Investing responsibly

In order to enhance the positioning and alignment of its business objectives with the Sustainable Development Goals and the main ESG issues, Snam makes extensive use of sustainable finance instruments, guaranteeing the company access to financial markets at competitive costs, with consequent positive effects on its economic, equity, financial and reputational situation. At present, sustainable finance represents 40% of Snam’s funding, with the aim of increasing it further to 60% by the end of the 2020-2024 Plan.

In recognition of the Group’s commitment in these terms, Snam has joined the Nasdaq Sustainable Bond Network, a sustainable finance platform managed by Nasdaq, which brings together investors, issuers, investment banks and specialist organisations.

Relations with the financial community and socially responsible investors, which increased significantly during the year, are fundamental for access to these instruments and are therefore maintained through constant and transparent disclosure of business strategy and performance, enhancing the dynamics that ensure the creation of value over time.

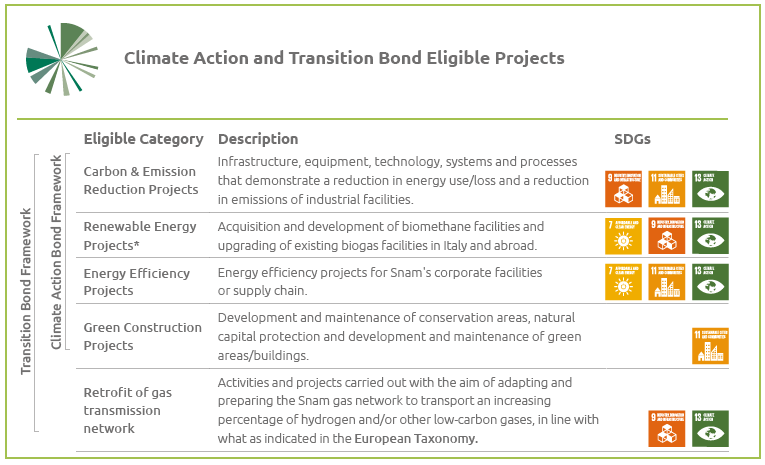

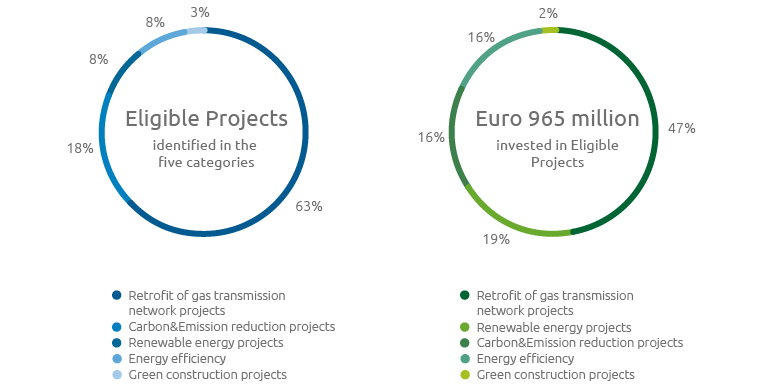

In 2019, Snam was one of the first companies in the world to issue a Climate Action Bond, the framework for which dates back to 2018, with the aim of better aligning its financial strategy with the Group’s sustainability objectives, consolidating its role in the energy transition in Europe, diversifying its base of investors and making them aware of Snam’s ESG initiatives and investments. The Climate Action Bond was also certified by DNV GL, which confirmed the bond’s alignment with the eligible categories defined in the framework, the Eligible Projects, which were financed and, in part, refinanced by the funds obtained from the bond issue, and which cover a broad spectrum of initiatives aimed at reducing emissions or the use of renewable energy, energy efficiency and the protection of land and biodiversity.

In 2020, Snam reconfirmed its frontline commitment to further integrate the Group’s sustainability objectives with its financial strategy by launching and issuing three Transition Bonds. At the same time, the perimeter of Eligible Projects already identified in the Climate Action Bond Framework has been expanded to include the new category “Retrofit of gas transmission network”, i.e. activities on the gas network aimed at increasing the integration of hydrogen and other low-carbon gases, as defined in the Transition Bond Framework, published in June 2020, and consistent with the mitigation criteria identified by the European Commission’s Taxonomy on Sustainable Finance.

Transition Bond Framework / Climate Action Bond Framework

(*) The acquisition of the biomethane plants is only covered by the Transition Bond Framework, while the other Renewable Energy Projects activities remain eligible for the Climate Action Bond Framework

The Transition bond not only further expands Snam’s investor base, but also sets the rules for issuing bonds to finance investments in environmental sustainability, in line with the key role recognised for renewable gas in achieving long-term decarbonisation targets and the role that existing infrastructure can play in facilitating this transition1.

In order to further align its financing strategy with sustainability objectives and to broaden its lender base, already in 2018 Snam finalised the transformation of its Euro 3.2 billion syndicated credit lines into Sustainable Loan, introducing environmental and social sustainability objectives that were met in 2019 and 2020, allowing it to benefit from a reduction in the interest rate applied.

Finally, again in pursuit of the objective of increasing the weight of sustainable finance in total funding, Snam has renewed its Euro Commercial Paper programme, increasing it from Euro 2 billion to Euro 2.5 billion, linking it to environmental and social sustainability objectives in line with the Sustainable Loan and obtaining an ESG rating of EE assigned by the ESG rating company Standard Ethics.

1) For more information, see the “Climate Action and Transition bonds Report”