Value, which contributes, directly and indirectly, to the economic growth of the context in which it operates.

The Added Value is calculated based on the standard prepared by the Gruppo di Studio per il Bilancio Sociale (GBS or Sustainability Report Study Group) and GRI Standards, the national and international reference frameworks, respectively, for identifying and calculating the benefit created by a company’s business. The calculation is made with reference to the values taken from the legally-required Income Statement, thereby becoming a useful tool for all stakeholders in understanding the economic impacts that the Group produces.

In 2020, the Gross Global Value Added produced by Snam amounted to Euro 2,758 million, an increase of Euro 63 million, or 2.3%, compared to 2019 (Euro 2,695 million).

Added Value

(Euro millions)

Snam’s fiscal responsibility

In line with the Code of Ethics, Snam and its subsidiaries apply principles of fairness, transparency, honesty and integrity, which in the tax area are implemented in the correct fulfillment of tax obligations. In order to ensure the constant application of these principles, the Snam Group has adopted the Tax Control Framework (TCF), which allows a structured approach to the detection, assessment, management and control of tax risks, through periodic assessment and monitoring activities, and which has allowed admission to the cooperative compliance regime.

Snam’s Fiscal Strategy has the following objectives:

- Tax Value, i.e. the effective management of the tax ‘cost’ inherent in a company’s business;

- Risks and Reputation, i.e. the control of fiscal risk with a view to protecting the reputation of the Company and the Group;

- Tax Compliance, i.e. integrity in the management of tax compliance and the determination of the tax liability of Group companies;

- Sharing values, i.e. promoting awareness at all levels of the company of the importance given to the values of transparency, honesty, fairness and compliance;

- Relations with tax authorities, i.e. establishing relations with tax authorities based on good faith and transparency;

- Resource enhancement, i.e. developing and strengthening the professional skills of resources involved in any capacity in the tax process.

For more information on Snam’s approach to taxation, see the chapter “Consolidated non-financial statement – Social aspects” in the 2020 Annual Report.